It is no secret that there is a burgeoning global consumer appetite for technology in recent years. And studies indicate that it’s only going to get bigger over the next five years or so. With all eyes on the technology, we wanted to take a deeper look into some of the major electronics markets:

Wearables

The market for wearable electronics is projected to reach US $45 billion by 2021, according to Euromonitor. That would be more than +19% CAGR from the estimated $18.7 billion for 2016. The market for activity wearables, such as fitness trackers, could rise from $6.5 billion in 2016 to around $7.4 billion over the coming five years. But, it’s smart wearables, like Apple Watch, that are expected to gain the most traction, with their market projected to increase from the current $12.2 billion to $37.2 billion by 2021, five times the expected size of basic wearables.

Wireless Speakers

According to Euromonitor, units of wireless speakers sold could surge by +25% over 2016-2021 to hit 73 million, with consumers willing to shell out higher prices for better quality and/or brand value.

Smartphones

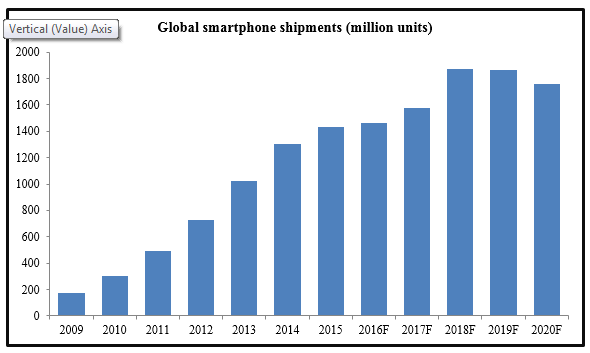

According to Statista estimates, smartphone shipments in 2018 would climb to 1.8 billion units – almost 10 times their 2009 levels.

Data source: Statista

Data source: Statista

By 2021, it is anticipated that one in three smartphones will be larger than 5.5”. This is largely due to consumers increased use of smartphones for computing, web browsing and photography. In addition to current leaders like Apple and Samsung, newer brands like Huawei and XiaoMi have progressed towards higher-end designs adding more competition to an already tough market.

Laptops and Tablets

Increased competition and growing consumer appetite for technology is driving makers of laptops and tablets towards more sophistication. According to Euromonitor, unit prices of laptops are estimated to steady off at around US$620 over the next five years, largely determined by convertible models.

Convertible versions are predicted to comprise 40% of tablet sales by 2021. Tablet producers will depend on features like detachable keyboards and bigger screens to demand higher prices and secure better margins.

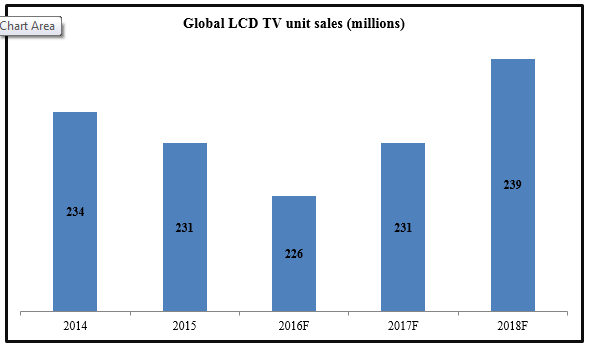

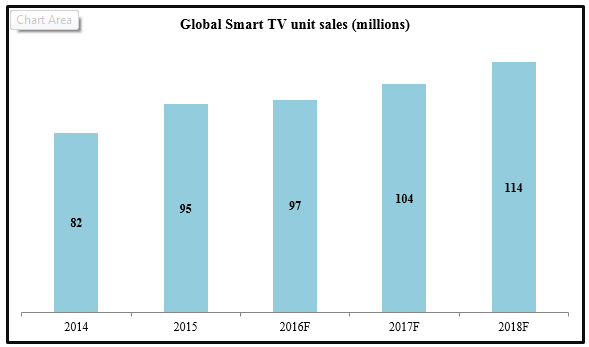

LCD/Smart TVs

Increasing quality-consciousness among global consumers and the growing popularity of streaming/multi-screen viewing are strengthening the demand for LCDs and smart TVs. According to Euromonitor, LCDs’ retail value sales could outweigh their volume sales by 2021 – meaning, a growing tech-savvy consumer base is likely to pay more for better resolution/features.

Data source: Statista

Data source: Statista

Data source: Statista

Data source: Statista

Bottom Line for Investors

A rapidly growing base of global tech-savvy consumers is driving sales of electronics. As more buyers seem willing to pay for added features, manufacturers could expand their product line into more sophisticated and higher-end models, without resorting to overdependence on discounts. This should help boost profit margins for manufacturers, and therefore, augur well for stocks in the consumer electronics space.

While this proves that the consumer electronics space is poised for growth, it is important to look at the market as a whole in order to affectively diversify your portfolio in order to manage risk. So, what does this mean in terms of investment strategy? And how can you ensure that your portfolio is balanced to manage your risk/reward equation? Our approach to managing assets at Zacks Investment Management focuses on risk management and your core objective – for many, this often means preserving wealth, creating an income stream or focusing on growth. For those with a portfolio of $350,000 or more, get performance details on our top investment strategies (aka our “Dean’s List”) by clicking below…we think you’ll be impressed!

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.