Quincy P. from Pueblo, CO asks: Hi Mitch, I’ve been hearing the term “richcession” lately, which I think is in reference to an economic downturn that mostly affects the affluent. Is this correct, and if so, what does it mean is happening in the economy exactly?

Mitch’s Response:

Thanks for emailing your question. I have indeed heard the term “richcession” recently, though I’m not entirely convinced it’s an appropriate description for the U.S. economy today.1

Generally speaking, recessions impact just about everyone in the economy. But usually, it’s the lower and middle class that are hit the hardest, since job losses tend to be concentrated within this segment, and since there are typically lower levels of savings to dip into.

A much different scenario appears to be playing out today. By some estimates, 50% of all layoffs announced to date have come from technology companies, which tend to pay high salaries and offer attractive benefits. Meanwhile, jobs in leisure and hospitality have yet to recover from the pandemic, and the Labor Department recently reported that there are at least a million more unfilled jobs in the sector than in pre-pandemic.

How to Prepare for a Recession

What will happen to your investments if a recession occurs? A recession can impact investors in many ways, but with foresight and planning, you may be able to avoid some of the damage a recession can cause.

To help you plan for what’s ahead, we are offering our recession guide, to help you understand the following –

- Recession signals and indicators

- How recessions work

- How long recessions last

- How to potentially protect yourself and your family from long-term damage

If you have $500,000 or more to invest, get our free guide. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather a potential one. Don’t wait—get this guide today!

Download Your Copy Today: A Recession is Coming: 6 Insights to Know You’re Prepared2

This dynamic is what “richcession” is attempting to describe. It’s a scenario where white-collar workers are experiencing layoffs and wages that are not rising in tandem with inflation, while blue-collar workers in areas like hospitality, travel, and retail have many jobs to choose from and have been experiencing robust wage growth. Add in the fact that lower- and middle-class families received a large fiscal stimulus boost from the pandemic, and the economy looks like one where lower-income people are doing well while upper-income folks are not experiencing the same kind of tailwinds.

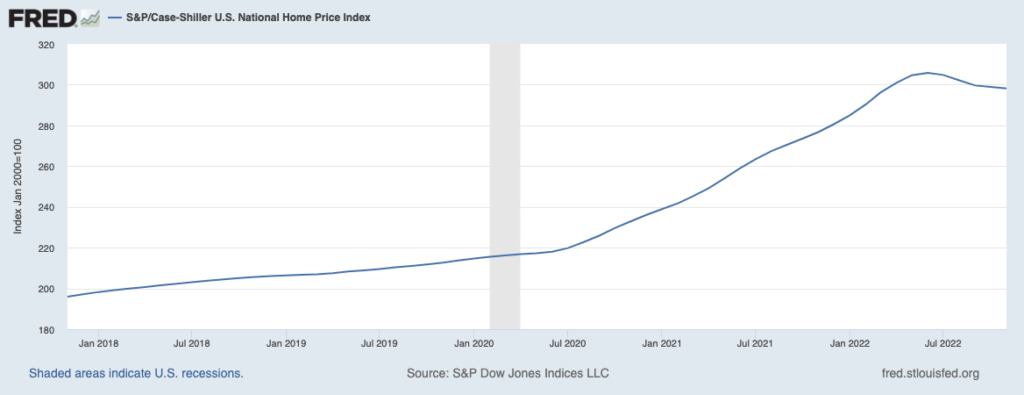

Besides wage growth and layoffs, the other explanation given for the “richcession” is that the stock and real estate markets have both experienced significant declines over the past year, and that’s where many middle- and upper-class households hold wealth. The stock market, as measured by the S&P 500, fell -18% in 2022 and existing home sales have fallen by over 35% year-over-year (in January). The chart below shows how home prices have fallen from summer 2022 peaks.

While these factors do seem to back up the “richcession” claim, I’m not buying into it for two key reasons. The first is that there does not seem to be an acknowledgment that people are being laid off at technology and other companies are having very few issues finding a new job quickly. It may not pay as much – which is another argument for a “richcession” – but I’m not convinced they’re feeling a level of pain synonymous with an economic downturn.

The second reason is that even with the stock and real estate market declines of 2022, there were still historic returns booked in the years leading up to it, such that the retreat is coming off of very high levels. Overall household net worth in the U.S. spiked in the two years following the pandemic, and has only slightly retreated from those peaks.

There is no way to know exactly when or if a recession will occur, but you can prepare for one.

It’s important to understand how recessions work, how long they last, and how to potentially protect yourself and your family from long-term damage to your assets and security. We can help you with our free guide, A Recession is Coming: 6 Insights to Know Now So You’re Prepared.4

If you have $500,000 or more to invest, get our free guide today. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather this one. Don’t wait—get this guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free: A Recession is Coming: 6 Insights to Know Now So You’re Prepared offer at any time and for any reason at its discretion.

3 Fred Economic Data. January 31, 2023. https://fred.stlouisfed.org/series/CSUSHPISA#

4 Zacks Investment Management reserves the right to amend the terms or rescind the free: A Recession is Coming: 6 Insights to Know Now So You’re Prepared offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.