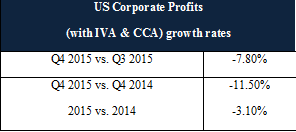

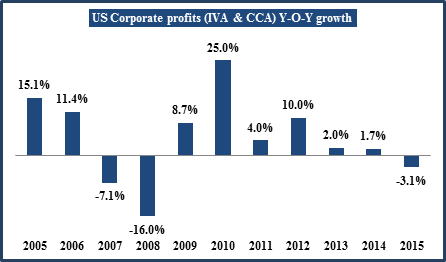

In 2015, U.S. corporate earnings posted negative growth for the first time since 2008. Last year, profits fell -3.10% from the previous year.

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

Here are three insights via charts showing factors that challenged Corporate America’s earnings last year:

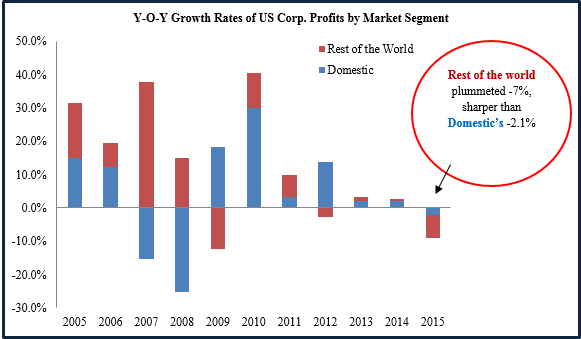

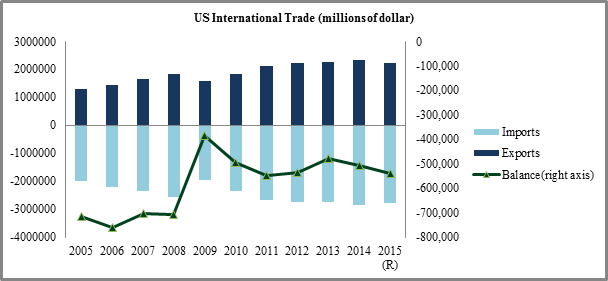

- Fading Global Demand Takes a Toll

Profits accrued from outside the U.S. fared worse than that from the domestic market in 2015. What’s more, trade deficits widened last year by +6.2%, as a strong dollar hurt foreigners’ ability to buy U.S. exports.

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

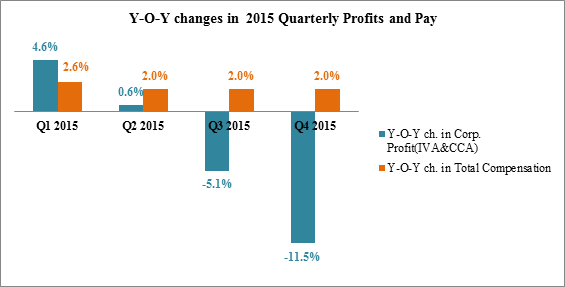

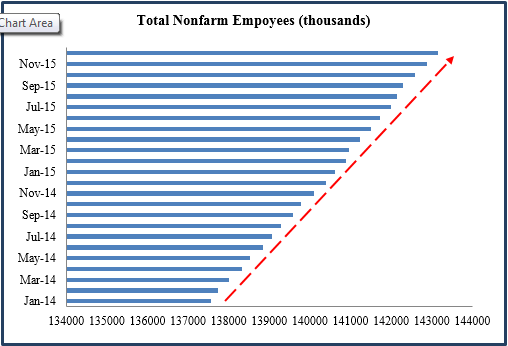

- Tightening Labor Possibly Squeezing Earnings

While profits decelerated through 2015, worker compensation growth did not drop and the number of employees expanded. A tight labor market could have compressed corporate profits.

Source: Bureau of Labor Statistics (for pay data); Bureau of Economic Analysis (for Corp. Profit data)

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

- The Biggest Scapegoat of All – Energy

A large part of last year’s profit decline can be attributed to the Energy sector (petroleum and coal producers’ profits slumped more than -75%). Numerous bankruptcies rattled the industry and strong players all had to cut headcount and reduce private fixed investment, yet they still couldn’t keep up with the impact of falling oil prices. The good news is that the earnings decline may just be limited to 2015 for the Energy Sector—crude oil prices have already bounced significantly from their lows and appear to resettling in a more predictable range. This should boost overall S&P earnings in the back half of the year.

Bottom Line for Investors

In spite of falling profits last year, the overall economy continues to grow—Q4 GDP growth figures were bolstered by a strong consumer sector and Q1 2016 GDP was estimated to have expanded by 0.8%, a bit better than expected. It’s only an estimate, at this point, but corporate profits appear better as well—the Bureau of Economic Analysis stated in late May that profits from current production (corporate profits with inventory valuation adjustment (IVA) and capital consumption adjustment (CCAdj)) increased $6.5 billion in the first quarter, in contrast to a decrease of $159.6 billion in the fourth.

That trend is in line with the research we’re viewing as well. According to our latest Zacks Consensus Market Strategy report, bottom-up and top-down strategists estimate S&P 500 earnings to grow by +2.5% and +5.5% respectively in 2016.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.