In this week’s Steady Investor, we’re highlighting important market news that we believe investors should keep an eye on, such as:

- Inflation picks up to 3.2%

- Growth in the U.K. economy

- Americans are more hopeful about retirement

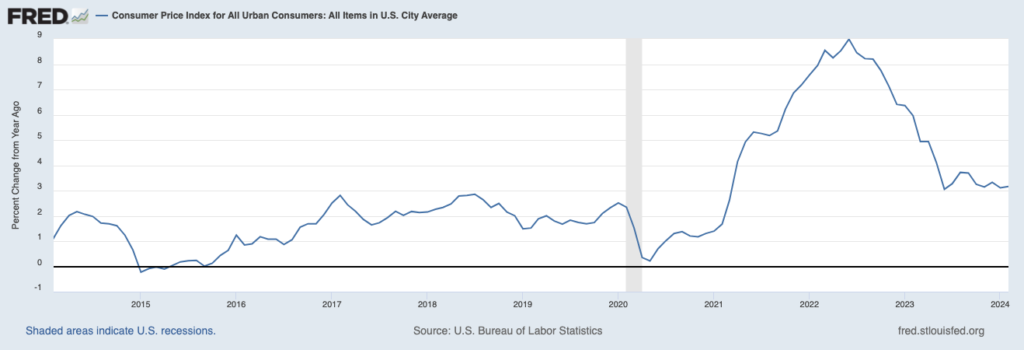

Inflation Slightly Hotter Than Expected, But Doesn’t Change Rate Outlook – The U.S. Labor Department released the latest inflation data on Tuesday, and prices ran a bit hotter than expected. According to the consumer price index (CPI) measure of inflation, prices increased by 3.2% in February from a year earlier, which was slightly higher than consensus expectations for a 3.1% rise.1

Source: Federal Reserve Bank of St. Louis2

Tax Planning? Get Our User-Friendly Guide for 2024

While tax planning might not be the most thrilling topic, it’s a crucial component of your financial strategy.

Our free guide, Tax Planning in 2024: A User-Friendly Guide2, aims to simplify the complexities of tax laws and empower individuals and business owners to make strategic decisions that minimize tax liability. It also covers a range of key tax issues, such as:

- Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

- Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

- Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions, and other essential topics.

- Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations, and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Download Tax Planning in 2024: A User-Friendly Guide3

Digging into the numbers a bit more, we find that gas prices and ‘shelter costs’ accounted for over 60% of the monthly increase, which we would argue helps explain why the stock market rallied after the CPI report’s release. Gas prices are notoriously volatile, and do not factor much into the Fed’s thinking on underlying inflation. And we’ve written before that shelter costs play a much bigger role in the CPI calculation than they do in the Fed’s preferred inflation measure, the PCE price index. All told, the latest CPI release likely does not move the needle on the Fed’s outlook for rates, reinforcing the market’s expectations for three rate cuts in 2024. The equity market has also taken some level of solace in the recent jobs report, which included downward revisions to December and January payrolls and showed decelerating wage growth.

The U.K. Economy Appears to Be Turning a Corner – The U.K. economy has been in something of a rut over the past few quarters, still struggling to fend off high inflation and experiencing a much less compelling post-pandemic recovery than the U.S. The tides may be turning. In January, the U.K. economy finally returned to growth, with GDP rising by 0.2% month-over-month – better than the 0.1% expected. This modest growth follows a contraction in the second half of last year, which was unique among the Group of Seven large rich countries – all of which saw expansion over that period. Flipping back to growth is an important development not only for the U.K. but also for the global economy, a signal that economic growth is broadening. The U.K. has a services-based economy where consumer spending is crucial, much like the U.S. It helps that real wages (adjusted for inflation) are rising again, up 1.8% in the three months through January.4

Americans are Feeling Better About Retirement – Many stories about retirement tend to highlight Americans’ overwhelming lack of preparedness. These stories still ring true today. But there are also some positive developments to highlight, which point to an improving retirement picture for many Americans. One study released this week from Vanguard illustrates these improvements. It found that Americans are saving into retirement accounts at record rates, with 43% of workers increasing the percentage of their paycheck saved into a 401(k) – compared to just 8% who decreased the percentage saved, and 2% who stopped altogether. One key factor that has been helping the retirement picture is automatic enrollment, which Vanguard says about 60% of its plans have. Of those plans, 60% of employees keep the deferral rate of 4% or higher. These trends, combined with a strong stock market in 2023, have led to average account balances at Vanguard increasing by 19% over the past year.5

Tax Planning in 2024 – Ease your tax-planning worries this year with our user-friendly guide, Tax Planning in 20246. This guide covers:

- Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

- Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

- Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions, and other essential topics.

- Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations, and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 Fred Economic Data. March 12, 2024. https://fred.stlouisfed.org/series/CPIAUCSL#

3 ZIM may amend or rescind the free guide “Tax Planning in 2024: A User-Friendly Guide” for any reason and at ZIM’s discretion.

4 Wall Street Journal. March 13, 2024. https://www.wsj.com/world/china/u-k-economy-returned-to-growth-in-january-73eaef0d?mod=djemMoneyBeat_us

5 Yahoo Finance. March 13, 2024. https://finance.yahoo.com/news/americans-are-feeling-hopeful-about-retirement-according-to-two-new-reports-090003455.html

6 ZIM may amend or rescind the free guide “Tax Planning in 2024: A User-Friendly Guide” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.