With all the recent news and headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

- Federal Reserve Governor rattles markets

- Inflation reaches household staples

- U.S. job market remains hot

- Shanghai’s lockdown effects on the global supply chains

Federal Reserve Governor Lael Brainard Rattles Markets – Market and Fed-watchers have been paying close attention to comments from Fed Chairman Jerome Powell and other Fed governors about the path for monetary policy tightening. Chairman Powell has strongly suggested that half-point rate increases were possible if not likely at future meetings, and the past week markets were rattled a bit by Fed governor Lael Brainard, who is awaiting Senate confirmation to serve as the Fed’s vice chairwoman. In comments this week, Ms. Brainard said the central bank will start reducing its balance sheet “at a rapid pace as soon as its May meeting,” which left many investors wondering how “rapid” that would be. Ms. Brainard has generally taken on a persona as being more dovish when it comes to monetary policy, so her comments caught investors off guard and signaled that the desire to speed up tightening is broad-based among Fed governors.1

____________________________________________________________________________

How Can You Survive a Potential Bear Market?

High inflation and market volatility concerns come with a lot of worries from investors about how to manage their investments if the market reaches bear market territory.

Don’t despair! You can potentially avoid the most harmful hazards of a bear market on your investments by making use of some useful tools I offer in our free guide – The Zacks Bear Market Survival Kit.2

This guide discusses some key tools to prepare for a bear market, including:

- Understanding how bear markets work, and how long they last

- The strategies we believe are most effective for mitigating downside over time

- The most harmful thing investors do in a bear market, in our opinion

- Plus, more ways to potentially survive a bear market and achieve your long-term goals

In this guide, you’ll get our viewpoint on the most important moves you can make to weather a recession. Don’t wait—if you have $500,000 or more to invest, get this guide before the storm hits.

The Zacks Bear Market Survival Kit2

____________________________________________________________________________

Inflation Reaches Household Staples – In a related story, inflation continues to put pressure on consumers around the world. The obvious sources of inflation can be found at the gas pump and in some food prices, but household staples are now starting to feel the pressure as well. American consumers are showing signs of cutting costs on mainstays like toothpaste and baby formula, as major consumer products companies push prices higher. Consumers are increasingly opting for discount brands versus those offered by conglomerates like Proctor & Gamble, Clorox, and Kraft Heinz. These companies have seen increased profits over the last 12 months as they nudged prices higher to account for rising input costs, but sales figures are starting to indicate that American consumers are buying less and eschewing traditional brands in favor of discount and store-name brands.3

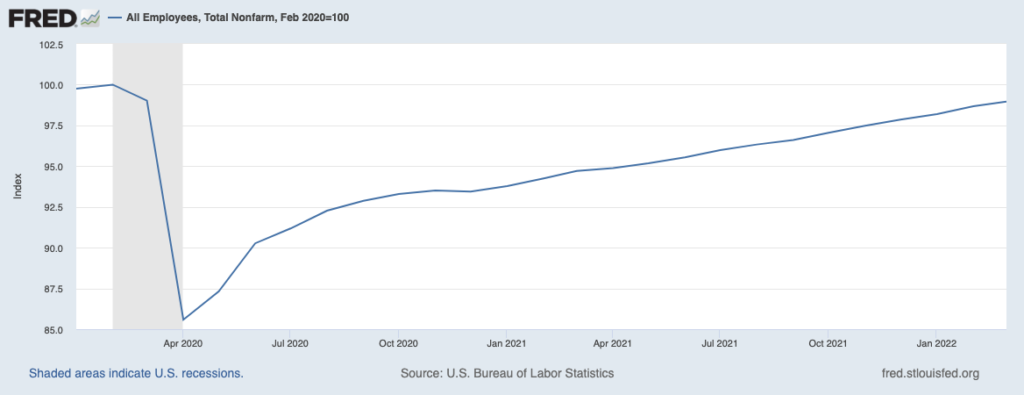

The U.S. Jobs Market Stays Hot in March – Headwinds are building in the U.S. economy, but there are still several strong fundamental underpinnings. One of them is the jobs market. In the latest jobs numbers released in March, U.S. employers added 431,000 jobs with particularly strong hiring in services industries like restaurants and retail. The Labor Department also said that hiring in January and February was stronger than initially reported, signaling that the jobs market is better than most appreciate. The latest release was the 11th straight month where job gains totaled more than 400,000, which marks the longest stretch of consecutive gains dating back to 1939. Nonfarm employment (chart below) is now very close to retracing all of the jobs lost in the pandemic.4

Shanghai’s Lockdown Continues, Could Impact Global Supply Chains – Due to a Covid-19 outbreak, most of Shanghai’s 25 million residents are in lockdown. Shanghai is a manufacturing hub, so the multi-day lockdown is likely to have downstream effects on production and supply chains. These additional pressures come at a time when inflation is already being pushed higher by a variety of other factors and serve as a reminder that inflationary pressures are very much a global concern.6

How to Survive a Potential Bear Market – With the sudden market changes that we’ve witnessed the past few weeks, investors may be wondering if we could potentially reach the bear market territory.

It’s important to remember that inflation and volatility is a natural (if unpleasant) part of the economic cycle, but you can potentially avoid the most harmful hazards of a bear market on your investments by making use of some useful tools we offer in our free guide, The Zacks Bear Market Survival Kit.7 This guide discusses some key tools to prepare for a bear market, including:

- Understanding how bear markets work, and how long they last

- The strategies we believe are most effective for mitigating downside over time

- The most harmful thing investors do in a bear market, in our opinion

- Plus, more ways to potentially survive a bear market and achieve your long-term goals

If you have $500,000 or more to invest, get our free guide today. You’ll get our viewpoint on the most important moves you can make to weather a recession. Don’t wait—get this guide before the storm hits.

Disclosure

2 ZIM may amend or rescind the “The Zacks Bear Market Survival Kit.” guide for any reason and at ZIM’s discretion.

3 Wall Street Journal. April 4, 2022. https://www.wsj.com/articles/with-inflation-not-letting-up-shoppers-cut-back-on-staples-11649064601?mod=djemRTE_h

4 Wall Street Journal. April 4, 2022. https://www.wsj.com/articles/march-jobs-report-unemployment-rate-2022-11648766857

5 Fred Economic Data. March 30, 2022. https://fred.stlouisfed.org/series/PAYEMS#0

6 Wall Street Journal. April 4, 2022. https://www.wsj.com/articles/shanghais-covid-19-cases-rise-above-13-000-as-city-extends-lockdown-11649119773?mod=djemRTE_h

7 ZIM may amend or rescind the “The Zacks Bear Market Survival Kit.” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.