In today’s Steady Investor, we focus on important factors that we believe are making an impact on the market today, such as:

How Economic Restrictions in Asia Affect the Global Economy – The Covid-19 Delta variant is causing problems for many countries across the globe, but it’s been weighing particularly hard on countries with low vaccination rates. And many of those countries are key to global supply chains. Vietnam is a prime example – only 3% of the population is vaccinated, and an outbreak there has led to lockdowns and economic restrictions that have stifled factory activity. A survey of manufacturing purchasing managers found that Vietnam, along with Malaysia and Indonesia, has seen factory activity move into contraction territory. That has left many Western brands that rely on Vietnamese factories to see a rise in costs. Companies like Adidas, Crocs, and Steve Madden rely heavily on Vietnamese manufacturing, which delivers over 30% of U.S. shoe imports. That’s why some 80 shoe and apparel companies wrote a letter to President Biden asking the administration to help Vietnam accelerate vaccinations. Taken together, economic restrictions in Vietnam and elsewhere in Asia can add to an already long list of supply chain issues, from delays at ports to rising raw-material prices, and ultimately, to higher costs for consumers.1

___________________________________________________________________________

Want to Breeze Through Your Retirement Uncertainties? Find Out How!

It’s important for every investor planning to retire to find a unique strategy that lines up with their financial goals and stick to it!

Here at Zacks Investment Management, we believe that every good retirement strategy involves some investment discipline. That’s why we encourage you to start your journey to a stress-free retirement now! In our guide, 8 Steps Towards a Stress-Free Retirement, you will get insight on:

- The “magic number” every retirement investor needs to know

- Three ways to generate income during retirement

- Plus, other key steps to help you realize your retirement goals

If you have $500,000 or more to invest, download our 8 Steps Towards a Stress-Free Retirement2

___________________________________________________________________________

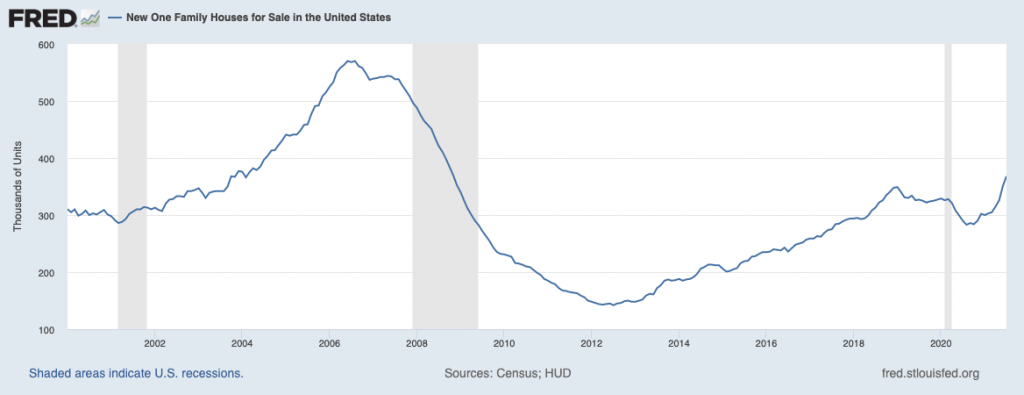

Housing Supply Ticks Up, But Prices Remain Firm – The housing market has charged ahead over the last year, with prices moving firmly higher and demand outweighing supply. There are signs, however, that supply is catching up, while demand backs slightly off its highs. The inventory of homes for sale at the end of July was 1.32 million, which is up 7.3% from June and marks the highest level of homes available since October 2020. With more homes on the market, sales of new single-family homes also ticked higher last month, rising 1% to a seasonally adjusted annual rate of 708,000. Even still, that level of sales is still lower than the pace at the start of the year, as limited supply raised prices and discouraged my new buyers. Homebuilders are still pushing to catch up, as there is a widespread belief that there are plenty more homebuyers still waiting in the wings for new houses to come online. While the current number of new homes for sale is still well below levels seen during the peak of the previous cycle, it’s clear that supply is picking up.3

Source: Federal Reserve Bank of St. Louis4

Is the U.S. Economy Already Cooling Off? The U.S. economy continues to expand, but there are a few signs that the pace of growth may be cooling off. In August, factories and service providers – as measured by the IHS Markit surveys of purchasing managers – saw activity dip materially. On the service-sector side, the purchasing manager’s index fell to an 8-month low of 55.2, while the manufacturing index sunk to a 4-month low of 61.2. There’s good news here, however – any reading above 50 signals expansion, so the economy is still showing relatively strong growth readings. The slowing pace of expansion is almost certainly due to the effects of the latest wave of Covid-19 infections, which may have caused consumers to retreat slightly as businesses also made adjustments. Cancellations, postponements, and other shifts in consumer and business behavior are softening activity.5

Out-of-Office for Two Years? Many businesses are now coming to terms with the reality that offices may be closed for a full two years, assuming a return to work does not happen until early 2022. Some major corporations are already announcing postponements – Apple announced to corporate employees that the planned return to U.S. offices would have to wait until January 2022 at the earliest, and other major companies like Chevron and Wells Fargo have pushed back planned September returns. Same goes for Facebook and Amazon. Other corporations like Goldman Sachs have announced vaccination requirements for employees and clients who wish to visit offices in person, which adds another layer to the challenges associated with reopening offices.6

Steps to Enjoy a Stress-Free Retirement – Planning a stress-free retirement means answering questions like – How can you generate income in retirement? And do you have a plan in place for emergencies that can derail your retirement investments?

For those who are planning for retirement, there are steps you can take to better prepare yourself and protect your secure and comfortable retirement.

If you have $500,000 or more to invest, get our free guide, 8 Steps Towards a Stress-Free Retirement.7 It will give insight on important keys to crafting and implementing a strategy to potentially reach your retirement goals. Click on the link below to get your free copy today.

Disclosure

2 ZIM may amend or rescind the “8 Steps Towards a Stress-Free Retirement” guide for any reason and at ZIM’s discretion.

3 Wall Street Journal. August 23, 2021. https://www.wsj.com/articles/u-s-home-sales-rose-2-in-july-amid-higher-inventory-11629727991

4 Fred Economic Data. August 24, 2021. https://fred.stlouisfed.org/series/HNFSUSNSA

5 PMI. August 23, 2021. https://www.markiteconomics.com/Public/Home/PressRelease/2ebf3c08ba874510879b6b2976cc98c4

6 Wall Street Journal. August 22, 2021. https://www.wsj.com/articles/remote-work-may-now-last-for-two-years-worrying-some-bosses-11629624605

7 ZIM may amend or rescind the “8 Steps Towards a Stress-Free Retirement” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.