This week was packed with newsworthy headlines that we believe are impacting this current market, such as:

- Possibility of bigger rate hikes

- The boom in hospitality and healthcare

- Women in the workforce

Fed Chairman Jerome Powell Signals Possibility of Bigger Rate Hikes – In testimony given before the Senate Banking Committee this week, Chairman Powell surprised markets by indicating the Fed could potentially speed up rate increases if economic data and inflation continue to run too hot. The Fed implemented 75 basis point rate increases last June, July, September, and November, then downshifted to a 50 basis point increase in December and a 25 basis point increase in February. The market had largely expected that 25 basis point increases would come at the next meeting or two, then the Fed would pause rate hikes to allow the impact of higher rates to set in (rate hikes tend to work on a lag). But Chairman Powell’s testimony this week upended these expectations, and he seemed to be relenting to the idea that a recession/hard landing would be necessary to control inflation. In Chairman Powell’s words, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” adding that “if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” The Fed was particularly disheartened by very strong jobs and spending report in January, and inflation data that showed prices decelerating at a much slower pace than previously. The Fed’s preferred inflation gauge, the PCE index, increased by 5.4% year-over-year in January, which marked an uptick from December’s 5.3% year-over-year rate of increase. Market and Fed watchers should pay close attention to Friday’s jobs report, as well as the February release of PCE index figures next week.1

Time to Focus on YOUR Financial Situation!

Instead of getting caught up in the ever-changing headlines, focus on YOUR financial situation. This can be more beneficial in the long-term in my experience.

This involves understanding your long-term goals, your risk tolerance, your investment time horizon, and other factors that make up your financial situation. To help you do this I recommend reading our guide, “4 Steps to Managing Your Retirement Assets.”

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free guide today!

Download 4 Steps to Managing Your Retirement Assets!3

While the Tech and Housing Sectors Slow, Healthcare and Hospitality are Booming – From a job and hiring perspective, the information technology sector is puttering in 2023, while healthcare and hospitality are booming – essentially the opposite of what we saw in the months and year following the pandemic. This dynamic is meaningful to the overall strength of the labor market, which is one of the factors frustrating the Fed’s efforts to tame inflation. Information technology jobs account for about 1 in 40 jobs in the U.S., while healthcare and hospitality account for 30% of the workforce. Operators of hotels, restaurants, and bars are among the country’s fastest growing employers, and combined with healthcare, created 207,000 new jobs in January – about half of that month’s payroll gains. Other industries are also performing better than information technology. According to the Bureau of Labor Statistics, payrolls in 72% of industries are expanding, which is solidly above the 10-year average of 62%.3

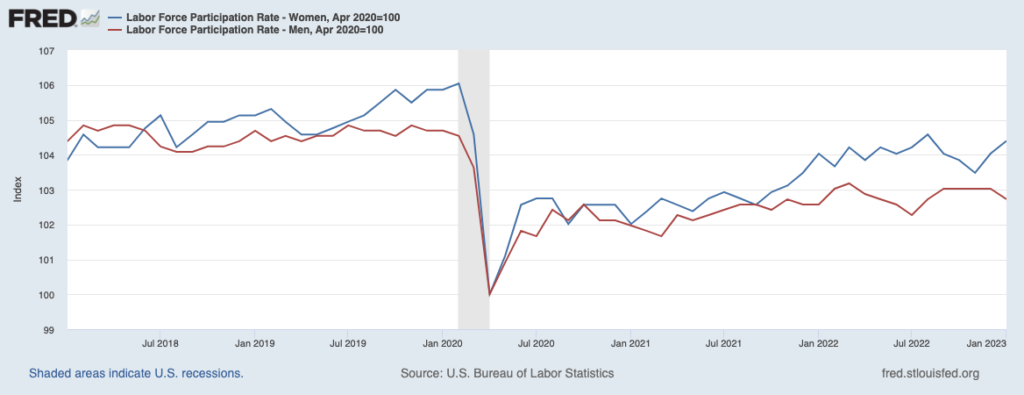

Women Return to the Workforce in Strong Numbers – Despite continued difficulty finding child care particularly following the pandemic, women are returning to the workforce in compelling numbers. For the last four months, women have added more to total payrolls in the U.S. than men, and their return to the workforce has overall been better than men following the pandemic (chart below).4

All told, women hold 66% of all jobs in leisure, private education, healthcare, hospitality, and other services jobs. And since those jobs comprise a large percentage of total jobs in the economy, women now hold 49.8% of all nonfarm jobs. Women’s return to the workforce has been a largely unsung pillar propping up the economy over the last few months, and it could serve as a force to soften inflation if the number of available job openings falls as women fill more positions.

How to Navigate Your Retirement? You may be wondering how you can determine your long-term goals, your risk tolerance, your investment time horizon, and other factors that make up your financial situation. This can be a difficult process to navigate on your own. So, to help you get a head start, I would recommend referring to our guide, “4 Steps to Managing Your Retirement Assets.6”

This guide offers insight to help you make critical decisions about your retirement and outlines four simple steps that can give you an added advantage when you retire.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free guide today!

Disclosure

2 ZIM may amend or rescind the “4 Steps to Managing Your Retirement Assets” guide for any reason and at ZIM’s discretion.

3 Wall Street Journal. March 5, 2023. https://www.wsj.com/articles/bars-hotels-and-restaurants-become-the-economys-fastest-growing-employers-47f5292f?mod=djemRTE_h

4 Wall Street Journal. March 8, 2023. https://www.wsj.com/articles/women-jobs-workforce-economy-international-womens-day-5fc372a3?mod=djemRTE_h

5 Fred Economic Data. February 3, 2023. https://fred.stlouisfed.org/series/LNS11300002#

6 ZIM may amend or rescind the “4 Steps to Managing Your Retirement Assets” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.