Currently, inflation has fallen down to 5%, the construction industry is hiring, and job openings have slowed – what does this mean for your investments? Find out in our latest Steady Investor.

Inflation Falls to 5% in March – The Labor Department released closely-watched Consumer Price Index (CPI) data last week, which confirmed that inflation remains in a downtrend. CPI registered at 5% year-over-year in March, down from February’s 6% year-over-year increase and marking the smallest increase since May 2021. Core prices, which strip out food and energy, were higher at 5.6% y-o-y, largely because of pressure in services prices, and specifically, the shelter component, which makes up one-third of CPI. A positive takeaway from still-high shelter prices is that their effect on CPI happens with a lag. The index measures what renters and homeowners pay for housing by including new and existing leases, which means that meaningful declines won’t show up in the CPI numbers right away. But we do know that new leases have come down sharply in price, with an index of new leases now declining at a 3-month annualized rate of slightly less than 3%. By the summer and fall of this year, the shelter component should contribute significantly less to inflation. Food prices also remain sticky, having risen by 10.2% year-over-year in February, far higher than energy’s 5.2% contribution. The food and energy categories tend to be volatile, which is why core inflation is the more closely-watched measure. It’s also worth noting that CPI is not the Federal Reserve’s preferred inflation indicator for setting monetary policy – they prefer the personal consumption expenditures (PCE) price index, which rose 5% year over year in February. Mark your calendars: the March release for the PCE price index is on April 28.1

How Much Do You Need to Retire in this Market?

Are you planning for retirement, but questioning the process? It’s not easy, especially if you haven’t established your goals and determined your financial needs.

However, if you spend some time focusing on what you want your retirement to look like, you can formulate a plan that works for you!

We are offering our exclusive guide that looks at important questions that we believe investors should consider when defining their financial needs in retirement, such as:

- What will be your retirement lifestyle? Will you travel or stay home?

- At what age do you plan to retire?

- What essential expenses will you have?

- What part will Social Security benefits play in your financial picture?

- Plus, many more factors you may want to consider to help you plan for a secure retirement

If you have $500,000 or more to invest, get our free guide, “How Much Exactly Do You Need to Retire2” today!

Now Hiring: The U.S. Construction Industry – Home construction in the U.S. has encountered pressure from rising interest rates. Not so for the construction of industrial plants, warehousing, infrastructure, and other nonresidential projects. Spending on nonresidential construction rose 17% year-over-year in February to nearly $1 trillion, putting the backlog of contracted nonresidential projects at 9.2 months. Some of the key areas of investment in the construction industry have come from new plans for electric vehicles, warehouses for e-commerce, and other manufacturers who are carrying-through plans to ‘reshore’ supply chain production to the U.S. in the aftermath of the pandemic. According to the Census Bureau, construction spending on manufacturing reached all-time highs last year. And there may be more spending in the pipeline: new spending from the infrastructure bill has started flowing to public works projects, defense, and semiconductor ‘fabs,’ or chipmaking facilities. There’s a problem however with ballooning demand for construction projects—there aren’t enough workers and sometimes materials are in short supply. Carpenters and electricians are in high demand but short supply. According to the National Association of Manufacturers, the industry is short about 800,000 workers, which raises questions about whether the demand boom is sustainable.3

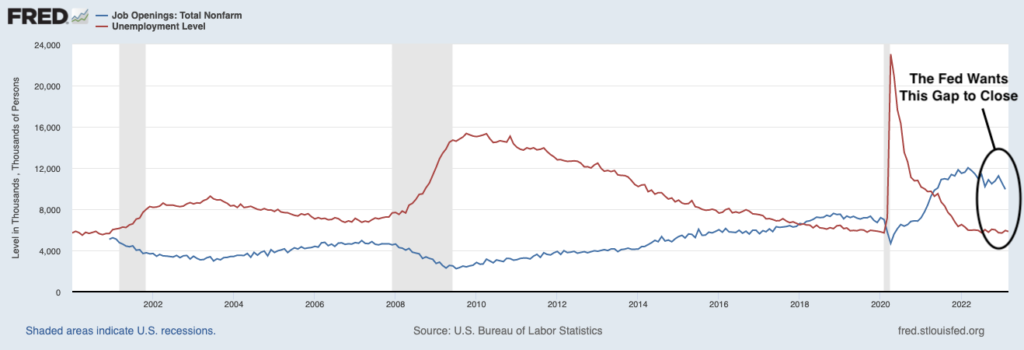

Job Openings Fall in February and Hiring Slowed in March—Which is Actually a Good Thing – Job openings fell in February, to 9.9 million from January’s 10.6 million. This marks a meaningful decrease from the peak of 12 million job openings reached in March 2022 and is important in the Fed’s ongoing battle against inflation pressures. For now, there are still roughly 6 million more open jobs than there are unemployed workers in the U.S., which exerts wage pressures in the labor market and frustrates the Fed’s efforts to fight inflation.4

Source: Federal Reserve Bank of St. Louis5

Even still, falling job openings and the fact that employers added 236,000 jobs in March – the smallest gain in more than two years – has released some pressure on wages, with average hourly earnings rising 4.2% year-over-year. This size of wage gains is not necessarily compatible with the Fed’s 2% inflation target, but it does signal pressures are easing.

Planning For Retirement? Planning for retirement can be complicated, especially in a volatile market. The key is to envision and plan a retirement that aligns with your financial needs! To help, we are offering our exclusive guide, How Much Exactly Do You Need to Retire6, which takes a look at important factors that we believe investors should consider when defining their goals, such as:

- What will be your retirement lifestyle? Will you travel or stay home?

- At what age do you plan to retire?

- What essential expenses will you have?

- What part will Social Security benefits play in your financial picture?

- Plus, many more factors you may want to consider to help you plan for a secure retirement

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the guide “How Much Do You Need to Retire” for any reason and at ZIM’s discretion.

3 Wall Street Journal. April 10, 2023. https://www.wsj.com/articles/construction-industry-has-work-needs-more-workers-da763703?mod=djemRTE_h

4 Fred Economic Data. April 4, 2023. https://fred.stlouisfed.org/series/JTSJOL#

5 Fred Economic Data. April 4, 2023. https://fred.stlouisfed.org/series/JTSJOL

6 ZIM may amend or rescind the guide “How Much Do You Need to Retire” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.