Was There Just Another Bank Bailout? Last Sunday, the Federal Reserve, U.S. Treasury, and Federal Deposit Insurance Corp. issued a joint statement declaring SVB and SBNY as “systemic risks,” which from Dodd-Frank legislation in 2008 is a characterization that gives government officials and regulators more flexibility when dealing with the banks. The action went on to make all SVB and SBNY depositors whole, including all those with deposits over the FDIC-insured $250,000 limit. The Fed was hoping this action would also stem the flight of deposits from other regional banks and in turn prevent the crisis from worsening. The Fed went a step further to protect regional banks from insolvency by creating a special emergency facility called the Bank Term Funding Program. Under this program, debt securities like long duration U.S. Treasuries could be used as collateral for cash loans for up to a year, giving banks access to liquidity without having to sell securities at a loss. This emergency capital can prevent a bank from becoming insolvent, but the issue of owning debt securities with fair market value below balance sheet value remains – as long as interest rates are elevated relative to where they were in 2020 and 2021. So, do these actions rise to the level of taxpayer bailout? It really depends on who you ask, but the Treasury Department said “no losses will be borne by the taxpayer,” and bondholders in both banks have no protection. The FDIC said it would make up for losses to its deposit insurance fund with penalties on the banks, but the bigger question is whether those penalties will ultimately result in higher costs for bank customers, which in effect would mean taxpayers do feel the impact.1

Keep Your Investments Protected in a Potential Bear Market!

Market volatility concerns come with a lot of worries from investors about how to manage their investments if the market reaches bear market territory.

Don’t despair! You can potentially avoid the most harmful hazards of a bear market on your investments by making use of some useful tools I offer in our free guide – The Zacks Bear Market Survival Kit.2

This guide discusses some key tools to prepare for a bear market, including:

- Understanding how bear markets work, and how long they last

- The strategies we believe are most effective for mitigating downside over time

- The most harmful thing investors do in a bear market, in our opinion

- Plus, more ways to potentially survive a bear market and achieve your long-term goals

In this guide, you’ll get our viewpoint on the most important moves you can make to weather a recession. Don’t wait—if you have $500,000 or more to invest, get this guide before the storm hits.

