Bobby C. from Boise, ID asks: Good Morning Mitch, pretty much everything I’ve been reading points to a rough winter – for economics, the pandemic, and I think we can pretty much all agree politics. The question is, if the economy is set up for a rough road in the first few months of the year, shouldn’t that mean a rough road for markets as well?

Mitch’s Response:

Thanks for writing, Bobby. There is really no sugar coating how challenging the winter months could be, from a public health standpoint as you mention and certainly within the realm of ‘uncertainties.’

Just last week, data showed that jobless claims remain elevated with about 750,000 Americans applying for unemployment benefits each week, a number that has remained fairly steady since October. In December, U.S. employers shed 140,000 jobs, the first employment decline since April 2020. The services sector is also notably suffering, as the pandemic continues to restrict in-person economic activity. Current economic fundamentals are by no means rosy.1

_________________________________________________________________________

Use Market Volatility to Your Advantage!

We may not know how the market will be affected within these next few months, but for a long-term investor, the key is to develop a strategy that can guide you through ups and downs in the market. In times like these, it’s important to not get caught up in emotional decision-making. Instead, there are several positive aspects of volatility that I recommend you keep in mind.

Get our insights, based on decades of experience, about how a volatile market may be able to actually help investors refine their strategies and potentially generate solid returns over time.

In our guide, “Using Market Volatility to Your Advantage,” you’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, get our free guide, “Using Market Volatility to Your Advantage,” by clicking on the link below.

Download Our Guide, “Using Market Volatility to Your Advantage”2

_________________________________________________________________________

But remember, the stock market does not really concern itself with in-the-moment or backward-looking data, in my view. The stock market is almost always looking forward, sometimes 6, 12, or even 18 months into the future. As an investor, I think it is paramount to look forward as well, and to think about what the economy will look like this fall, not this February.

There are a few key fundamentals I’ll point out that should hopefully give you a bit more optimism. First, we recently saw a new $900 billion fiscal stimulus package pass, which amounts to over 4% of total U.S. GDP. Many expected the package to be bigger, but with Democrats controlling the White House, Congress, and Senate, I think we can reasonably expect another round of fiscal stimulus in the not-too-distant future. Fiscal stimulus drives market support, in my view.

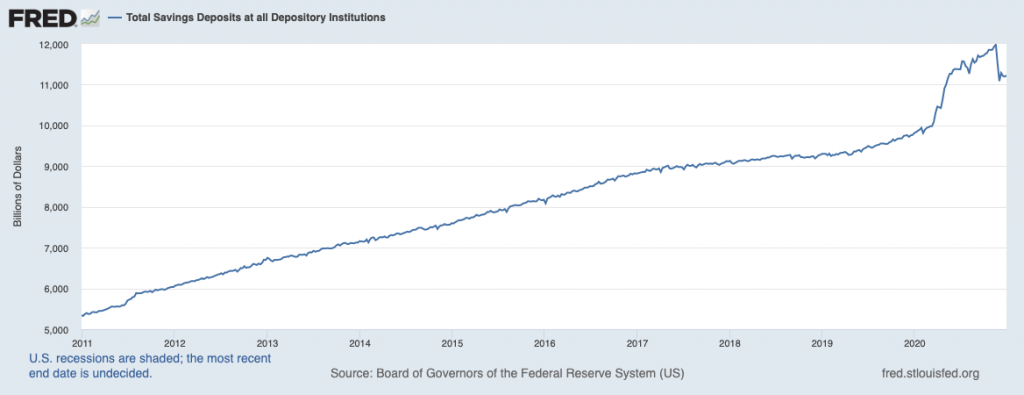

Second, it is sometimes assumed that the pandemic has crushed American households across the board. But in aggregate, American households are not struggling and dipping into savings—they are adding to savings. In fact, people who can work remote, spend less, invest in the stock market, and hold hard assets such as real estate have actually increased their net worth during this time. Just look at how the savings deposits have shot higher since the pandemic hit:

Source: Federal Reserve Bank of St. Louis3

Finally, the Federal Reserve has made it fairly clear that even if we experience inflationary pressure later this year, they are going to keep borrowing costs close to the zero bound. That creates a favorable environment for borrowers and investors, but not necessarily savers. As the old saying goes, “you can’t fight the Fed.”

At the end of the day, we cannot really know if this winter and spring will be volatile for markets, but for a long-term investor, that shouldn’t matter. In my view, long-term investors should be positioning for where the economy might go, not necessarily where it is today. And when I look out to the back half of the year and beyond, I see growth and accelerating earnings.

It is important to remember that volatility is a normal part of flow of the markets. There are positive aspects to volatility that shouldn’t be overlooked. The key is not to look for ways to eliminate it, but to develop a mental approach to dealing with it.

Our guide, “Using Market Volatility to Your Advantage,”4 will provide you with insights and tips to do just that. Get answers to questions like:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 ZIM may amend or rescind the guide “Using Market Volatility to Your Advantage” for any reason and at ZIM’s discretion.

3 Fred Economic Data. January 7, 2020. https://fred.stlouisfed.org/series/SAVINGS#0

4 ZIM may amend or rescind the guide “Using Market Volatility to Your Advantage” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.