The current state of the market is volatile and can have a significant impact on your investment portfolio. This week, we dive into key factors we believe investors should be aware of, such as:

- Rise in home prices

- Trends in U.S. manufacturing

- Another U.S. labor shortage

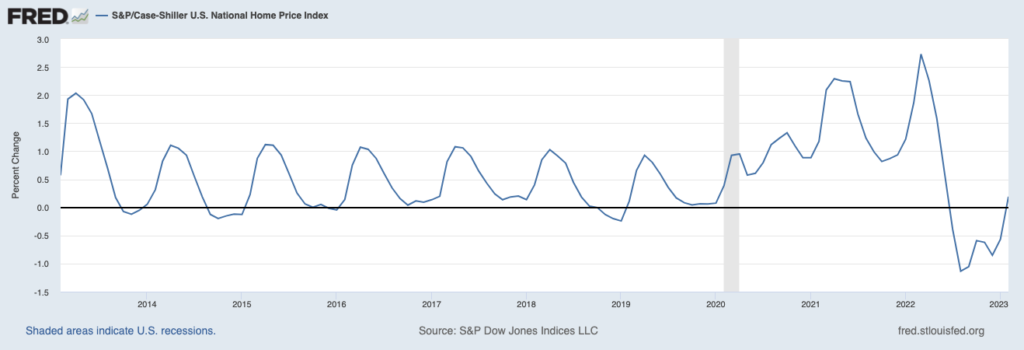

Home Prices Tick Slightly Higher After Seven Months of Decline – The U.S. housing market has endured a soft patch for about a year, but February data signaled that a ‘bottoming’ may be underway. Following seven straight months of declines, the S&P CoreLogic Case-Shiller National Home Price Index rose 0.2% from January to February (see chart below).1

S&P Case-Shiller Home Price Index (% Change)

Source: Federal Reserve Bank of St. Louis2

You Can’t Eliminate Volatility, But Here’s How You Can Deal with It!

The challenge that investors face is not finding a way to eliminate volatility—it is

developing a disciplined and mental approach to facing it.

Our exclusive guide, “Helping You Manage Market Volatility,2” will help you better handle volatility and answer certain questions, such as:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you and $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”2

On a year-over-year basis, prices were up 2% in February. Part of the reason for price support likely stems from mortgage rates, which fell in December of last year and early in 2023. The markets’ expectation for a recession later this year combined with a likely ‘pause’ in rate hikes from the Federal Reserve eased pressure on long-duration Treasuries and also the 30-year fixed mortgage rate, which finished last week at 6.39% – down from a peak of over 7%. Another reason for the bump in home prices likely came from inventories that remain low, which has kept markets competitive, particularly in the East and South. Prospective buyers have been increasingly opting for new single-family houses versus existing homes, with sales of new houses jumping to an annual pace of 683,000 in March, the highest level in a year.

Trends in U.S. Shipping Signal Weakening Overall Demand – The Dow Jones Transportation Index has fallen about -10% from highs, an indicator we referenced in last week’s Steady Investor. The takeaway, in short, was that markets seemed to be anticipating a slowdown in shipping and freight, a possible sign of economic weakness or a recession ahead. Diesel gas prices may be telling the same story – wholesale diesel recently fell to $2.65 a gallon, a significant decline from $5.34 last summer. Benchmark diesel futures fell this week to $2.45 a gallon, a 15-month low. Last year, record diesel prices impacted everything from construction sites to goods sold at retail locations, and those higher costs may have dampened the appetite of many producers to ramp up in the new year. It’s also true that many stores and warehouses remain overstocked as a legacy of the goods-driven consumption boom, which is negatively impacting fuel demand. According to federal record-keepers, the impact on domestic demand was over -8% (year-over-year). The upshot to this story is that lower diesel costs may lure many producers back into the market, and encourage a rebound in manufacturing production.4

Another Labor Shortage in the U.S. – $42.5 billion in new government funding is earmarked to install, repair, and maintain broadband networks across the U.S., as part of President Biden’s infrastructure plan. Millions of American households still do not have access to fixed broadband, and the legislation meant to change that. The problem: there aren’t enough workers available to lay cable and repair wired broadband networks. According to the Fiber Broadband Association, an additional 205,000 “fiber splicers” – which is what the needed broadband workers are called – will be needed through 2026 to complete all of the needed projects, which marks a nearly 50% increase from current levels. One potential solution to this labor shortage is for cellphone companies to provide more wireless internet service across rural areas, which would also qualify for the federal subsidies. But the longer-term issue with this approach is that wireless has lower capacity and speeds than fiber, which is likely to create problems as Americans use an increasing amount of data for everyday needs.5

This week brought to the forefront a challenge many investors face – how to react to volatility. In our view, it is important to remember that volatility is a normal part of the ebb and flow of the markets. We believe the key is not to look for ways to eliminate it, but to develop a mental approach to dealing with it.

Our Volatility guide, “Helping You Manage Market Volatility,”6 will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you and $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 Fred Economic Data. April 25, 2023. https://fred.stlouisfed.org/series/CSUSHPINSA

3 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

4 Wall Street Journal. April 25, 2023. https://www.wsj.com/articles/sliding-diesel-prices-signal-warning-for-u-s-economy-c6400724?mod=djemRTE_h

5 Wall Street Journal. April 25, 2023. https://www.wsj.com/articles/high-speed-internet-plan-worker-shortage-be83a843?mod=djemRTE_h

6 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The Dow Jones Transportation Average is a 20-stock, price-weighted index that represents the stock performance of large, well-known U.S. companies within the transportation industry. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.