U.S. consumer confidence peaked to record highs in December, as suggested by recent surveys.

The Conference Board’s Consumer Confidence Index climbed to 113.7 (1985=100) – the highest level since August 2001. It moved +4.3 points higher than November’s level, while beating the prior forecast of 109 (according to Bloomberg reports).

Notwithstanding a decline in sentiments on current conditions, the measure of consumer expectations soared to 105.5, the highest level since December 2003 and therefore, accounted solely for the overall confidence index’s December surge. The expectation gauge rose +11.1 points from the preceding month’s level.

Following are some highlights of specific areas covered by the Board’s survey:

- Outlook on Business Conditions: The proportion of Americans with an improved outlook on the next six months’ business conditions is 23.6%, the largest since February 11, and up from the previous share of 16.4%. The share of respondents expecting business conditions to deteriorate fell from 9.9% to 8.7%

- Outlook on Labor Market:

- At 21% compared to the previous share of 16.1%, a greater share of consumers expects to see more job creation in the coming months. Although the percentage of people predicting fewer jobs also increased, it did by a much smaller margin of +0.5 points.

- The share of consumers hopeful of higher incomes increased from 17.4% to 21%. The percentage expecting a decrease in incomes declined from 9.2% to 8.6%. Which means, the share differential between the two consumer groups widened to 12.4 points, the largest gap since January 2007.

- Outlook on Stock Markets: Proportion of consumers expecting higher share prices in 2017 increased to 44.7% in December, the largest since January 2004.

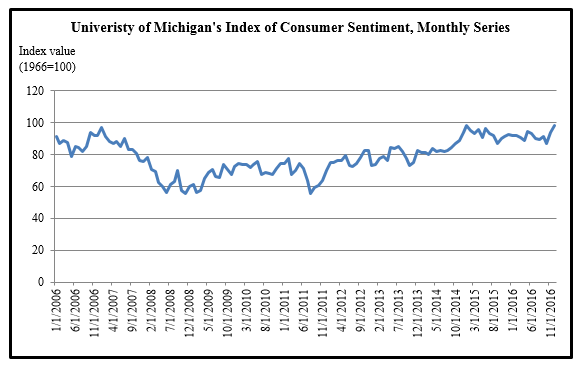

University of Michigan’s Index of Consumer Sentiment increased +4.7 points from November’s level to reach 98.2 in December, its highest level since January 2004.

Source: Survey of Consumers, University of Michigan

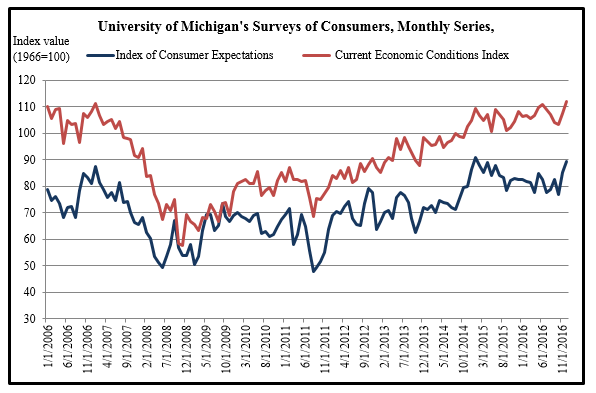

The University’s gauge of consumer expectations climbed to 89.5, up from November’s 85.2. The measure of Americans’ sentiment on current economic conditions improved from the previous month’s 107.3 up to 111.9.

Source: Survey of Consumers, University of Michigan

Bottom Line for Investors

The surge in U.S. consumers’ optimism is largely believed to be a result of their expectations for Donald Trump’s presidency. Trump’s proposed policies, including boosting domestic employment cutting tax rates and raising infrastructure spending, have potentially heightened Americans’ hopes for more jobs, better salaries and higher equity/portfolio returns.

The higher optimism among Americans could possibly offer tailwinds to household spending & investments. But more than short-term expectations, what will eventually drive economic growth are consistent long-term fundamentals – which are likely to strengthen in the coming years. The unemployment rate is predicted to fall to 4.4% next year and to 4.3% in 2018 (versus 2016’s 4.8%). The real GDP is expected to grow at +2.1% in 2017, up from 2016’s +1.7%. For Q1 2017, the projected S&P 500 earnings growth is +10.4% – a marked improvement from the estimated +3.4% in Q4 2016 (According to Zacks Investment Managements Economic Outlook report).

Which sectors/companies would likely be the biggest growth contributors in coming years? And, which are losing out? These are critical questions when it comes to building your nest egg. We can help you get the answers and assist you in planning your financial future effectively. To learn more, please call us at your convenience at 1-800-918-3114.

In the meantime, check out our just-released Stock Market Outlook report to get insights into economic variables, click on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.