The U.S. dollar has been strengthening considerably over the last few months, with the WSJ Dollar Index hitting its highest point since September 2020. There are a few factors arguably driving the dollar higher – the U.S. economy is strong relative to the rest of the world, and the Federal Reserve is about to engage in the ‘tapering’ of monthly bond and mortgage security purchases (QE). A strong economy plus tightening financial conditions generally equals a stronger dollar.1

Federal Reserve policymakers have also been commenting more on sticky inflation in the U.S. economy, which has been pushing up the timeline for possible rate increases. Up until recently, the market had been anticipating no interest rate hikes until 2023, but now some believe the first interest rate increase could come as soon as next summer. If the U.S. is indeed entering a tightening cycle, it could mean constricted supply of U.S. dollars (and more dollar strengthening as a result).

__________________________________________________________________________

Are You Taking Steps to Reach Your Long-Term Financial Goals?

Amongst the many lessons that can be learned from the economy’s ups and downs, the most important lesson is to not time the market. There have always been factors that heavily shifted the market in the past, but over time there has also been a positive return. So, instead of focusing on short-term choices, I recommend sticking to the fundamentals and maintaining a diversified portfolio.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks Rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Zacks Rank industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released November 2021 Stock Market Outlook2

__________________________________________________________________________

For the U.S. economy, the impact of a strengthening dollar depends on who you are. Companies in the S&P 500 (large-cap) generate approximately 40% of their revenue from abroad, so a strengthening dollar is generally negative – it weakens the value of international sales. Foreign demand may also fall over time if strengthening is sustained since a stronger dollar means less purchasing power for consumers in foreign countries. On the other hand, small- and mid-cap U.S. companies are generally less impacted by a stronger dollar, since many sales are generated domestically.

What about the impact of a stronger dollar on equity markets? As ever, history may be our best guide.

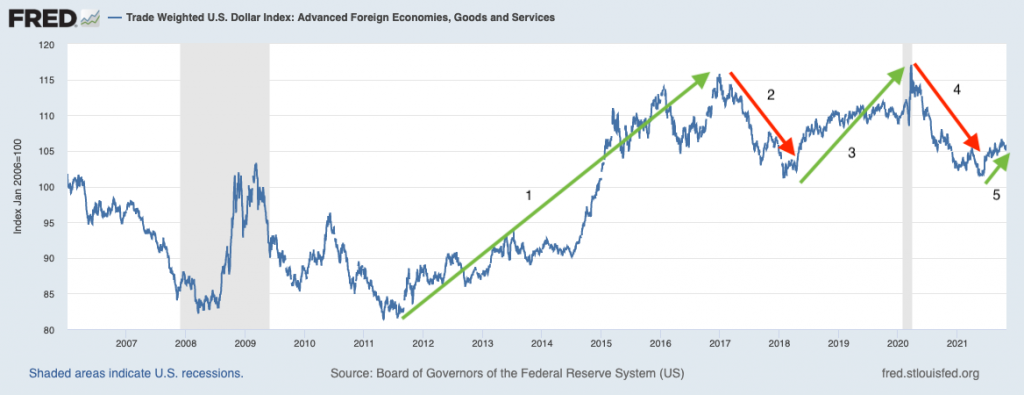

The chart below takes a look at the foreign exchange value of the U.S. dollar against the cost of goods and services of advanced economies like the Euro Area, Japan, and England. The green arrows on the chart signify times when the U.S. dollar was strengthening, while the red arrows show periods of dollar weakening. As you can see, the U.S. dollar routinely shifts from periods of strengthening to weakening, and back again.

U.S. Dollar Strengthening (Green) and Weakening (Red)

There are several notable periods, but the first to highlight is the dollar surge in 2014. Indeed, from July 14 to December 2016, the U.S. dollar strengthened by 21% – a significant jump. Similar to the current environment, the dollar was strengthening in 2014 because the Fed was unwinding its post-Great-Recession QE program, which eventually gave way to interest rate increases beginning in December 2015. Here’s what the S&P 500 did over the same period:

