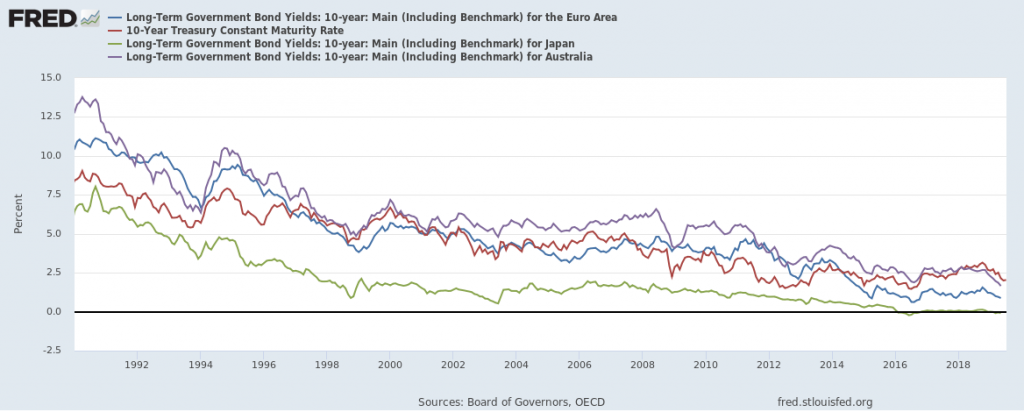

Government bond yields across the globe are in serious decline – and have been for some time now. Investors are paying closer attention to yields these days, however, because in many developed countries like Japan, Germany, France, and the Netherlands 10-year bond yields have actually turned negative.1

The chart below shows the methodical, steady decline of government bond yields over the last 20+ years:

Source: Federal Reserve Bank of St. Louis2

_____________________________________________________________________

Time to Focus on the Fundamentals!

Want to learn more about global bond yields as well as other key economic indicators and how they could impact the economy and your investments? Download our just-released July 2019 Stock Market Outlook report.

This 22-page report contains some of our key forecasts to consider such as:

- Inside the China tariff war

- Why are Zacks strategists (including me) staying bullish?

- Stock market returns expectations for 2019

- Small-cap and large-cap outlook in 2019

- What of cuts in global growth?

- What produces 2019 Optimism?

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released July 2019 Stock Market Outlook3

________________________________________________________________________

So, what does this mean for investors?

First let me state the obvious: if you want to own 10-year government bonds in a country where the yield is negative, you have to pay money to loan that government money. If that’s a head-scratching proposition, it should be. Even though government bonds of highly developed countries are considered “risk-free,” you’d still nominally lose money over a 10-year period (not to mention factoring in the purchasing power effects of inflation).

Buying 10-year government bonds in countries where the yield is still positive, such as in the U.S., U.K., or Australia, does not do an investor too much better. Here are the 10-year yields as of close on July 5th:4

- United States: 2.037%

- United Kingdom: 0.739%

- Australia: 1.293%

Not exactly what we’d call ‘inspiring’ yields, and certainly not what investors would hope to receive in return for locking money up for 10 years.

The cause of the decline in global bond yields has a few sources, but it’s also difficult to pinpoint exactly where the pressure is coming from. In Germany, for instance, there is a short supply of government debt securities as the country is notoriously frugal and sports a low debt-to-GDP ratio. There are only $1.7 trillion of German government debt securities, compared to $16 trillion for the U.S. When demand for German ‘bunds’ drives up prices, yields fall.

But the biggest factor in declining bond yields, I would argue, is low inflation expectations tied to the “muddle-through” GDP growth we’ve come to expect from the global economy in this expansion. Central banks across the world have set a low bar for interest rates and the consensus is that easy monetary policy will remain the status quo for 2019. I do not expect a breakout for rates any time soon as a result.

For consumers, lower rates can be a plus – the average 30-year mortgage rate dipped from 5% in November to around 3.8% as of last week, according to data from Freddie Mac.5

But for investors, paltry yields on risk-free debt can present challenges. Many retirees bank on Treasuries and government debt as safe sources for yield, which in turn can provide steady retirement income and cash flow in an investment portfolio. But securing a yield lower than 2% over 10 years is not many retirees’ idea of a good investment. And it probably shouldn’t be.

Where Can Investors Turn to Find Yield in a Low-Interest Rate Environment?

Government bonds are not the only fixed income options in the marketplace. Here at Zacks Investment Management, we look to high grade corporate bonds and municipal bonds as other areas where we can diversify away from Treasuries, in an effort to create yield and cash flow in a strategy.

But investors should also remember that stocks can be a good source of cash flow, too. For one, many high-quality dividend stocks often pay yields exceeding 2%, and an investor could explore a dividend stock strategy that generates yield in excess of the 10- or even the 30-year U.S. Treasury. Of course, investing in stocks means enduring the volatility associated with equity investing, but for investors with a long time horizon or a higher risk tolerance – or both – dividend stocks can potentially be a useful alternative for yield.

Bottom Line for Investors

In an investment marketplace starved of risk-free yield, it can be challenging for income-seeking investors to find reliable sources of cash flow. But it’s not impossible. Investors can explore higher yield alternatives in the form of high-grade corporate bonds, municipals, or even dividend-paying stocks. We diversify across all of those categories at Zacks Investment Management, and would be happy to discuss them further with you.

In the meantime, to help you learn more about global bonds as well as other key indicators that could impact the economy, I invite you to download our Just-Released July 2019 Stock Market Outlook Report.

This Special Report is packed with our newly revised predictions for 2019. For example, you’ll discover Zacks’ view on:

- Inside the China tariff war

- Why are Zacks strategists (including me) staying bullish?

- Stock market returns expectations for 2019

- Small-cap and large-cap outlook in 2019

- What of cuts in global growth?

- What produces 2019 Optimism?

- And much more.

If you have $500,000 or more to invest, learn how you may be able to prepare your portfolio for changes in the economy by reading this new report today.

FREE Download – Zacks’ July 2019 Stock Market Outlook6

Disclosure

2 Federal Reserve Bank of St. Louis, June 14, 2019. https://fred.stlouisfed.org/series/IRLTLT01EZM156N

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

4 The Wall Street Journal, July 8, 2019. https://www.wsj.com/market-data/bonds/governmentbonds

5 The Wall Street Journal, June 23, 2019. https://www.wsj.com/articles/world-economy-comes-to-grips-with-bond-yield-plunge-11561311410

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.