A sloppy start to the year for U.S. and global stocks, coupled with growing economic uncertainty, weak earnings growth and China’s hard landing, have weighed heavily on Initial Public Offerings (IPOs). Offerings in the 1st quarter of 2016 hit the lowest levels since the depths of the financial crisis in 2008-09.

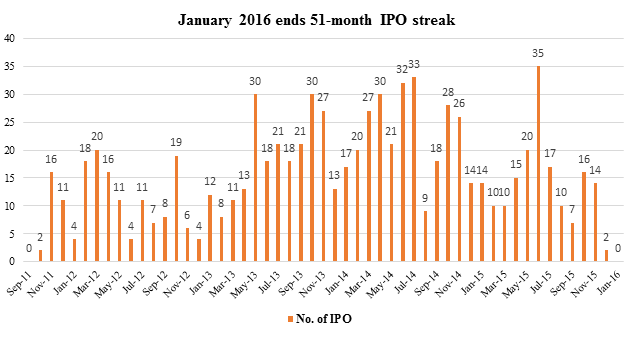

January 2016 was not only the slowest IPO issuance month since January 2009, it also ended a 51-month streak of IPO activity that started in November 2011.

Source: NASDAQ.com

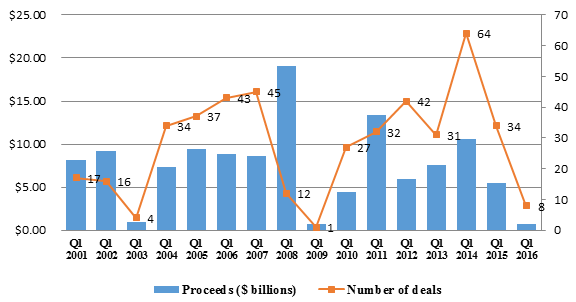

But, there may be hope. The IPO market saw some rays of light in February when two biotech companies, Editas Medicine Inc. and BeiGene Ltd., raised $291 million collectively with new equity offerings—thus ending the U.S. IPO drought. Even still, Q1 2016 saw only eight deals worth $700 million and all came from the Health Care sector.

Key Highlights of Q1 ‘16 IPO Market

- Slowest quarter of U.S. IPO market since 2009—number of IPOs down by 76% and proceeds raised down by 87%

- Low tradable float helped the IPO market to garner an average gain of 20%

- Health Care was the only sector to see IPO activity

- Q1 2016 was the first quarter without any private equity investment since Q1 2009

- Almost 88% of the IPO deals in Q1 2016 were backed by venture capital

- Number of new IPO filings in Q1 2016 stood at 24 (compared to 48 in Q1 2015 and 98 in Q1 2014) with just 7 new filings (total) in February and March

U.S. IPO activity – Quarterly

Source: NASDAQ.com

Recent stock market turmoil was certainly a factor in giving CEOs and investment banks ‘cold feet’ for new deals. Some 16 companies postponed or withdrew from their scheduled IPOs since mid-February, making it one of the worst starts to a year on record. In total, there have been around 11 instances when the IPO market froze for more than a month or so since 2002. But, it was only in 2008 where we saw a similar number of deals being postponed or called off. Before that, the worst year was 2001, when nearly 29 companies called off or delayed their listing.

2001? 2008? Weren’t those huge bear market years? Is this a sign of market doom ahead?

Bottom Line for Investors

Don’t bet on a gloomy outcome yet. Despite a slow start to the year, the outlook for the IPO market looks positive for the rest of 2016, largely due to the healthy pipeline of pre-IPO companies. Sentiment has also received a confidence boost as equity markets recovered convincingly since mid-February (and also given a relatively subdued climate in the geopolitical sphere). Moreover, as the U.S. economy strengthens with a relatively healthy job market, rising wages, steadying oil prices and growing consumer spending, the IPO market is expected to rebuild its volume through 2016 (though carefully).

Investors interested in IPOs might look to sectors like Health Care and Retail, which are expected to grab a significant share of IPO activity as investors seek a combination of growth and value generation.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.