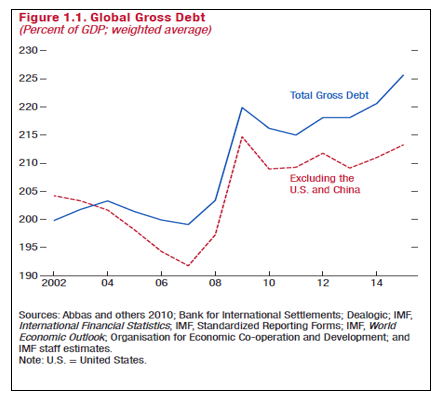

At 225% of GDP, global nonfinancial debt levels have hit record highs. The IMF’s Fiscal Monitor shows that around two-thirds of the $152 trillion in total debt belongs to the private sector.

Source: IMF Fiscal Monitor October 2016

But since the 2008-2009 global financial crisis, it is government debt that has experienced the largest increases across advanced, emerging and low-income economies.

The low interest rate environment no doubt fueled borrowing among households and corporations in advanced economies in the pre-crisis period. In the U.S., for instance, a host of government-funded programs were deemed necessary to resuscitate the economy. The U.S. government shelled out around $426.4 billion into the Troubled Asset Relief Program (TARP), which included purchases of toxic assets from major corporations such as Citigroup, Bank of America, American International Group, General Motors, Chrysler, and so on. The overall federal cost in responding to the financial crisis was around $1.6 trillion – around 10% of the five-year average U.S. GDP.

The question is, will mounting debt levels cripple the economy and put theU.S. at risk of default?

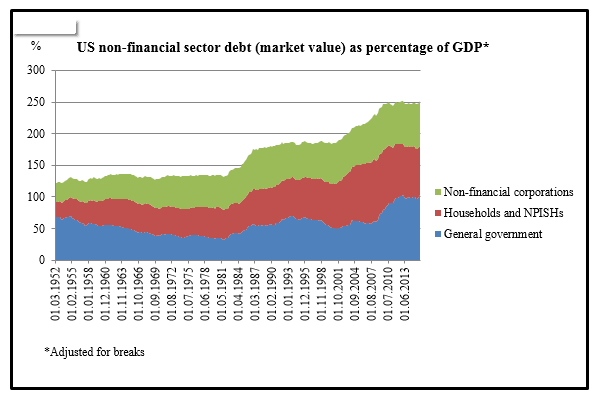

According to the Bank for International Settlements data, the U.S.nonfinancial sector’s steadily rising debt-GDP ratio is now around 250% of its GDP. Since the end of 2006, U.S. government debt (at market value) has increased from 58.5% to 102.4%, while the nation’s private non-financial sector’s share in GDP has fallen from 160.2% to 150%.

Source: Bank for International Settlements

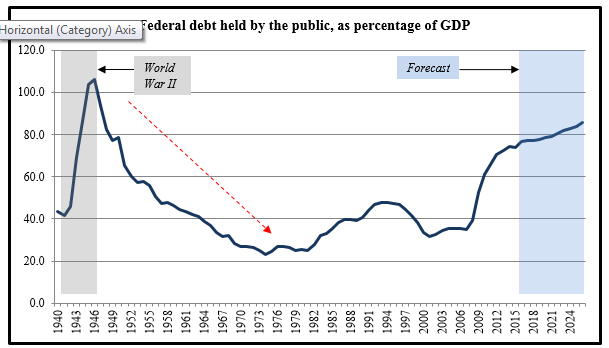

U.S. government debt held by the public rose from 35.2% of GDP in 2007 to 73.6% in 2015, and is projected to rise further over the next decade. But, this level of debt is actually not new to our country – we saw debt levels exceed GDP during WWII, only to rapidly fall below it in the post-war years. By 1963, the federal debt (held by public) to GDP ratio fell to 41%. It may be over-optimistic to expect a similar recovery over the next decade, given the U.S. economy’s modestly strengthening domestic fundamentals and the global economic challenges that exist in much of the developed world. But it’s certainly possible, and the U.S. has shown before that it can with stand such high levels of debt.

Source: CBO’s August 2016 Report, An Updateto the Budget and Economic Outlook: 2016 to 2026

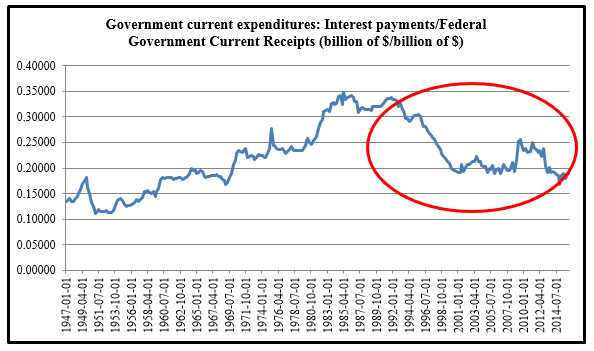

One key metric that many debt critics underappreciate is that the federal interest payments’ share of current receipts has been trending downward for a while – something that should ease concerns over the U.S. government’s debt servicing abilities.

Source: Bank for International Settlements

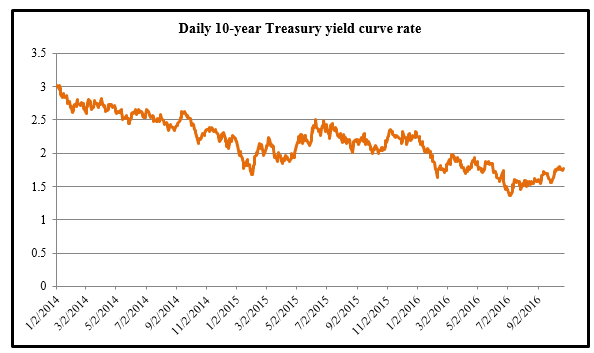

Not just that, the decline in Treasury yields (as investors seek safety in government bonds) could even make way for favorable refinancing conditions for the government for many years to come.

Source: U.S. Department of the Treasury

Source: U.S. Department of the Treasury

Bottom Line for Investors

Although global debt levels are high, they don’t pose the same threat to all economies. While countries like Brazil and China could be facing tougher times due to their ongoing sluggishness, America’s steadily recovering economy coupled with its record low interest rates/Treasury yields should render debt more affordable.

Similarly, degrees of default risks are not always the same across all sectors or companies. That’s why it is crucial to diversify country, sector, and industry exposure across your portfolio, to minimize downside risk where possible. At Zacks Investment Management, we help you make that selection with confidence, by customizing a portfolio suited to your needs and risk tolerance. To learn more about how you can manage your retirement assets, download our free guide “4 Steps to Managing Your Retirement Assets”

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.