As we adjust to the new year, now is the perfect time for investors to keep an eye on key factors that could impact the market for the next 12 months. In today’s Steady Investor, we take look at three investment themes to consider for 2021:

- China’s economic growth in 2020

- Federal budget deficits swell

- 10-year U.S. Treasury yield rises

One Major Country Posted Economic Growth in 2020 – It was China. The country’s strict national lockdowns and travel restrictions squashed the virus in a matter of months, and the economic engine was flipped back on by summer. While the rest of the world reeled from the spread of Covid-19 pandemic, China was expanding its role in global trade and strengthened its position as the world’s factory headquarters. China’s exports hit a record $2.6 trillion in 2020. China also pushed further into the global financial markets, by accounting for a record share of IPOs and secondary listings last year – driving major capital inflows into stocks and bonds. In all, China’s 2020 GDP accounted for 16.8% of total global GDP, which is up from 14.2% just four years ago. Meanwhile, it is estimated that the U.S. contributed 22.2% of global GDP, which is flat from 2016 levels.1

___________________________________________________________________________

Plan Your Retirement Without Making Investment Mistakes

Many investors may be wondering how to prepare for what’s to come, especially when it comes to retirement planning. Feeling uncertain is normal, but making rapid decisions due to uncertainty could lead to a snowfall of mistakes for investors who don’t take their time when planning their future.

While there are many unknowns at present, we believe there are nine common mistakes that many investors make when planning for retirement. In our guide, 9 Retirement Mistakes to Avoid, we outline these mistakes and how you can potentially avoid them.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Learn About the 9 Retirement Mistakes to Avoid!2

___________________________________________________________________________

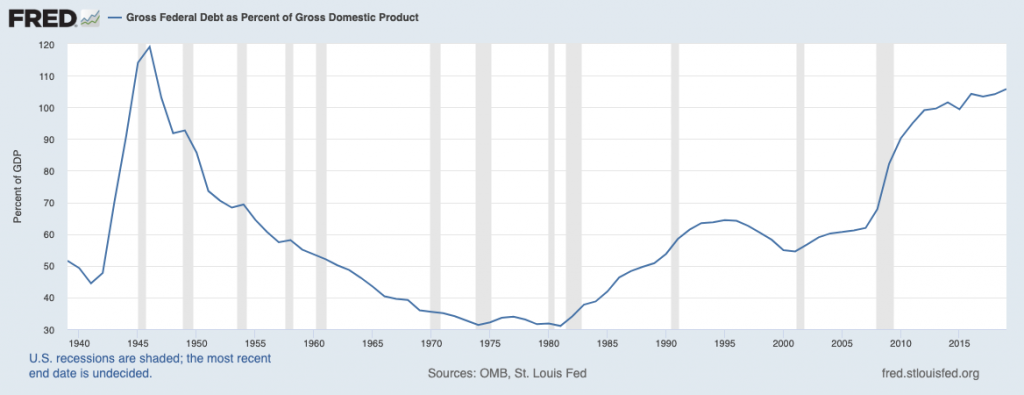

Federal Budget Deficits Swell, and are Likely to Get Bigger – From October to December, which marks the first three months of the federal government’s fiscal year, the budget deficit swelled by 61%. The growing deficit was predictable – the federal government continues to spend in an effort to stabilize the economy, and the new $900 billion in fiscal stimulus sets the stage for even higher outlays. Meanwhile, with many businesses posting lighter earnings and the number of unemployed Americans remaining elevated, tax receipts are materially lower – hence the budget gap. Indeed, for the 12 months ending December 31, the federal government ran a $3.3 trillion deficit, or approximately 15.8% of GDP. As you can see in the chart below, total federal spending (blue line), has far outpaced total federal receipts during over the last year.3

The U.S. Budget Deficit Soared in 2020

Source: Federal Reserve Bank of St. Louis4

Eyeing U.S. 10-Year Treasury Bond Yields – The 10-year U.S. Treasury yield has been rising of late, crossing 1% for the first time since March 2019. One of the forces driving 10-year Treasury yields higher is expected inflation. The Fed’s balance sheet expansion has in large part been to finance business loans (PPP and Main Street Lending), direct payments to Americans, and expanding unemployment benefits. These dollars are not being parked in bank reserves – they are being directly transferred into the real economy. President-elect Biden has also stated that more stimulus is on the way, and the 50/50 split in the Senate should make another short-term spending package all but assured. The end result is that the M2 money supply is rising at an unprecedented 25% year-over-year rate, which is much faster than during the inflationary period of the 1970s. It makes sense, in our view, that 10-year U.S. Treasuries would be ticking higher as a result. We expect this trend to continue in 2021.5

Source: Federal Reserve Bank of St. Louis6

Avoid Making Mistakes During Retirement Planning – In times like these, there are common mistakes that investors make while planning retirement – like forgetting to take a diversified approach. We believe that there are strategies that investors can use to help guide their investments to succeed in the long term. To help you understand some of these mistakes and how to avoid them, we have created the guide, “9 Retirement Mistakes to Avoid.”7

In this guide, we provide our thoughts on what we believe are nine of the biggest retirement mistakes investors should avoid. If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 9 Retirement Mistakes to Avoid offer at any time and for any reason at its discretion.

3 Wall Street Journal. January 13, 2021. https://www.wsj.com/articles/u-s-budget-gap-rose-61-in-first-quarter-of-fiscal-2021-11610564411

4 Fred Economic Data. January 13, 2021. https://fred.stlouisfed.org/series/MTSO133FMS#0

5 Wall Street Journal. January 11, 2021. https://www.wsj.com/articles/treasury-yield-climb-extends-into-sixth-session-11610392090

6 Fred Economic Data. January 12, 2021. https://fred.stlouisfed.org/series/DGS10#0

7 Zacks Investment Management reserves the right to amend the terms or rescind the free 9 Retirement Mistakes to Avoid offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.