Last week, I wrote about public debt levels in America. The conclusion drawn was that, while America’s debt levels have grown swiftly relative to GDP in the last decade, it’s also true that our debt-to-GDP ratio has been higher in the past. Think post World War II era—higher debt during this period was not debilitating to growth. In fact, the 1950’s were seen as booming times. As then, I don’t think high debt will cripple the economy now—with rock bottom interest rates, debt is easily serviceable and interest payments are cheap.

But, What about Corporate America?

Much attention is drawn to the fact U.S. nonfinancial corporations held a record $1.85 trillion in cash (as of the end of 2015). That’s a trillion, folks. Sounds like a huge number! That is, until you look at how much total debt those corporations have in the coffers: a whopping $6.6 trillion.

Analyzing the situation leads to some other noteworthy findings—the most important of which is that this massive debt load is largely being shouldered by companies not listed in the Top 25. Allow me to explain…

The Cash Rich and Debt Poor Divide

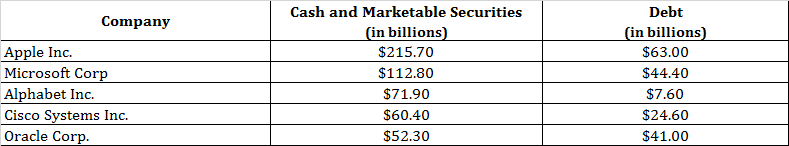

If we take a look at the top five cash-hoarding companies in the U.S., you’ll notice a trend of favorable cash-to-debt ratios:

Source: S&P Capital IQ, McGraw Hill Financial (values as of year-end 2015)

Source: S&P Capital IQ, McGraw Hill Financial (values as of year-end 2015)

A similar trend plays out for the Top 25 nonfinancial companies by cash holdings. These companies have $939 billion in cash versus $627 billion in debt—generally speaking, in fine financial shape.

You may have already picked-up on something here. If total nonfinancial cash holdings were $1.85 trillion (as of end of 2015) and $939 billion of that is on the balance sheets of just 25 companies, this means that all remaining companies have just $911 billion in cash! The same applies to debt—the top 25 companies have just $627 billion of the $6.6 trillion debt, meaning that the remaining companies are saddled with massive debt—some $6 trillion!

Strip away the top 1% of companies from these figures and you will see the true colors of the corporate debt problem: $6 trillion in debt versus $900 billion in cash.

So, we know that many companies are upping the ante on leverage. But, there is a multitude of factors to consider before calling this a ‘major red flag.’ The first, and most important, is that leverage is only a problem if a company cannot service their debt obligations and, as far as investment grade companies are concerned, this is largely not a problem.

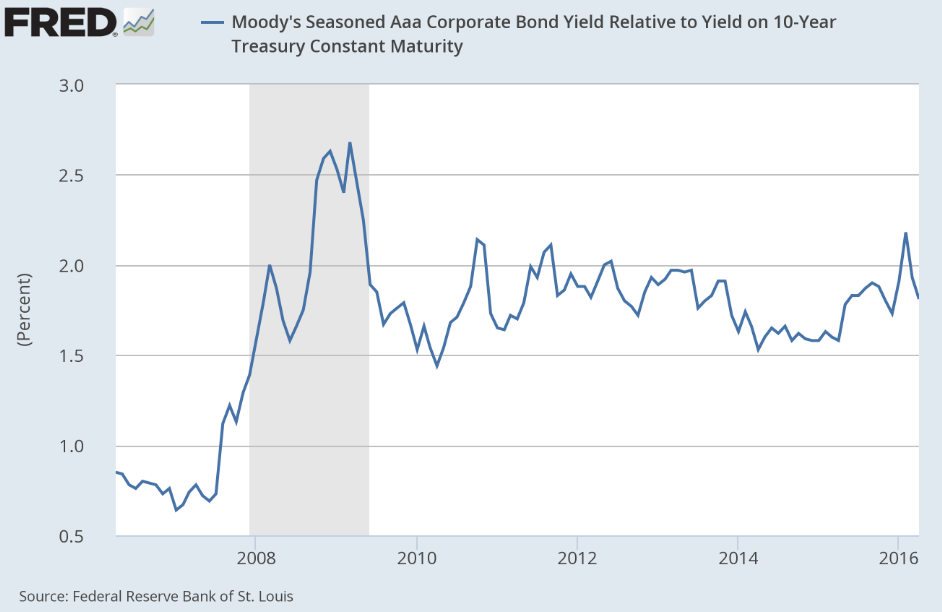

Secondly, the cost of new debt is nearing historic lows. On a global basis, overall borrowing costs for investment grade companies stands at about 3%, which is significantly below the 4.5% average of the last twenty years. If a corporation’s return on equity is higher than the interest rate paid on new debt, then it actually makes sense to borrow. Many companies see this as an opportunity to strike while the iron is hot.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Third is examining what these borrowing companies are doing with the borrowed capital. In many cases recently, it has been for merger and acquisition activity and share buybacks. Investors have to be careful here as share buybacks and M&As often help support share prices and company growth, but they’re short-term fixes (many of which are often undertaken by CEOs aiming to appease shareholders). It’s better to see borrowed capital being allocated towards research, fixed investment, hiring and growth into new markets.

Bottom Line for Investors

I think the key here is for investors is to remember to take a look at debt-to-equity ratios when buying stocks, and to focus on quality. In a rising interest rate environment, borrowing costs could start to increase incrementally and you want to make sure the company is prepared financially to handle it. While it’s likely that investment-grade companies, and companies at the stronger end of speculative-grade spectrum, will be able to adjust to higher rates, some companies on the other end of the spectrum will not.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.