Ted R. from Philadelphia, PA asks: Hello Mitch, I’ve seen you mention before that geopolitical events and risks can have a big impact on the economy and markets. What do you make of the attacks on ships in the Red Sea? With many ships re-routing, should we expect more inflation pressures, and thus higher interest rates? Those both seem like negatives for stocks, to me.

Mitch’s Response:

Thanks for writing, Ted, you ask an excellent question. Higher-than-expected inflation – and thus upward pressure on interest rates – is a major risk to any forecast for positive stock market performance and an economic soft landing in 2024. So, to the extent that shipping disruptions in the Red Sea can trigger global inflationary pressures, there is certainly cause for concern.

Let’s frame the issue first, then analyze it.

In recent weeks, Houthi rebels in Yemen have been attacking commercial shipping vessels in the Red Sea, disrupting the flow of goods through the Suez Canal. The Houthis claim these attacks are aimed at ships with a trade link to Israel, but they seem to be attacking virtually any ship they can. The attacks have caused major ocean carriers like A.P. Moller-Maersk and Germany’s Hapag-Lloyd to re-route ships around South Africa’s Cape of Good Hope, which makes the trip about 30% to 50% longer and can add more than a week to delivery times.1

As you point out in your question, longer trips mean higher costs. According to London-based Drewry Shipping Consultants, the average cost of shipping a 40-foot container more than doubled in January, rising 23% in a single week (ending January 18). And this isn’t just for ships that run between eastern Asia and Europe—the cost of moving a container from China to Los Angeles rose 38% in the same week referenced above.

How Could Recent Geopolitical Events Impact the Market?

During geopolitical events like regional wars, investor sentiment tends to sour, leading to pronounced volatility and short-term pull-backs. However, long, grinding bear markets from wars have been rare, with the last one occurring in 1942 during World War II. Despite numerous geopolitical crises since then, none have caused a bear market. Why is that?

In our free guide, How Geopolitical Crises Affect the Stock Market2, we take a closer look at that question in this guide, as we explore the relationship between geopolitical crises and the stock market, to understand how conflicts have affected the global economy and stocks. You’ll get insight on:

• Five significant conflicts since World War II, from Korea to Crimea

• An analysis of each conflict and its economic impacts

• U.S. GDP and S&P 500 figures for key periods of these wars

• Plus, more insights on how these crises affect the economy and market

If you have $500,000 or more to invest, request this report today!

Download Your Free Guide, How Geopolitical Crises Affect the Stock Market2

The inflation link is worth exploring here. If the cost of shipping goods across the world goes up materially, it can apply price pressure to manufacturers, importers, goods sellers, and ultimately, consumers. This is the type of extraneous shock that could keep inflation stubbornly high and put pressure on central banks to keep interest rates high in response. As you say, a negative for stocks.

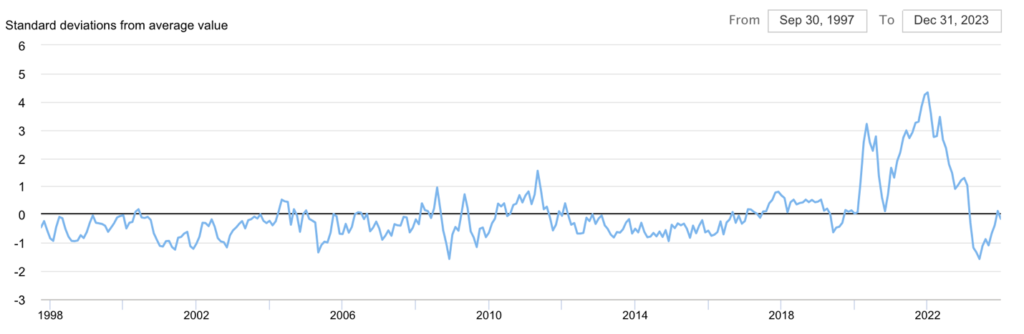

This extraneous shock scenario is also what we saw during the pandemic when supply chains were snarled, global shipping costs surged, and inflation followed. In the chart below of the Global Supply Chain Pressure Index, you can see the ‘pressure spikes’ that became key drivers of inflation.

The New York Federal Reserve’s Global Supply Chain Pressure Index

I think it’s important to call out some key differences between what we’re seeing now in the Red Sea, versus the surge in shipping costs experienced in 2021. First, the Suez Canal accounts for just 12% of global trade, which I’m not sure is quite substantial enough to cause global price pressures. Second, it’s important to remember that the pandemic also featured a massive surge in demand for goods, thanks to trillions in stimulus money. Spending is strong globally today, but I don’t think it’s significant enough to cause the same type of mismatch we saw in 2021.

The U.S. and other allies, including India, have deployed forces to try and restore stability in the Red Sea. Regardless, I think this situation is worth monitoring closely in the months ahead. It’s early, but we did already get one data point signaling that the issue may not be as severe as some fear. Eurozone Manufacturing PMI rose to its highest level in 10 months in January, and average input costs fell sharply. If the Red Sea issue was truly problematic, we’d expect to see input costs rising, not falling.

To help guide your investing decisions during this time, I am recommending our free guide, How Geopolitical Crises Affect the Stock Market4. This guide provides a historical perspective on the effect of regional war on the market and includes:

• An overview of five significant conflicts since World War II, from Korea to Crimea

• An analysis of each conflict and its economic impacts

• U.S. GDP and S&P 500 figures for key periods of these conflicts

If you have $500,000 or more to invest, request this report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free How Geopolitical Crises Affect the Stock Market offer at any time and for any reason at its discretion.

3 Federal Reserve Bank of NYC. 2024. https://www.newyorkfed.org/research/policy/gscpi#/interactive

4 Zacks Investment Management reserves the right to amend the terms or rescind the free How Geopolitical Crises Affect the Stock Market offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets countries and 27 Emerging Markets (EM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. An investor cannot invest directly in an Index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.