To say that the internet has revolutionized the way we learn is an understatement. Today, technology is seeping into conventional classroom and changing the world of teaching. In what’s dubbed as ‘EdTech’(a portmanteau of ‘education’ and ‘technology’), a plethora of online platforms and applications are offering learning tools, structured courses and tests, much like what a school or university intends to do, but with the freedom to study at almost ‘anytime and anywhere.’

The education market is at almost $5 trillion – almost eight times the size of software industry and thrice that of media and entertainment (according to EdTechXGlobal). And with traditional educational services becoming more expensive, up-and-coming firms looking to capitalize on the burgeoning demand by offering less-costly and more accessible alternatives are flowing fast into the market.

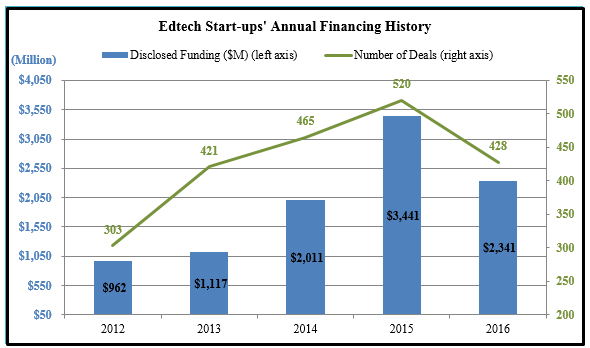

Although there was some cooling off last year, funding in Edtech start-ups has already shown tremendous growth over the preceding years. Investments in Edtech start-ups burgeoned from $962 million in 2012 to $3441 million in 2015 – a more than +255 increase! Over the same period, the number of deals in the space surged around +72%. (According to data from CB Insights).

Source: Data from CB Insights

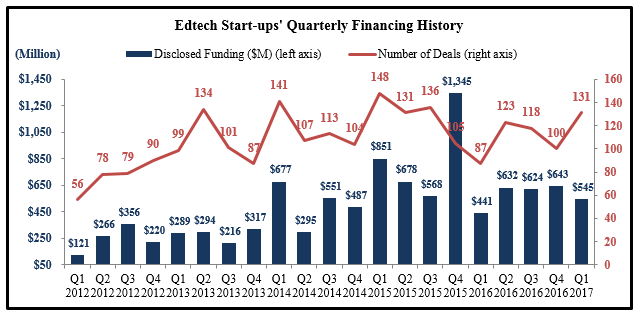

In the latest quarter, the number of investment deals in this space rocketed to 131 – the highest since Q3 2015.

Source: Data from CB Insights

The bulk of investors’ dollars in the Edtech space are directed towards professional skills or higher education. It’s not hard to see why. Higher education or technical knowledge are considered to have the most immediate impact on people’s career prospects and thereby driving demand for these skills from both students and professionals. This kind of demand is unlikely to fade, and might continue to evolve, thereby pushing for more diversity in online course offerings and even galvanizing more players’ entry in the space. So, with an enviable long-term growth potential, Edtech is proving to be quite the sweet spot for venture capitalists investors looking for the next ‘big bang’ for their buck.

Corporate World’s Betting Big on Edtech

In a recent survey by the Career Advisory Board (DeVryUniverisity), 44% of the 51 hiring executives polled said that their current employees lack the “evolving skills” in the field of technology that their organizations require, with just 15% claiming that their workers are actively enrolling for training. Such skills’ gap potentially spells opportunity for leading online education platforms like Coursera and Udacity to thrive on.

These online platforms are teaming up with corporate executives to provide courses specially suited to industry and organization-specific needs, helping companies procure a better trained pool of candidates to choose from or fine-tune skills of their existing workforce. Coursera has partnered with companies such as Google, IBM and PwC, while Tech-centric Udacity has found partners in Amazon, Google, Facebook and Salesforce.

Education Goes Beyond Textbooks

People can now get a taste of world-renowned universities’ teaching styles even without enrolling in one. EdTech start-ups have garnered wide user bases by offering lessons from the best in the business, in a way that’s relatively cost-friendly to users. Coursera has teamed up with 150 universities – such as, Harvard, Yale, University of California to name a few – to offer courses in a range diverse subjects. As of February 2017, the site had 24 million registered users. Users have the option of accessing material for free or paying a fee for a certificate, starting at $49.

Even elementary and high schools are warming up to technology in education. According to LearnTrials (a start-up that provides software services for schools), more than 3,900 math and reading apps, classroom management tools and other software services have been adopted by schools across the U.S.

Bottom Line for Investors

Online education may not replace the physical classroom, but technology has disrupted learning in a big way.

The Edtech market is projected to grow +17% per annum to reach $252 billion globally by 2020, according to a joint study by EdTechXGlobal and IBIS Capital. The report also mentions the U.S. as the current leader in the space. Other parts of the world are also gaining momentum, with Asia experiencing the fastest growth in Edtech investments in the world.

What potentially adds to Edtech’s attractiveness is the non-cyclical nature of the demand for education – which should entail fewer swings in market value, with respect to fluctuations in the broader market economy.

The fact that established names in the corporate world are collaborating with online teaching platforms only bolsters outlook for Edtech’s potential. There could even be a potential win-win for valuations of Edtech start-ups and of corporations leveraging the technology to boost worker productivity.

While the future of Edtech start-ups looks promising, all sectors from technology to education are subject to change. And with markets changing constantly, investors are taking aim at a moving target, which is no small feat. But, achieving long-term success as an investor does not have to be complicated. There are four timeless keys to investing that are central to our approach at Zacks Investment Management. Get an inside look into our timeless keys to investing and get a leg up on other investors by downloading – 4 Timeless Keys to Investing – simply click on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.