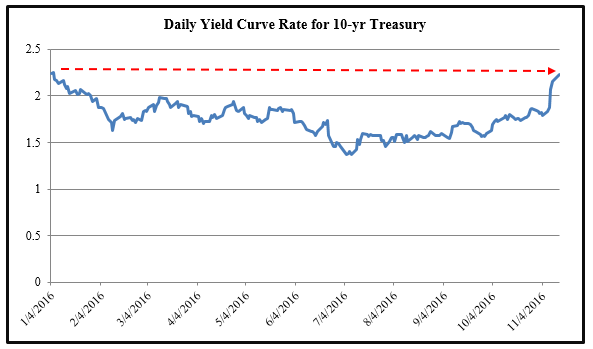

Following the election results, investors rushed to sell off U.S. Treasuries. On Monday, November 14, yield curve rate on 10-year Treasuries jumped 8 basis points from the previous day to 2.23% (According to the U.S. Treasury) – the highest level since the beginning of the year. Only four months back, yields were at record lows.

Source: U.S. Department. of the Treasury

Yield curve rates on 30-year Treasury rose to 2.99%, which is the largest after January 5. Yields on 2-year Treasury notes climbed to 1% (a first since January 2016).

The massive sell-offs were possibly driven by expectations about the new government’s fiscal stimulus. To finance increased spending, the government could issue bonds – which means, bond prices could drop. So, investors are rushing to dispose of their bond holdings now, probably to avoid capital losses later.

While betting on the Republicans to pursue demand-boosting policies, many investors are possibly factoring in higher inflation expectations, and with that upward momentum in yields. That’s because increased inflation could lead people to demand higher bond yields to compensate for lower purchasing power of money. In fact, the divergence between yields on 10-year Treasuries and Treasury Inflation-Protected Securities widened to around 1.97 percentage points – the largest since April 2015.

In addition, uncertainty around the new U.S. government’s policies/strategies and their impact (both domestic and global) could be driving investors across the world to shift their holdings away from bonds, at least for some time. Worldwide, bonds have already lost $1.2 trillion in value following the election (according to Bloomberg).

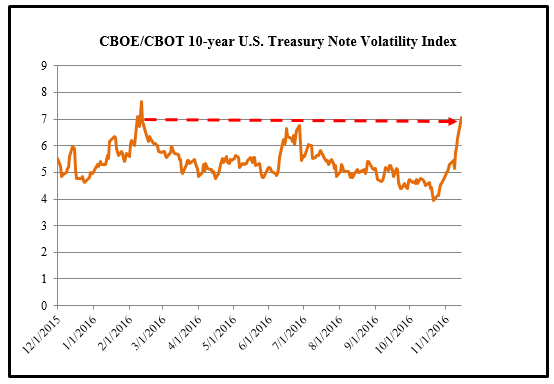

The turnaround in the U.S. government bond market was also reflected in the surge in volatility, with the CBOE/CBOT 10-Year Treasury Note Volatility Index peaking to its highest level since February.

Source: CBOE

The bond sell-offs on Monday may have far exceeded ‘normal’ levels. The 10-year yield’s Relative Strength Index increased to about 83 – the highest since 1990. Any value over 70 represents a possible “overbuying” of yields (i.e., over-selling of bonds).

Bottom Line for Investors

Volatility following an election is not surprising. But more importantly, it should not worry investors as long as the domestic fundamentals are sturdy, which they are. Moreover, for the Treasury market, where yields this year have trended downward for a while, the recent spike should not be bothersome – it could even signal a correction.

It’s too early to ‘time’ the new government’s policies and their economic effects. What’s essential for an investor is that they trust fundamentals while picking securities for their portfolio and maintain a discipline that aligns with their long-term goals—fretting over volatility does not help. At Zacks Investment Management, we can help you stay on track and optimize long-term returns. Get insights into various industries and equity categories with our Stock Market Outlook report. To download this report, click on the link below

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.