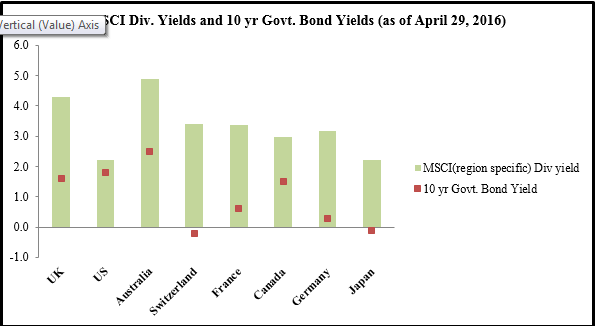

Breaking from 20-year historical precedent, dividend yields have now surpassed government bond returns. Currently, tthe 10-year U.S. Treasury yield which is around 1.7%. This trend is occurring globally as equity yields have exceeded government bond yields in most developed economies; Australia, the U.K., Switzerland and France are churning out the highest yielding dividends.

Sources: MSCI; Bloomberg

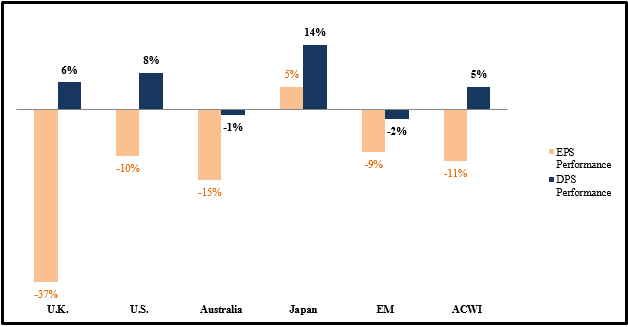

Dividend per Share Outpaces Earnings per Share

While dividend per share (DPS) has increased approximately +5%, earnings per share (EPS) has slipped -11% since February 2015. Major contributors to this divergence include the U.S., U.K., and Australia. Even though Japan has experienced positive EPS growth, it’s still slower than the DPS upward momentum.

Source: CITI’s Research Report

Here’s the problem: with the pace of DPS growth outstripping that of EPS, payout ratios (DPS/EPS) have been bumped up from 43% two years ago to 51%, rising above the long run median of 46%. Leading the pack is the U.K. with currently about a 90% payout ratio (far ahead of its long run median of around 50%), followed by Australia and Latin America. The U.S. payout ratio is still close to, if not less than, its long term median level.

Among sectors, energy and materials payout ratios are at lofty levels, as earnings take a beating from the commodity rout. On the other hand, IT, Consumer Discretionary and Financials are recording the lowest payout ratios—in-line with their long run trends.

A corporation often feels pressed to payout higher dividends to appease income-seeking shareholders, leaving the business with less capital to invest in growth opportunities. So, when earnings fall, it means that they’re generally paying out too high a percentage of earnings; this may cause corporations to change their dividend plans. With that in mind, dividends could theoretically be in danger of falling.

But, with earnings growth set to recover, the trend could see some reversing. According to some estimates, global DPS could grow by +3% in 2016 and +6% in 2017, while EPS is expected to rise by +3% and +13%, respectively. That should cool off the payout ratio—from 51% to 47%. If these predictions hold, sustainability of current dividends could actually improve.

Bottom Line for Investors

Regions that are expected to be in the optimal “high yield/high dividend growth” include Europe (excluding the U.K.), Emerging Market Asia, Central & Eastern Europe, Middle East and Africa. While the U.S. and Japan are likely to generate sufficient dividend growth, they offer relatively low yields. Overall, investors should remain wary of dividend cuts by companies with underwhelming profits and/or limited expansion opportunities.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.