In today’s Steady Investor, we take a look at key factors that we believe are currently impacting the market, such as:

- Bond yields on the rise

- Small caps strongly outperforming

- Higher prices everywhere

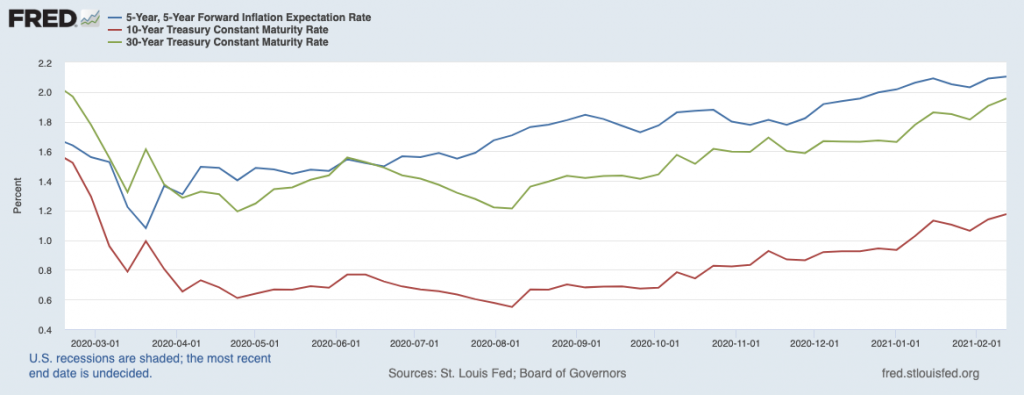

Bond Yields are On the Rise: What Does This Means for Investors? – Over the last few years, a common narrative in the bond markets has been that yields are at – or near – all-time lows. Low yields result in low borrowing costs, attractive mortgage rates, and have arguably provided a boost to the equity markets for investors starved for yield. But as you can see in the chart below – which looks at the 10- and 30-year U.S. Treasury yields alongside the 5-year forward expected inflation rate – bond yields are on the rise. February will mark the 7th month of flat-to-negative returns for long-dated Treasuries.1

______________________________________________________________________________________________

Thinking about Retiring Soon? Let’s Help You Make It Happen!

When retiring, you should feel as confident and assured as possible. Yet, for many investors, witnessing the day-to-day highs and lows of the market can cause anxiety and bring up concerns for the future, especially for those who are building a retirement portfolio. While apprehensions about the future are normal, making a detailed plan for retirement can help alleviate this anxiety and help you to retire with peace of mind.

To help you do this, we are offering readers our free guide that provides a step-by-step blueprint to potentially help you build a sound retirement portfolio. This guide offers you a checklist of the most important financial, tax, and investment considerations for new retirees, with detailed explanations to help you prepare for this new stage in your life.

If you have $500,000 or more to invest, get our free guide today!

Download Zacks Guide, Thinking of Retiring Soon? Here are 4 Things to Consider First3

______________________________________________________________________________________________

So, what’s driving U.S. Treasury bond yields higher? We think a strong economic growth outlook, coupled with the Fed not buying as much as promised, are contributing factors. But in our view, the biggest driver is higher inflation expectations (blue line in the chart). If market participants expect higher inflation down the road, they will want to be compensated more today (in the form of higher yields) for long-dated fixed income products. In this way, higher inflation expectations push the 10- and 30-year U.S. Treasury bond yields higher. Higher bond yields could have several implications investors should keep in mind: among them, pressure on high valuation areas of the stock market, and perhaps a positive outcome for companies that benefit from a steeper yield curve. Namely, banks.

Small Caps are Strongly Outperforming. Can It Last? Small-caps have been posting robust performance relative to their mid- and large-cap counterparts, with the outperformance widening to the biggest margin in over 20 years. Indeed, the Russell 2000 Index (small-caps) has climbed some 15% in 2021 alone, setting over 10 new closing records as the S&P 500 lags behind. Zooming out over the past six months, small-caps are outperforming the S&P 500 by 30%. The question is, can it last? Historically, small-caps have done well on a relative basis early in new economic expansions and bull markets. Anticipating strong growth rebounds benefiting companies with room to grow, investors tend to favor small-caps early in a cycle because of the belief they could post the strongest growth rates (and potentially strongest stock returns). Sustained leadership in small caps shows that investors are ‘risk-on,’ but also that investors may be looking for trades outside of the ‘Big Tech’ category where valuations are stretched.4

Higher Prices, Everywhere – Prices seem to be rising everywhere. The price per barrel of oil has been climbing steadily higher. Copper is up over +50% over the past year. Freight prices are up over +200%; lumber prices have jumped +117% on the heels of a housing boom. The S&P Case-Shiller Home price index is up +9.5%.5 To be fair, many of these prices are jumping sharply off lows, so the triple digit price increases are due to low comparisons. But there is another consideration at play here: the trickling effect of higher inflation. Investors should keep a close eye on inflation, because inflation could be the factor that moves the Fed to tighten monetary policy. Recent Fed minutes indicate no appetite for tightening any time soon. But it’s also important to remember that ‘tightening’ does not only happen when the Fed raises rates – there are plenty of ways the Fed can take their foot off the gas, such as paring back quantitative easing. Each time they do, the equity market is likely to respond with volatility (remember “taper tantrums?”).

Planning Retirement Soon? Here are 4 Steps to Consider First – If you’ve been planning to retire for a while, but are still hesitant of whether this is the right time, here are some steps to consider! To guide you through this new phase, we’ve created our new guide to help you review your financial and investment situation so you can make any adjustments necessary to keep your plans and lifestyle on track.

If you have $500,000 or more to invest and want to understand your retirement options, get our guide, Thinking of Retiring Soon? Here are 4 Things to Consider First.6 Simply click on the link below to get your copy today!

Disclosure

2 Fred Economic Data. February 19, 2021. https://fred.stlouisfed.org/series/DGS30#0

3 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire in 2021? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

4 Wall Street Journal. February 22, 2021. https://www.wsj.com/articles/historic-gains-in-small-stocks-highlight-investor-exuberance-11613989800?mod=djemMoneyBeat_us

5 Fred Economic Data. February 21, 2021. https://www.wsj.com/articles/inflation-depends-on-where-you-look-for-it-11613903414

6 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire in 2021? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.