Amidst all the gloom surrounding global economic woes this year, many people overlooked some silver linings—one of them being 2015’s record high global foreign direct investment (FDI) flows.

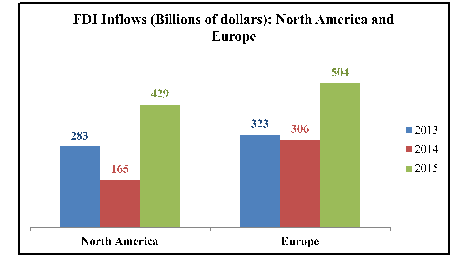

Swelling +38%, global FDI flows (i.e., aggregate investments made by companies/entities directly into overseas businesses versus buying shares on public stock exchanges) peaked to $1.76 trillion in 2015—the highest level since the global financial crisis of 2007-08. And, a quarter of the flows went to North America, outshining the region’s 2000 FDI levels.

The region also registered the sharpest rise at +160% last year from 2014 inflows, driven mainly by more than +250% jump in FDI to the U.S.

Notwithstanding debt woes, the European Union registered a +50% surge and Switzerland received a +886% rise to $69 billion.

Reversing a nearly five-year-old trend, developed economies collectively received the greater share (55%) of global FDI flows in 2015 versus the preceding year’s 41%. The spurt of FDI into advanced economies was largely due to cross-border mergers and acquisitions, particularly in the U.S.

Data Source: UNCTAD

Data Source: UNCTAD

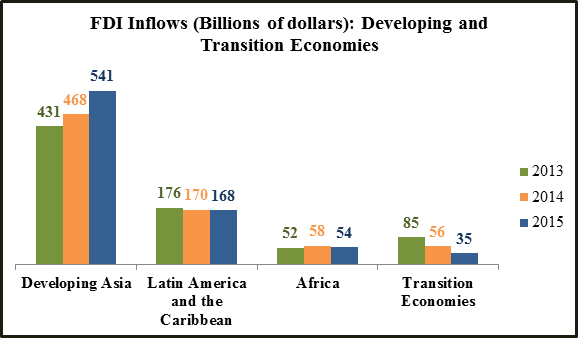

On the other hand, developing economies (excluding Caribbean financial centers) experienced a +9% increase, but flows to transition economies plunged -38% from 2014 levels.

FDI flows to Developing Asia rose around +16%. On the other hand, commodities and energy price routs discouraged foreign investments in Africa (~ -7%), Latin America and the Caribbean (~ -2%).

Data Source: UNCTAD

Harbingers of Future Growth

Usually a long-term investment, FDI occurs in the following alternative ways—a foreign company acquiring shares of, and/or expanding operations of a domestic entity; the overseas company setting up its subsidiary in the target country; or, a cross-border merger. In the process, technologies and skills exchanged between the two entities can potentially lead to efficiency gains, more employment opportunities and improved profitability—benefits which may not just be restricted to the recipient firm/subsidiary alone.

FDI contributed to around 12 million U.S. jobs in 2013—consisting of 6.1 million directly employed by foreign-owned entities plus 5.9 million jobs indirectly attributable to foreign investments via by-products, like productivity gains and supply chains.

Majority-owned U.S. affiliates of foreign entities accounted for $53 billion investment in R&D in 2013, which is 16.4% of total American R&D expense by businesses that year, underscoring FDI’s importance in sustained economic growth.

Also, emerging countries are fast capturing global investors’ attention owing to their growing market and rapid urbanization. The Indian aviation sector, for example, has reaped substantial gains, with FDI leading to the launch of two airlines, Vistara and Air Asia India, and to Etihad’s purchase of a 24% stake in Jet Airways. The developments have facilitated expansion of international air traffic from the country and operations from several new cities.

Bottom Line for Investors

Even though current global weakness is predicted to slow foreign capital flows globally in 2016, last year’s record foreign investments, particularly in developed economies including the U.S., should potentially provide adequate support for companies’ long-term prospects. Furthermore, by 2018, global FDI flows are predicted to exceed $1.8 trillion on the back of an expected global economic recovery.

As for Corporate America in particular, recent regulatory challenges may have restricted certain cross-border deals this year, but prospects of real growth offered by firming domestic fundamentals and an expected rebound in corporate earnings by end of the fourth quarter augurs well for returns on existing FDIs and add to U.S. companies’ appeal to global investors looking forward.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.