The Zacks Bear Market Survival Kit2

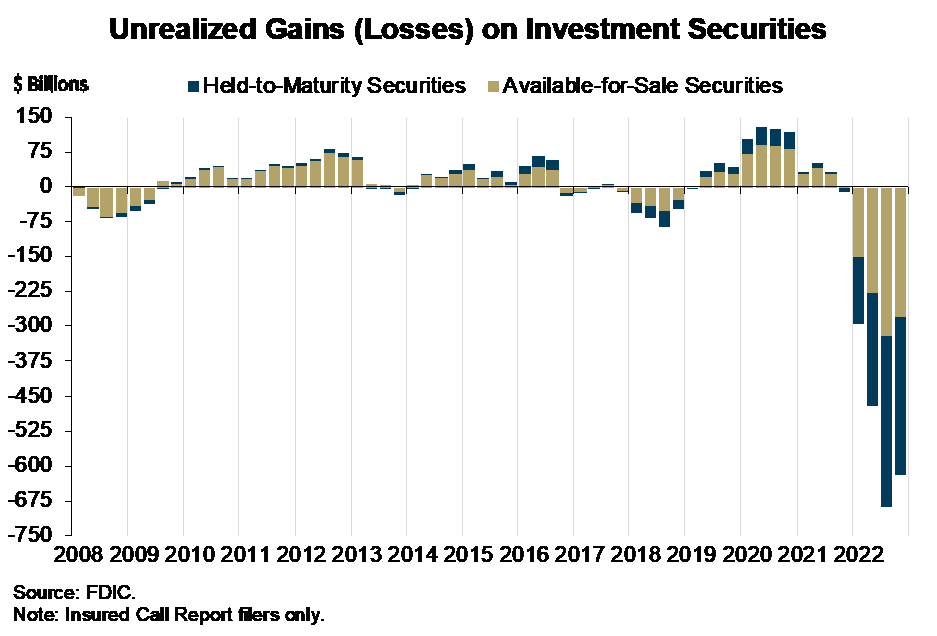

How Problems in the Banking Sector May Influence the Fed – the recent failures of Silicon Valley Bank (SVB) and Signature Bank (SBNY) have led to jitters in the market that a banking contagion – perhaps for regional banks – is a growing possibility. The Federal Reserve and Treasury Department moved to stem the crisis, but understanding the root of the problems offers insight as to why these bank failures may influence Fed policy going forward. Most bank failures historically have been caused by credit risk issues, but SVB and SBNY were unique cases where a run on deposits needed to be offset by selling long duration securities at significant losses. How did these banks end up with large portfolios long duration securities with sizable, unrealized losses? The story starts in early 2020, when extraordinary fiscal and monetary stimulus in response to the Covid-19 pandemic resulted in an explosion of liquidity, which also led to a surge in bank deposits. Banks like SVB that cater to niche markets (in SVB’s case, tech startups and VCs) do not have very diversified deposit bases, and their deposits soared at much higher rates than banks with large amounts of retail customers. This massive deposit growth came at a time when the fed funds rate was anchored to the zero bound, and US Treasuries were paying 2% at most, but often far less. Many banks – not just SVB (see chart below) – heavily invested new deposits in long duration Treasuries and other types of fixed income, which while normally a prudent action, turned out to be a matter of terrible timing. As the Fed encountered surging inflation and responded with rapid interest rate increases, yields across fixed income durations moved higher, deeming the fair market value of many fixed income securities portfolios as lower than balance sheet values:2

So how may this event influence the Fed? Since we know rising rates were the cause of rapid growth in unrealized losses, it follows that the Fed may feel pressure to rethink their planned path of interest rate hikes, since higher rates would arguably continue to create bigger losses on bank balance sheets. The market is starting to price-in the possibility that the Fed could pause – investors in interest-rate futures markets on Wednesday forecast a 50% chance the Fed would not increase rates at their March 21-22 meeting, which was up from 30% just the day before. Rate cuts also appear more likely in 2023, according to futures markets – markets saw a nearly 70% chance the Fed would cut rates below 4% by the end of the year.

Softer Economic Readings in February Could Nudge the Fed – in addition to problems in the banking sector possibly influencing the Fed, there were some economic data releases in February indicating softer activity. The Core Consumer Price Index (CPI) rose 5.5% year-over-year in February, the smallest increase since September 2021. That’s of course still well above the Fed’s 2% target, but it underscores inflation moving in the right direction. Spending at stores, online, and in restaurants also fell by 0.4% in February following a 3.2% rise in January; the producer price index fell 0.1% in February from the prior month; orders for machinery, appliances, and other manufactured goods fell; and finally, home sales have declined for a year straight. Softer economic data could support a decision to pause rate increases at the March 21-22 meeting.5

What Happens to Your Investments in a Bear Market? Investors should remember that volatility is a natural (if unpleasant) part of the economic cycle, but you can potentially avoid the most harmful hazards of a bear market on your investments by making use of some useful tools we offer in our free guide, The Zacks Bear Market Survival Kit.6

This guide discusses some key tools to prepare for a bear market, including:

- Understanding how bear markets work, and how long they last

- The strategies we believe are most effective for mitigating downside over time

- The most harmful thing investors do in a bear market, in our opinion

- Plus, more ways to potentially survive a bear market and achieve your long-term goals

If you have $500,000 or more to invest, get our free guide today. You’ll get our viewpoint on the most important moves you can make to weather a recession. Don’t wait—get this guide before the storm hits.

Disclosure

2 ZIM may amend or rescind the “The Zacks Bear Market Survival Kit.” guide for any reason and at ZIM’s discretion.

3 The Wall Street Journal, March 14, 2023. https://www.wsj.com/articles/bank-failures-market-turmoil-fuel-bets-on-a-pause-in-fed-interest-rate-increases-4b487cd6?mod=djemRTE_h

4 FDIC, Q4 2022. https://www.fdic.gov/analysis/quarterly-banking-profile/qbp/2022dec/

5 The Wall Street Journal, March 15, 2023. https://www.wsj.com/articles/us-economy-retail-sales-february-2023-6b98a40b?mod=djemRTE_h

6 ZIM may amend or rescind the “The Zacks Bear Market Survival Kit.” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.