In today’s Steady Investor, we cover current events that we believe are shifting the current state of the volatile market, such as:

- China reopens

- EU plans to impose wide-ranging sanctions on Russian oil

- Home prices surge

- Lumber prices fall sharply

China Starts to Reopen – Following two months of almost total lockdown, residents of Shanghai were allowed to resume normal life this week. In our view, consternation in the equity markets was likely tied to the economic impact of lockdowns in China, especially given that Shanghai is China’s most critical business and manufacturing hub. Economic output in China suffered in April and May, but signs of recovery are starting to emerge. Daily container output through Shanghai’s port hit 95% of normal capacity last week, and about 80% of pre-lockdown cargo shipments are moving through the main airport. The government in Shanghai is also stepping in with measures meant to encourage workers and employers to ramp back up, with new tax breaks, accelerated property development approvals, and rent waivers. Other parts of China continue to have Covid-19 restrictions in place, and it appears that China has no plans to change its zero-Covid approach. Overall, China’s economy remains caught in an unwinnable battle with a highly transmissible virus. A negative surprise would be continued lockdowns in various parts of the country over the course of 2022, but a positive surprise would be China altering policy to focus more on keeping the economy open.1

_________________________________________________________________________________________________________________

Avoid Market Timing in 2022. Here’s Why!

The market has been full of surprises – inflation peaked and there were many sudden changes over the last few weeks.

During this time of turbulence, it’s normal to fall into the habit of selling in and out of the market based on fear. Investors often fall into the trap of trying to buy “at just the right time,” or selling stocks during a crisis when emotions are running high.

To better help you avoid acting off emotions and fear, try downloading our guide, “How Market Timing Can Affect Your Retirement Plan.2” This guide explains these behavioral traps and offers potential solutions.

If you have $500,000 or more to invest and want to learn how you may be able to avoid these mistakes today, click on the link below to get your free copy:

Download Zacks Guide, “How Market Timing Can Affect Your Retirement Plan.”2

_________________________________________________________________________________________________________________

The EU Ramps-Up Energy Sanctions on Russia – Following the U.S. and U.K.’s lead, the European Union has announced plans to impose wide-ranging sanctions on Russian oil. The EU is planning to ban imports of Russian oil, which will include 90% of imports by the end of the year, while also blocking insurance companies from covering cargo ships carrying Russian oil. In the near term, the EU will block all Russian crude and refined fuels that arrive on ships, and by the end of the year, Germany and Poland will stop buying oil that arrives via pipeline. The sanction on insurance companies will apply to Russian oil being shipped anywhere in the world, not just the EU. European companies insure most of the world’s oil trade, but to be fair, insurers from other parts of the world can step in to cover the cargo ships in the EU’s stead. Taken together, however, the EU’s bold new moves will further fragment Russia’s energy export market and damage the Russian economy (likely severely) in 2022 and beyond.3

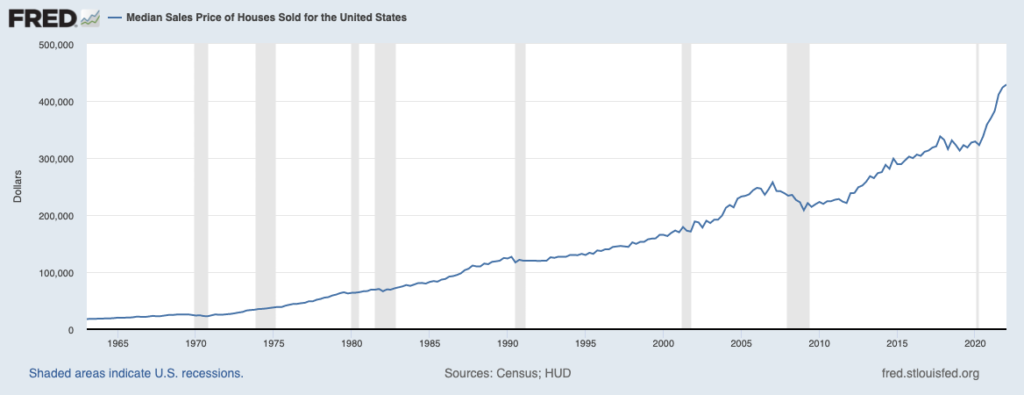

Home Prices Surge, Again – Home prices in the U.S. keep rising, with few significant signs that price pressures will abate in 2022. From March 2021 to March 2022, the average home price as measured by the S&P CoreLogic Case-Shiller National Home Price Index rose by a stout +20.6%. That’s the highest rate of growth ever recorded for the index, and as readers can see from the chart, marks a continuation of a steep ascent that began in the months following the pandemic.4

Mortgage interest rates have moved sharply higher in 2022 so far, but other supply-demand fundamentals in the housing market point to continued strength ahead. Inventories of existing homes are historically low, and the number of buyers is likely to remain high as the largest cohort of new homebuyers – namely, Millennials – are still in their early 30s. Millennials now make up a big segment of the population than Baby Boomers, and many of them have yet to purchase their first home.

Lumber Prices Fall Sharply – In a positive sign for the housing and remodeling market, lumber prices have fallen sharply after soaring during the summer of 2020. By spring of 2021, lumber cost more than two times what it did before the pandemic, and soaring prices in the summer of 2020 turned out to be a leading indicator of supply chain problems and the goods inflation that followed. As lumber producers ramped production and Americans slowed pandemic remodeling projects, prices of lumber futures have plummeted by over 50%. If there is still a wood-based remodeling project you need for your home, later this summer may be a good time to take it on.6

How to Avoid Market Timing – Factors such as rising inflation and increased volatility, can cause investors to fall into the trap of trying to buy “at just the right time,” or sell stocks during a crisis out of fear.

Both of these impulses are likely to lead to more failures than successes over time. Even when emotions are running high, we recommend focusing on the long-term view and sticking to your course.

But before making any big decisions, check out our guide, “How Market Timing Can Affect Your Retirement Plan.”7 This guide seeks to explain emotional and behavioral traps that investors can fall prey to and offers potential solutions to common mistakes that many self-managed investors make.

If you have $500,000 or more to invest and want to learn how you may be able to avoid these mistakes today, get your free copy by clicking on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.