Are people increasingly getting spooked by the thought of retirement? A recent survey by Charles Schwab suggests that this is the case—they found that saving enough for retirement is the most common anxiety amongst a host of financial concerns for Americans. Even for young workers, retirement savings are a bigger concern than paying off credit card debt or student loans, or job security.

Lower projected returns on investments and longer life expectancies are imposing a tall order on Americans, particularly millennials. They will need to work for seven more years and save twice as much to accumulate the same wealth as the earlier generation, as suggested by a new report by McKinsey & Co.

Are Lower Return Expectations Freaking Out Future Retirees?

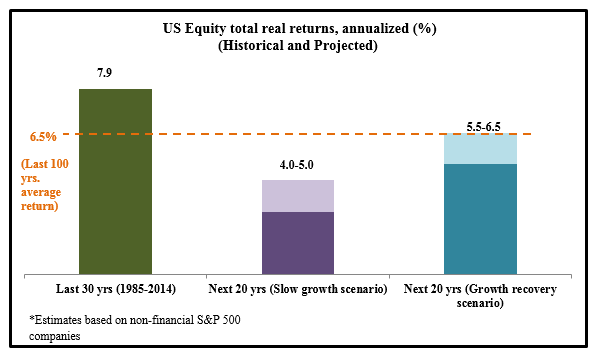

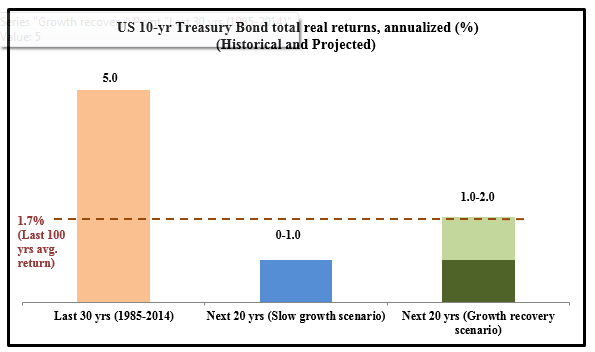

Annualized returns over the past 30 years on equities and government bonds were well above the long-term averages (+6.5% and +1.7% respectively), but projections for the next 20 years do not look as promising, (McKinsey Global Institute study).

Data source: McKinsey Global Institute analysis

Data source: McKinsey Global Institute analysis

Given these estimates, even pension funds could find it hard to plug the funding deficit, which is already a gaping $1 trillion for U.S. public retirement plans.

How to Avoid the Retirement Headache

Given the long-term outlook for broader asset classes—which is a result of continued growth but perhaps at a slower rate than previous decades—it makes sense that the sooner you plan out your finances and portfolio diversification, the better chance you have of averting a hard landing through your retirement years. At the same time, we realize not everyone knows how to go about financial planning. More than half of the Charles Schwab survey participants have admitted to being unsure about the ideal savings amount necessary for a comfortable retirement.

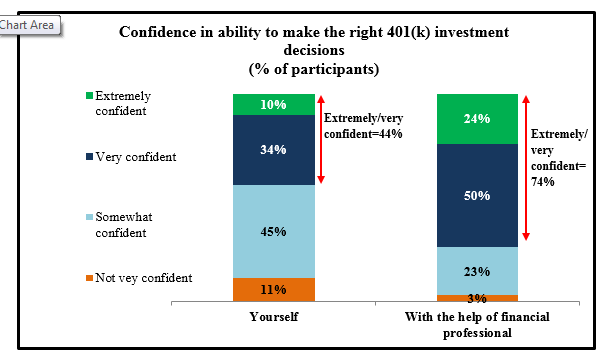

Saving effectively for your future does not have to mean making great sacrifices to your present living standards. What’s essentially needed is a properly balanced saving/investment discipline, which a financial advisor can help you set up and hold you accountable for. Indeed, the survey reveals that having professional advice boosts confidence among people making 401(k) investment decisions, compared to doing it by themselves.

Data source: Charles Schwab’s 2016 401(k) Participant Survey Results, August 2016

Bottom Line for Investors

Recent volatility and more modest return expectations for the next business cycle or two have many retirees and investors worried. But, investors should keep two things in mind. First, global growth should continue apace regardless over the next 20+ years, and no matter what the rate it should take equity prices with it as it has historically done repeatedly. Second is that the ‘not-so-secret’ formula for wealth accumulation over time remains the same and is not likely to change—save and invest. It’s that simple.

Knowing how to save and how to invest is a different task, and it’s probably wise to seek professional financial advice. Professional management not only saves you time, but the expertise involved can also potentially offer more skillful portfolio diversification and tactical strategies, helping you build your nest egg with greater confidence while easing your retirement woes. The members of the Zacks Investment Management Committee have over 100 years of combined experience. So, we know a thing or two about how to plan for retirement with confidence.

The right investment manager can make an enormous difference over the long term and help you stay steady through market changes. But, don’t take our word for it. If you’re thinking about working with a manager, read “What to Look for in a Money Manager” – it includes 10 tough questions you can ask any prospective investment manager…download it now…

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.