Darren B. from Tigard, OR asks: Hey Mitch, I’m not feeling so great about interest rate cuts in 2024. With the jobs report from last week and given the Fed’s comments from a recent meeting, it seems like March cuts are off the table. Isn’t a big part of the bull case in 2024 because of rate cuts? What if they don’t come? Thank you.

Mitch’s Response:

Thank you for sending your question, Darren. I think you’re right to bring attention to the potential risk of fewer-than-expected interest rate cuts. But I would frame this risk a bit differently – not as a potential death knell for the bull market, but as a potential avenue for short-term equity market volatility and possibly a correction in 2024.1

In other words, the economy and equity markets don’t need a certain amount of rate cuts to perform well in 2024, in my view. However, disappointment about the trajectory of interest rates could certainly cause some short-term turbulence, and I would not be surprised if that’s what we saw this year.

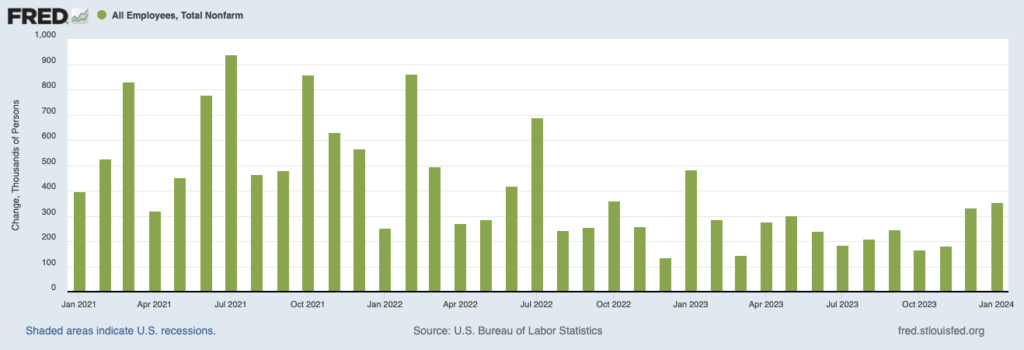

As you point out in your question, fundamentals continue to suggest that the economy is managing the higher interest rate regime just fine. The Labor Department reported last week that the U.S. economy added 353,000 jobs in January, which was about double what economists had forecasted and marked the best month of jobs growth in a year.

Make the Most Out of Market Turbulence

What steps are you taking to capitalize on the current market conditions and optimize your investment strategy?

Our free guide, Using Market Volatility to Your Advantage, explores ways volatility can actually help investors refine their strategies and potentially generate solid returns over time. You’ll get our ideas on:

• How market volatility can “shake up” complacent investors

• Potential bargains that may be uncovered through turbulence

• Why volatility may help prevent overheating and market “bubbles”

• What history shows us about opportunities for steady investors in turbulent markets

• Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”2

Nonfarm payroll gains (change, thousands of persons)

In the Federal Reserve’s first policy meeting held last week, the central bank reiterated that it was thinking about when to cut rates – but also signaled a cut was by no means imminent. In Chairman Jerome Powell’s words, “I don’t think it’s likely that the committee will reach a level of confidence [to cut rates] by the time of the March meeting.”

To place even more emphasis on the low likelihood of an interest rate cut in March, Chairman Powell gave a February 4 interview on “60 Minutes” where he struck a tone of caution about starting the process of reducing interest rates. Powell repeated the view that the Fed does not need to wait until inflation falls to 2%, but he also hedged by saying the central bank is still looking for signs that inflation’s decline is “sustainable.”

The market response was fairly swift, with traders scaling back their bets not only for March rate cuts but also for May rate cuts. I would argue the market has been far too optimistic about the size and frequency of rate cuts for a long time, so I would expect some corrective action as expectations more closely align with reality.

But my bottom line when it comes to interest rate policy in 2024 is that if rates stay high because the economy is strong – and not because inflation is increasingly stubborn – then the bull case should remain intact. In other words, it’s a year where I think economic and earnings growth matter more than whether the market gets what it wants in terms of Fed policy.

I recommend that investors make the most of these uncertain times. To give you insight into some of the positives, I am offering all readers our guide, Using Market Volatility to Your Advantage4, which includes insights on:

• How market volatility can “shake up” complacent investors

• Potential bargains that may be uncovered through turbulence

• Why volatility may help prevent overheating and market “bubbles”

• What history shows us about opportunities for steady investors in turbulent markets

• Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

3 Fred Economic Data. February 2, 2024. https://fred.stlouisfed.org/series/PAYEMS#

4 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.