Roxanne S. from Wrightsville Beach, NC asks: Hello Mitch, I’ve been a bit disheartened lately with the slew of bad news. Inflation, the Delta outbreak, and now the situation in Afghanistan. It feels like some of the cards are stacked against the economy and the stock market. What do you think? Time to step aside for a few months?

Mitch’s Response:

Thanks for your note, Roxanne, and I empathize with your concern over the string of bad news this summer. Many Americans had been hoping the pandemic risk would be completely faded by now, and that the economy (and normal life) would be charging ahead. Not only is the outbreak currently worsening, but there are also the layered concerns of inflation pressures and a messy situation in Afghanistan.

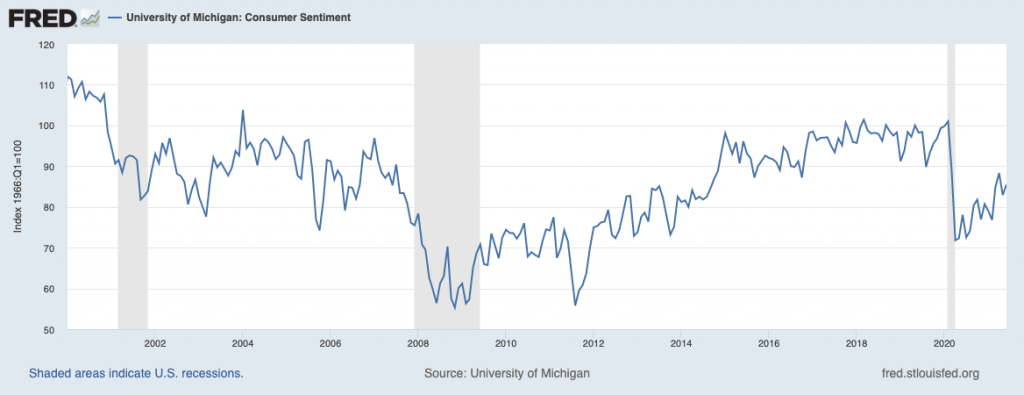

The confluence of bad news has many people concerned. An August survey from the University of Michigan found that the U.S. Consumer Sentiment Index (CSI) fell to 70.2, which was far below the 80+ expectation and marked a -13.5% decline from July. The only other times the CSI has fallen so steeply was October 2008 – at the cusp of the Global Financial Crisis – and April 2020. And we all know what happened then.

______________________________________________________________________________________________

See How You Can Navigate Through Turbulent Times

Investing is an emotional process. But to better reach your financial end goal, staying invested is key. Since 1926, investors who remained in the market over the long term came out ahead 99% of the time.

In our guide, How to Avoid Emotional Investing, we cover:

- How to do a “reality check” on individual stocks during a market correction

- How to potentially protect your portfolio from extreme market swings

- Plus, more useful techniques to take emotions out of your investing

If you have $500,000 or more to invest, get our free guide, How to Avoid Emotional Investing. It provides our advice, based on decades of experience, to help you navigate through turbulent times.

Download Our Guide, How to Avoid Emotional Investing.2

______________________________________________________________________________________________

The University of Michigan survey cited “dashed hopes” from Americans who were expecting the pandemic to be over by now. Folks are clearly feeling a bit disheartened and erring on the side of caution, as it sounds like you are.

Consumer Sentiment Dipped

I understand the concern, but at the end of the day, it’s important to remember the stock market is forward-looking, while consumer sentiment is a coincident indicator. In other words, if you’re worried about how things look today, remember that the stock market is focused on how things will be six or even 12 months from now.

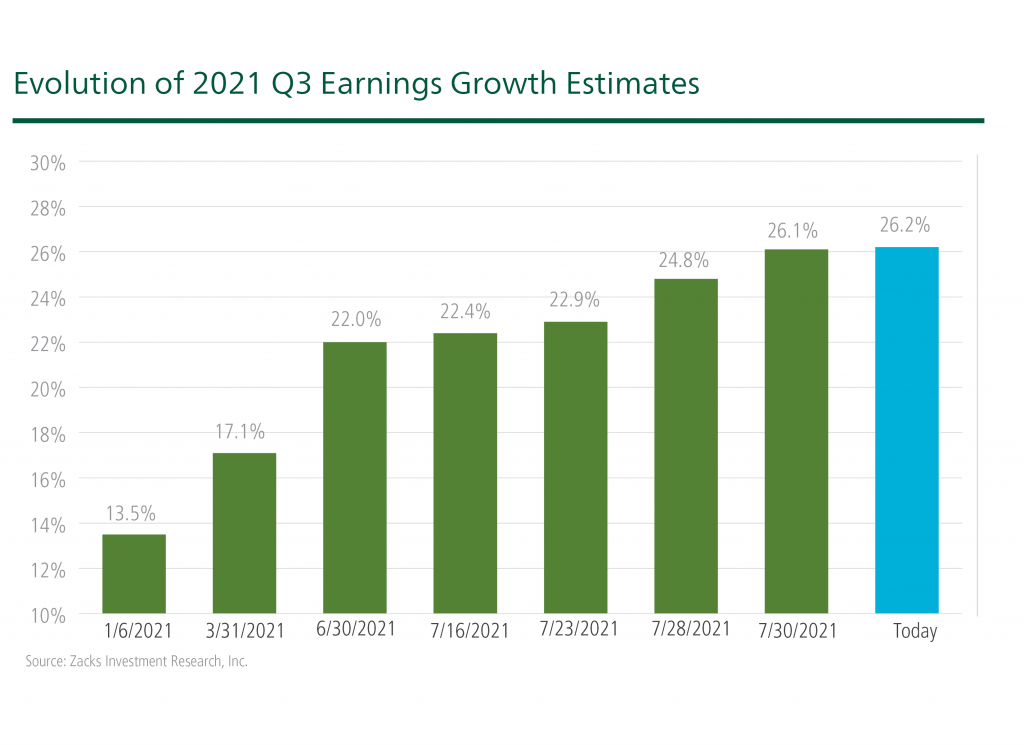

And looking ahead just one quarter, we can see that most U.S. corporations – whose sales and profits matter most to stock market returns – are still feeling good about the coming months and quarters. Total S&P 500 earnings in Q3 are expected to be up +26.2% on +13.3% higher revenues, and the chart below shows how Q3 estimates have been pushing higher since the start of the year. That’s a sign of more confidence, not less.

To be fair, the magnitude of upward revisions is on the lower side relative to what we had seen in the preceding quarter’s comparable period, but it is still quite strong.

The last point I’ll make is regarding the classic “wall of worry.” As bad news builds and folks become more cautious and skeptical about the economic outlook, it usually means that expectations for growth are revised downward – which ultimately makes the hurdle lower for the economy to clear. If expectations fall and the outcome is not as bad as everyone expects, those are the precise times you want to be in stocks, in my view.3

In times like these, when news headlines are causing investors to worry, the key is to not let your emotions get the best of you. The more you stay invested, the better your financial outcome will be!

If you have $500,000 or more to invest, get our free guide, How to Avoid Emotional Investing.4 It provides our advice, based on decades of experience, to help you navigate through turbulent times. Click in the link below to get your copy!

Disclosure

2 Fred Economic Data. August 27, 2021. https://fred.stlouisfed.org/series/UMCSENT

3 Zacks.com. August 13, 2021. https://www.zacks.com/commentary/1781776/3-things-to-know-about-the-q2-earnings-season

4 ZIM may amend or rescind the “How To Avoid Emotional Investing” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.