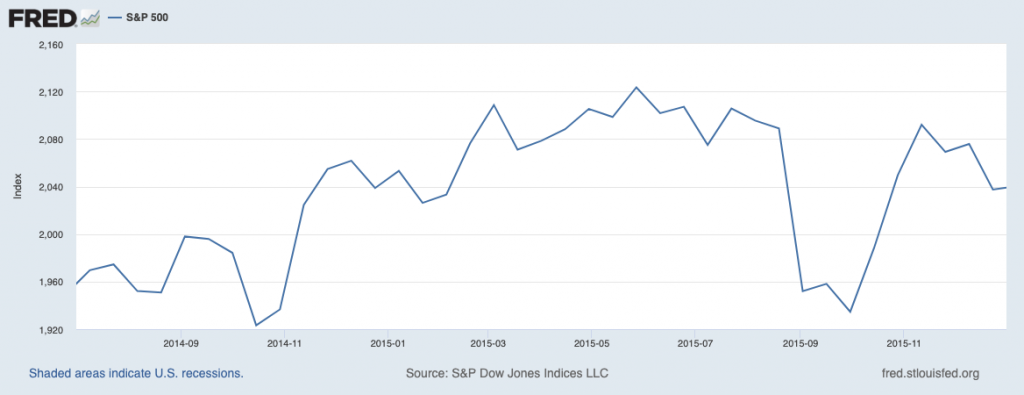

The S&P 500 from July 2014 to December 2016

As you can see, the S&P 500 endured a choppy period and moved only slightly higher, but there was another key factor in play besides Fed tightening and a stronger dollar: U.S. corporate earnings (as measured by year-over-year earnings per share growth) were down -11% in 2015. As the Fed was tightening and the dollar was strengthening, it was a weak year for profits in what we now know was a mid-cycle pause.

Another period at which to look more closely is the dollar weakening in 2017 (red line labeled “2” in the chart). In that year, the U.S. dollar slipped 10% against a basket of advanced foreign currencies, which was the biggest decline in over a decade. Yet in 2017, the S&P 500 was up +19%.

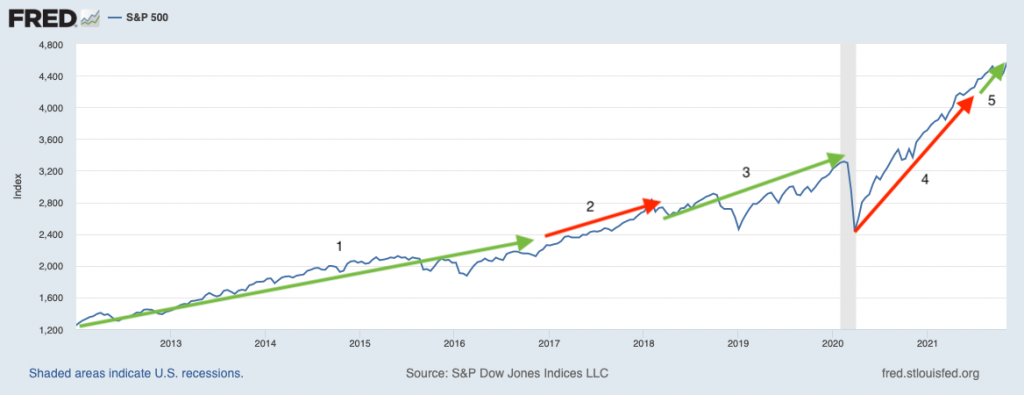

This quick look at history may lead one to conclude that a stronger dollar is bad for stocks and a weaker dollar is good for stocks. But a zoomed-out look at history suggests a much weaker correlation between the U.S. dollar and U.S. stocks. On the S&P 500 chart below, I’ve labeled the periods of dollar strengthening (green arrows, numbers correspond to chart above) and dollar weakening (red). As you can see, the stock market does not have a firm preference on which way the dollar moves. Stocks have managed to do well under both strengthening and weakening regimes.

The S&P 500 Since 2012

Bottom Line for Investors

In 2014 and 2015, the dollar was surging and the stock market was wobbling, which understandably leads some investors to link the two. But the real factor driving the volatility and sideways move in equity markets in those years, in my view, was the decline in corporate EPS registered in 2015. Weak profits almost always mean weak stock market returns.

As long-time readers of this column know, I believe corporate earnings results and shifting expectations around future earnings are the biggest drivers of equity returns. If corporate earnings are expected to surge in the next twelve months, and the results end up being better-than-expected, then it doesn’t matter if the dollar is strengthening or weakening. So, if the dollar continues to strengthen as the Fed tapers and eventually tightens, it will only matter for equity markets if corporate earnings and expectations are falling at the same time. That’s not what we’re seeing now, but this will be a key factor to watch in 2022.

Also, to stay on track for this upcoming year, we recommend working with a trusted advisor, keeping a diversified portfolio, and staying calm through market volatility. One way to stay calm is to focus on key data points and economic indicators that could positively impact your investments long-term. To help guide you, I am offering all readers our Just-Released November 2021 Stock Market Outlook Report.

This report looks at several factors that are producing optimism right now and contains some of our key forecasts to consider such as:

- Zacks Rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Zacks Rank industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released November 2021 Stock Market Outlook6

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Fred Economic Data. November 1, 2021. https://fred.stlouisfed.org/series/DTWEXAFEGS

4 Fred Economic Data. November 1, 2021. https://fred.stlouisfed.org/series/DTWEXAFEGS

5 Fred Economic Data. November 1, 2021. https://fred.stlouisfed.org/series/SP500#0

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.