Bill C. from Kansas City, KS asks: Hi Mitch, I have a couple of technical questions about our national debt. My questions are when the government spends more than it makes, where does the additional money come from? Second question, are there any scenarios where the debt would go down?

Mitch’s Response:

Thanks for writing. I’m happy to answer your question about the national debt, as I know it is a topic on many investors’ minds today.

Let’s start with your first question. When government spending exceeds revenue (from taxes), the U.S. will cover the difference by selling securities, like Treasury bonds. Investors are drawn to U.S. Treasuries because they are essentially risk-free (the U.S. has never missed an interest or principal payment) and they are backed by the U.S. government. Since the U.S. government generates revenue by taxing businesses and households in the economy – and the U.S. economy is the largest and most dynamic in the world – Treasuries are almost always viewed favorably across the world.1

10 Questions You Need to Ask Your Money Manager

You’ve worked hard on your investment portfolio – you deserve a money manager that will work as hard for you as well! With the right manager, it’ll be easier for you to maintain and better protect your investments from today’s market challenges.

In our guide, What to Look for in a Money Manager, we explore 10 questions every investor should ask their money manager, such as:

- How have your investment strategies performed vs. their benchmark?

- Are there fees or penalties if I decide to leave your firm?

- How do you measure risk?

- How are you compensated?

- And 6 more pointed questions

Download Our Free Guide, What to Look for in a Money Manager today!2

The yield paid on Treasuries depends on a variety of factors, from supply and demand to inflation expectations and expectations for the benchmark fed funds rate. The U.S. is not the only country to issue debt, of course, as all developed countries sell bonds and many emerging markets countries do as well (though since those bonds are riskier, they tend to pay higher yields). But overall, in the world of sovereign debt, I’d make the case that U.S. Treasuries are the best available.

In your second question, you ask if the federal debt could ever come down. The short answer is yes! All the U.S. government needs to do is run a budget surplus – where revenues exceed spending – and the debt could come down. During the 1990s, there was a period when the U.S. ran budget surpluses, an effect of tax increases, and reduced military spending as part of the Balanced Budget Act of 1997.

To run surpluses in the future, the same scenarios would need to apply – either the federal government raises more revenues (via higher taxes), or they spend significantly less. Or both. The opportunities to cut costs are somewhat limited, as about two-thirds of spending are mandatory outlays for Medicare, Medicaid, Social Security, and other entitlements. That leaves about one-third of discretionary spending that Congress would need to hammer out.

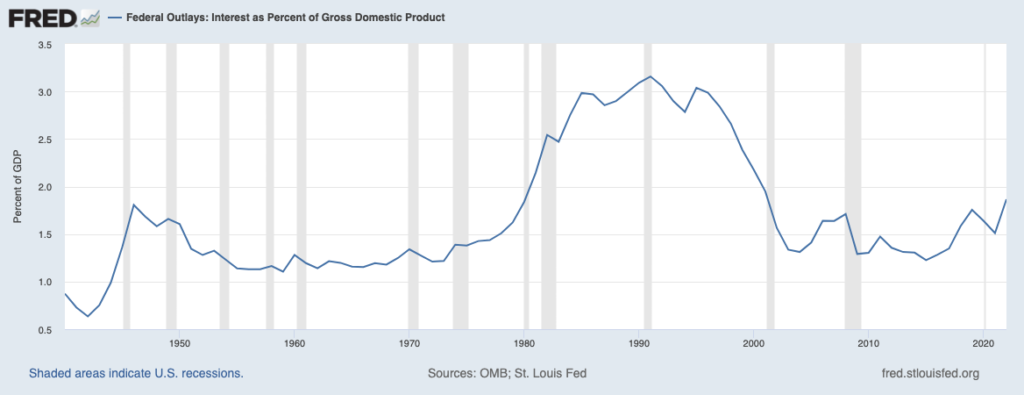

The last time the U.S. managed to run a budget surplus was 2001, so don’t hold your breath on that point. But it’s also true that the U.S. has run deficits for most of its history, and it hasn’t paid down all of its debt since 1835. But even during the Great Depression, the U.S. did not default on any bonds or miss an interest payment, and today interest owed as a percent of GDP (chart below) is at a very manageable level relative to history. The level of absolute debt in the U.S. is somewhat of an unfathomable number, but our ability to manage it (by making all principal and interest payments) is on solid footing.

Interest as a Percent of U.S. GDP

Overall, market changes can affect your investments if you don’t know how to manage them. But, ultimately some of the most important changes to your finances are the ones you make, such as conscious decisions to save more, spend less, or decisions to change the way you invest.

With that, the assistance of an experienced advisor can go a long way, so it’s important that before you chose someone to work with, you ask them the right questions to see if they are the right fit.

To help you do this, I recommend you read our free guide: What to Look for in a Money Manager.4 This guide highlights 10 questions you should ask any prospective or current investment manager. Click the link below to get your free copy!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free: What to Look for in a Money Manager offer at any time and for any reason at its discretion.

3 Fred Economic Data. January 26, 2023. https://fred.stlouisfed.org/series/FYOIGDA188S#

4 Zacks Investment Management reserves the right to amend the terms or rescind the free: What to Look for in a Money Manager offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.