Following the 2008 global financial crisis, central banks around the world implemented aggressive monetary policies in an attempt to reignite the global economy. Europe and Japan are still running QE (quantitative easing) programs and even China entered the game with several interest rate cuts. The U.S. has ended QE, but interest rates are still near zero and Janet Yellen’s reluctance to raise rates is consistently apparent.

The global economy has expanded since 2009 and is still expanding. Still, loose monetary policy has created consequences for income-seeking investors—a depressed interest rate environment. Fixed income investors know how difficult it is to find safe, quality yield in this market. Unfortunately, it could be years before this changes. Ultimately, the old adage of buying bonds for income and stocks for growth isn’t working well for many today.

Like no other time in history, investors are turning to stocks as yield assets. Why? Because dividends, generally, have been on the rise and stocks are yielding more than traditional fixed income instruments. At the end of Q1 2016, the S&P 500 paid a higher yield than the 10 and 30-year U.S. Treasuries. So, investors taking a targeted approach to dividend-paying stocks could have done even better on yield:

Yields as of March 31, 2016

10-year U.S. Treasury 1.78%

S&P 500 2.19%

30-year U.S. Treasury 2.61%

MSCI AC World index 2.7%

Russell 1000 Value 2.74%

Investment-Grade Corporate Bonds 3.2%

Zacks Dividend Strategy 3.32%

According to S&P Dow Jones Indices, U.S. companies increased dividends by 4.6% in Q1. This trend has been evident over the past year even as aggregate earnings growth has fallen. On a global level, the same trend applies. Since February 2015, global dividends per share have risen 5% while earnings per share have fallen 11%.

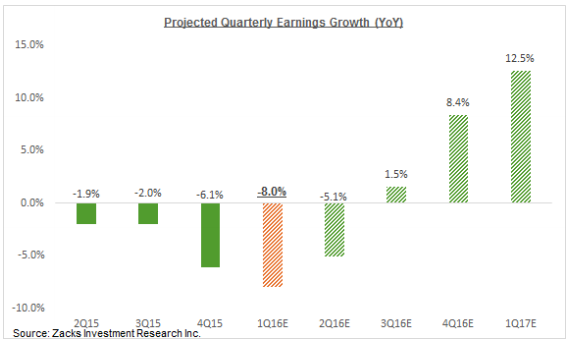

This begs the question – can this dividend party continue? Falling earnings typically drive companies to belt-tighten often making dividend increases a target for cutbacks. But, we believe that earnings growth will see a rebound in the second half of 2016 and, assuming this comes to fruition, dividend growth will likely remain steady. We see the Q1 earnings season as the inflection point for corporate earnings, with the growth picture starting to improve from Q2 onwards and turning positive in the back half of the year.

Source: Zacks Investment Research

An earnings rebound could support dividend increases. Also, higher prices in aggregate could make the total return for a dividend-paying stock portfolio attractive relative to fixed income alternatives. An investor has to accept more risk with this approach, but a diversified portfolio of dividend-paying stocks and a lengthy time horizon can help mitigate that.

Dividend-Targeted Investing

It’s my view that a high dividend yielding strategy can help reduce volatility and provide consistent and relatively predictable returns in a portfolio. Now, something I rarely do, if ever, is ‘plug’ my firm’s services in these pages. Still, you likely noticed that Zacks Dividend Strategy, managed by my firm, offers the highest current yield of the options noted above (including its benchmark the Russell 1000 Value).

The strategy is for investors seeking a dividend-targeted component for their portfolio as well as tax efficient returns from both capital appreciation and dividends. Through Q1 2016, Zacks Dividend Strategy has a 10-year return of 7.11% (net of fees) compared to the Russell 1000 Value’s return of 5.72% over the same period. Additionally, the strategy continues to rank in the top 2% out of 985 managers in the Morningstar Large Cap Value Universe. OK, ‘plug’ over.

Bottom Line for Investors

History has shown that stocks are much more volatile and risky than bonds. Replacing your fixed income holdings with dividend-paying stocks is not as simple as subbing-out a lower yield asset for a higher-yield one of the same risk profile. A one-for-one exchange of bonds for dividend-paying stocks would mean adding risk to your portfolio. So, if you’re considering this approach, you’ll want to analyze how best to do this in context of your overall asset allocation and timing for future needs.

Still, for investors that may have room for more equities in their portfolio, or are over-allocated to bonds, a hard look at dividend-paying stocks could be a smart strategy in this environment. For those playing the long game, it’s hard to argue for large bond allocations right now. It could be a good time to review and, potentially, make some changes to your portfolio. Again, it could be years before the fixed income situation improves given depressed interest rates.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.