In this week’s edition of Steady Investor, we dive into recent market dynamics influenced by significant events, including:

• U.S. government shutdown looms

• Americans feel the sting of higher rates

• Working a 4-day workweek

A U.S. Government Shutdown Looms – In a story that seems to get written every six to twelve months or so, the U.S. government is at risk of shutting down due to disagreements over spending bills. Congress holds the purse strings for U.S. government spending, which means they must pass – by majority vote in both the House and the Senate – a bill to fund the government. This week, the Senate passed a bipartisan short-term funding measure that the House of Representatives refused to put on the floor for a vote, as Speaker Kevin McCarthy acquiesced to the demands of the Republicans in his chamber. If brought to the floor for a vote, the Senate bill would likely pass, as it would garner a mix of Republicans and Democrats voting in favor. Instead, the House is working on its own version of the funding bill, which is likely to keep the two chambers pretty far apart. The House appears to be poised to vote on a stopgap measure that would cut spending to an annual $1.471 trillion rate, which would not include any more money for Ukraine or disaster relief. The House bill would also include strict border security measures. On the Senate side, spending would continue at the $1.6 trillion annual pace, with $6 billion in additional aid for Ukraine and another $6 billion for disaster relief. There were no additional measures for border security. The Senate appears to be willing to add some measures for the border, but they are not likely to budge on Ukraine and disaster relief. That leaves the House with a difficult needle to thread. If a bill is not passed by Sunday, certain agencies will shut down temporarily, which from a market and economic perspective could mean the released delay of economic data on wages, inflation, and GDP.1

Get These 7 Secrets to Building the Ultimate Retirement Portfolio

Navigating market cycles while creating a retirement portfolio that meets your financial goals is no small feat. To build a portfolio that can potentially reach your goals, you must put some time and effort into defining your investing objectives, determining your asset allocation, and managing your investments over time.

If you have $500,000 or more to invest, I recommend downloading our guide 7 Secrets to Building the Ultimate DIY Retirement Portfolio. It provides a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own and pursue long-term investing success.

Download Your Copy of 7 Secrets to Building the Ultimate DIY Retirement Portfolio.2

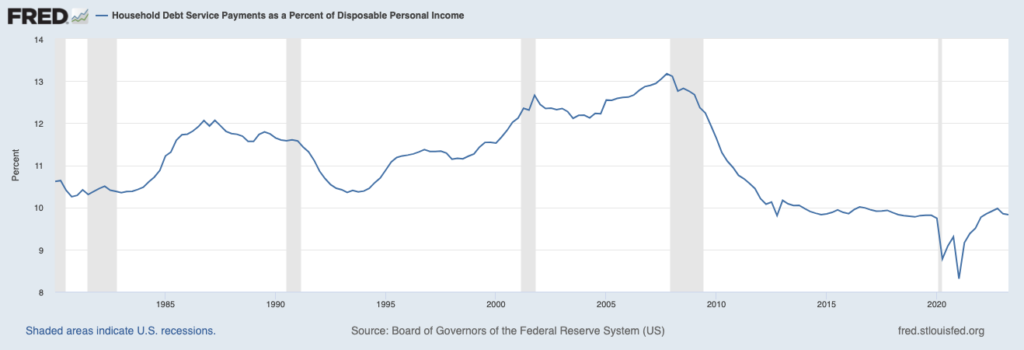

U.S. Borrowers Feel the Sting of Higher Rates – Two years ago, Americans looking for a house could benefit from a 3% rate on a 30-year fixed mortgage. Today, most 30-year mortgages carry rates around 7%. The same jump in rates is happening across markets for loans, from autos to credit cards. The National Association of Realtors estimates that the typical American family – with a median household income – cannot afford to buy a home in the current market. In the auto loan market, it is estimated that Americans now need about 42 weeks of income to buy a car. Three years ago, it was just 33 weeks. Credit cards have seen a similar jump, with the typical card carrying a 20.7% annual rate today versus a 14.6% rate in February 2022. For Americans who need to borrow, this environment is making it challenging to spend. But it also remains true that most Americans are not feeling a major burden because many mortgages and auto loans were locked in when interest rates were far lower. That’s why, as seen in the chart below, debt service (interest) payments as a percent of disposable income remains quite low in the aggregate, even though it jumped from 2020/2021 lows.3

Time to Embrace the 4-Day Workweek? – In Europe, the 4-day workweek is quite common, but not in the U.S. That could be changing now. Hundreds of employers are testing schedules and conventional ways of working – as evidenced by the shift to hybrid and remote work – and now also by trying out the four-day, 32-hour workweek. In the tight U.S. labor market, employers are seeking ways to keep employees happier, healthier, and more loyal. Offering a shorter workweek surely factors as an attractive benefit, but for employers, it also requires quite a bit of work and planning. That means cutting meetings, shifting employees off of email, and having them focus on just core elements of the work, and also doing more tracking – using reports from badge systems and work software to keep track of how long people are working.5

Looking to Build Your Retirement Portfolio? As we wait to see how the current events above pan out, we recommend taking a look at your financial portfolio. For long-term investors, it’s better to protect your investments from market volatility and inflation.

In our free guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio6, you will receive a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own and pursue long-term investing success.

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process to building and maintaining a retirement portfolio that will help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

3 Wall Street Journal. September 26, 2023. https://www.wsj.com/personal-finance/interest-rate-hikes-consumer-debt-d2b74401?mod=djemRTE_h

4 Fred Economic Data. September 22, 2023. https://fred.stlouisfed.org/series/TDSP#

5 Wall Street Journal. September 25, 2023. https://www.wsj.com/lifestyle/careers/how-a-4-day-workweek-actually-works-from-the-companies-pulling-it-off-1a5c0e2a?mod=djemRTE_h

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.