In today’s Steady Investor, we look at current news and key factors that we believe are impacting the market and what could be next for the economy such as:

- Consumer purchases shifting

- Business investment soars to new highs

- U.S. banks remain in strong shape

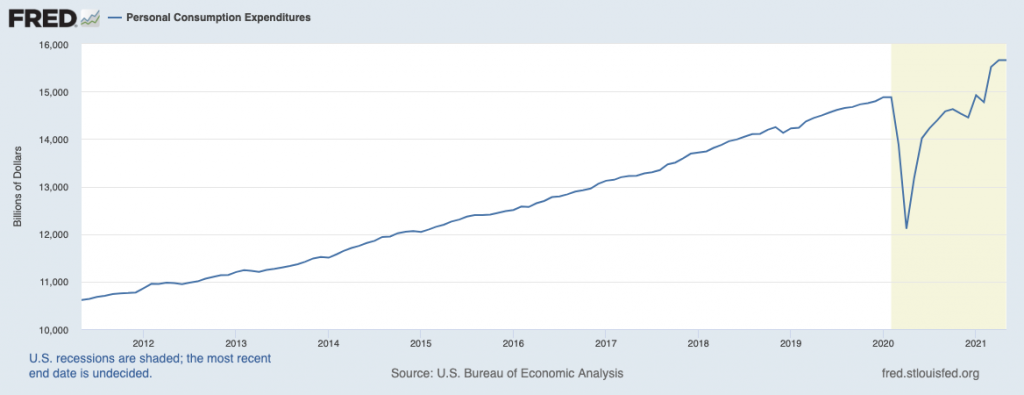

Consumer Spending Remains Strong, But Purchases are Shifting – American household spending was flat in May from the previous month, but a closer look at the data shows that U.S. consumers increasingly eschewed larger ticket items in favor of spending on travel, restaurants, and other everyday services. During the pandemic, Americans stepped up purchases of big-ticket items like cars, homes, and home improvement projects, while spending far less on services. In May, households were seen doing the opposite – spending on leisure and discretionary services rose 0.7% while spending on furniture and cars fell by -2.8%. Even still, strong spending throughout 2021 has started to show signs of easing, as households dig into the accumulated savings of the past year. The personal saving rate fell to 12.4% in May from 14.5% in April, as spending stabilized (see chart below). Consumers are eating into savings a bit, but remain confident about economic prospects looking ahead – the consumer confidence index rose to 127.3 in June, and has been fast approaching the pre-pandemic high of 132.6 reached in February.1

U.S. Consumer Spending

______________________________________________________________________________

See How You Can Produce Income from Retirement Assets!

For many investors, finding a retirement strategy that can also produce income is essential. For retirement investors who need income, here’s an option – a portfolio invested in stocks with a strong track record of dividends and dividend growth. This may give you the potential for a stable and predictable source of income in retirement.

To learn more about how to use dividend-paying stocks in your strategy to potentially generate cash flow for retirement, check out our guide “A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income.”

If you have $500,000 or more to invest, click on the link below to get our free guide today!

A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income3

______________________________________________________________________________

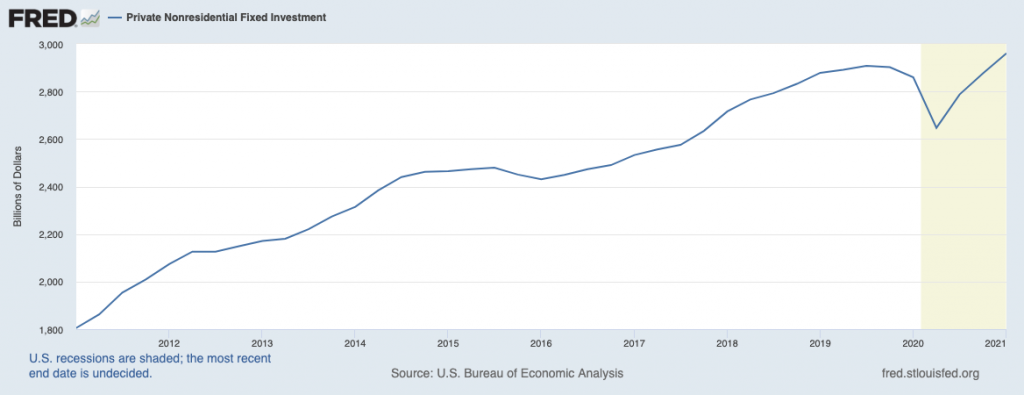

Business Investment Soars Past Pre-Pandemic High – Many market-watchers have long awaited a return of the business investment cycle, which was largely absent during the economic recovery following the 2008-2009 Global Financial Crisis. Following the “Great Recession,” businesses were more reluctant to invest in capital and equipment, and labor was cheap. Instead of investing in new plants, companies just hired more workers. In the current economic recovery/expansion, the labor market is tight, and workers are demanding higher wages. This setup has spurred businesses to increase spending on computers, equipment, technology infrastructure, and software to drive productivity. Nonresidential private fixed investment, which is a proxy for business investment, increased at a seasonally adjusted annual rate of 11.7% in Q1, following double-digit increases in Q3 and Q4 of last year (see chart below). It makes sense that the biggest outlays in spending came in software and tech equipment, as businesses position for the realities of less customer contact (think delivery everything) and a “hybrid” work model where employees work in some combination of home and office.4

Business Investment Climbs Above Pre-Pandemic High

U.S. Banks, Largely Unfazed by the Pandemic, Remain in Strong Shape – Remember the Fed’s “stress tests,” a legacy of the 2008 Financial Crisis where the Fed would check banks’ capital levels and readiness for an economic crisis regularly? The stress tests are still happening, but they barely make the news anymore because banks keep passing them easily. A fairly major shift happened this week, with the Fed saying it would now end limits on dividend payments and share buybacks for the biggest U.S. banks. In the news, many major banks announced plans to do both – raise dividends and buy back shares.6

As the economic recovery continues, you may be wondering what can you do in the meantime to protect your retirement. You have to invest somewhere, as cash won’t do. In times like this, I would suggest considering stocks that are growing earnings and dividends and have a track record of doing so.

To learn more about how to use dividend-paying stocks in your strategy to potentially generate cash flow for retirement, check out our guide, “A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income.”7

If you have $500,000 or more to invest, click on the link below to get our free guide today!

Disclosure

2 Fred Economic Data. June 25, 2021. https://fred.stlouisfed.org/series/PCE#0

3 Zacks Investment Management reserves the right to amend the terms or rescind the free A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income offer at any time and for any reason at its discretion.

4 Wall Street Journal. June 27, 2021. https://www.wsj.com/articles/capital-spending-surge-further-lifts-economic-recovery-11624798800

5 Fred Economic Data. June 24, 2021. https://fred.stlouisfed.org/series/PNFI

6 Wall Street Journal. June 24, 2021. https://www.wsj.com/articles/fed-gives-big-banks-clean-bill-of-health-in-latest-stress-test-11624566662

7 Zacks Investment Management reserves the right to amend the terms or rescind the free A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.