After 30+ years of hibernation, bond bears are starting to emerge from the caves. Their heightened concern stems from the sharp selloff in bonds we’ve seen since the U.S. presidential election. On November 8, the yield on the 10-year US Treasury was 1.88%. As of January 13, that yield jumped to . For those keeping score out there, that’s about a 30% increase in the yield paid on a 10-year U.S. Treasury – a spike that happened over a very short period of time. It’s natural that the bond bears are growling.

Before I tell you what bond manager, Bill Gross, is saying about this spike in yields, I’d like to remind readers that here at Zacks Investment Management we do not blindly rely on other people’s research. We put more weight on our own internal analysis. However, it is helpful in many cases to review what the talking heads are saying out there, so we can analyze where consensus is forming in the marketplace.

Which brings me to some comments made recently by the widely-followed bond manager, Bill Gross. In his latest letter to investors, he writes: “Watch the 2.6 percent level [on 10-year U.S. Treasuries]. Much more important than Dow 20,000. Much more important than $60-a-barrel oil. Much more important that the Dollar/Euro parity at 1.00. It is the key to interest rate levels and perhaps stock price levels in 2017.”

One of Bill Gross’s biggest competitors and adversaries in business, Jeff Gundlach of DoubleLine Capital, countered by saying the breaking point for bonds would be 3%.

We don’t necessarily disagree that bonds could be at the cusp of a bear market, with yields gradually moving up for the foreseeable future. What we do disagree with, in the near-to-medium term, is that rising yields will have a dramatic effect on stock prices, and that somehow bond yields are more important than stock prices, the dollar, and/or the price of oil. In our view, that’s only true if you make all of your money by managing bonds.

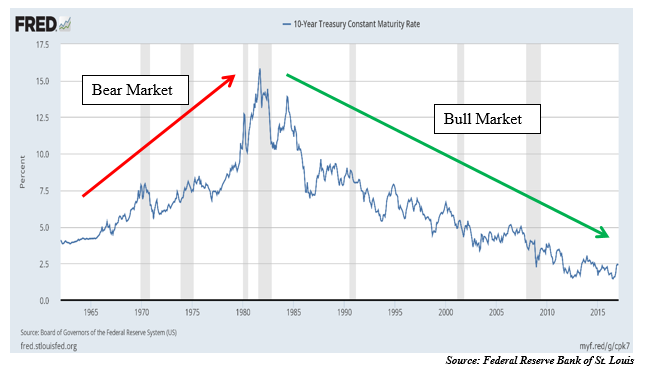

You can see from the chart below how the bond market has experienced secular bull and bear markets over the last 50+ years. Unlike the stock market, a rising trend line indicates a bear market for bonds, since yields are rising and prices are falling (remember, there is an inverse relationship between bond prices and bond yields). The falling trend line from 1982 through today indicates a strong secular bull market for bonds.

One theory is that bond yields are in the process of bottoming out, and may begin a long-term upward trend – signaling a bear market for bonds. Again, we wouldn’t outright agree or disagree with this possibility. If you look at the factors likely to affect bond yields, some of them indicate upward pressure: more risk-taking due to reduced regulation in the financial industry, a hawkish Federal Reserve, inflation drivers via lower corporate taxes, fiscal stimulus, and potentially higher import costs. Rate hikes in 2017 are data dependent, but we wouldn’t be surprised if we see two or three.

On the other hand, there are forces that may prevent bond yields from rising substantially from here. For one, yields on US bonds are significantly higher than yields on bonds in Germany, the UK, France, and Japan. For example, the spread between US and German 10-year bonds recently hit its highest level in two decades, with the U.S. 10-year yielding 2% more than the German 10-year bund. Even Italian and Spanish bond yields are lower than the US’s. Foreign buyers seeking safety and yield could tend to favor U.S. bonds, which would keep upward pressure on bond prices and downward pressure on bond yields.

Remember, too, that a lot of the recent market movement in bond yields is based on anticipated events. With Trump’s election, some market participants may be pricing-in an acceleration of GDP growth, higher inflation, and substantially lower taxes. But as we learn time and again, the promises made on the campaign trail are often significantly watered-down before becoming law. The impact of tax cuts may take years to be felt; Congress may balk at the price tag of fiscal stimulus; the strong dollar could hurt the export of domestically-produced goods, thus hurting U.S. manufacturers; and so on. If economic data disappoints at any point along the way, yields could feel substantial downward pressure.

Bottom Line for Investors

Interest rates and bond yields will be a key feature to watch in 2017. For investors, this doesn’t mean eliminating bonds outright from portfolios. But, what it does mean is taking a closer look at your fixed income allocation, and figuring out if you are positioned for changes in the bond market.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.