As we anticipate a rebound in the energy sector, Big Oil has already posted an improvement in cash flows over the last quarter. Exxon Mobil Corp., Royal Dutch Shell Plc, Chevron Corp., Total SA and BP Plc. – Western world’s biggest publicly traded oil companies – jointly brought in $26 billion from operations in Q3 2016, which is a +67% growth from the preceding quarter. The amount also exceeds twice the flows of first quarter. (According to Bloomberg).

As cratering crude prices took a toll on earnings, energy behemoths hinged on cost-cutting to get through the supply glut. And, it seems their savings have borne fruit through improved cash earnings:

- Exxon Mobil pocketed $5.3 billion in operational cuts, which is a more than +15% surge compared to Q2.

- Shell saw its operating cash flows rise to $8.5 billion, from second quarter’s $2.3 billion, largely aided by its purchase of BG Group Plc. Despite the costs incurred in the acquisition, it slashed its operating expenditures by $600 million from a year ago. The company expects a further cost reduction of -25% next year compared to 2015.

- Chevron plans to retrench operating expenses by at least $2 billion in 2016 from the previous year

- French energy giant, Total SA, reportedly wants to reduce operating costs by more than $2.7 billion (an increase from its initially planned $2.4 billion).

Debt Continues to Accumulate

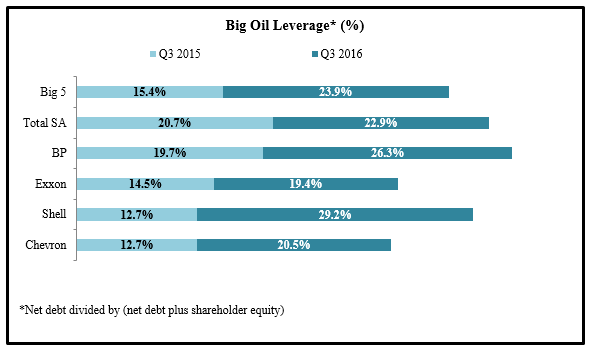

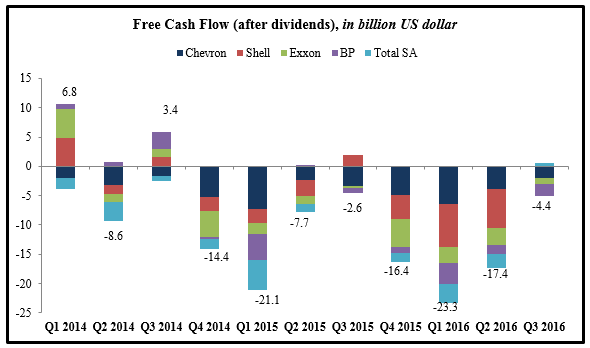

However, the industry’s yet to have adequate cash to fully cover capital expenditures/new investments plus dividend payouts. The five oil majors’ aggregate free cash flow post dividend payments were in the negative territory—at -$4.4 billion in Q3 2016, worse than Q3 2015’s $2.6 billion. That explains how debt has continued to mount on Big Oil’s books.

The debt of the five companies totaled $142 billion as of the end of Q3 2016, up from around $46 billion a decade ago (Bloomberg). Over the past year, the firms added $93 billion of net debt, and their overall leverage ratio increased by +8.5 percentage points.

Source: Bloomberg

Source: Bloomberg

Are Firms Slowing Down on Cash Burn?

Although firms burnt through more cash in Q3 2016 compared to the same quarter last year, funding deficits have been narrowing down through consecutive quarters this year.

Source: Bloomberg

Source: Bloomberg

In Q3 this year, Chevron’s funding gap reduced to -$1.95 billion—the smallest gap since Q3 2014. Shell received more flows from operations in Q3 than the total of the preceding three-quarters, allowing it to have a ’balanced’ cash position, just enough to meet capex and dividend payments. Although Exxon’s free cash flow (after dividends) in Q3 2016 is lower than that in Q3 2015, it managed to slow down its pace of cash burn in the last quarter.

BP, on the other hand, had its cash flows from operations halved in Q3, from the same period last year. Its free cash flow (after dividends) was -$2 billion in the latest quarter, lower than -$0.9 billion in Q3 2015.

Although Total SA recorded the largest free cash flows among the oil majors in the third quarter, it was largely due to its scrip dividend policy.

Bottom Line for Investors

The spurt in operational cash flows to energy behemoths in the latest quarter should offer hope for a sector that’s been in a prolonged rout. However, cash generation still lags behind the $36.5 billion flows that oil majors received in the third quarter of 2015, and is far-off the $65 billion mark they jointly exceeded in Q1 2008. Big Oil’s increasing dependence on leverage to make up for the cash deficits could aggravate concerns about this industry.

Nevertheless, all five companies beat earnings estimates in Q3 – a first as a group since Q1 2015, according to Bloomberg data. And, several of these companies have an improved outlook for their cash positions for next year, hoping to see oil prices stabilize above $50 a barrel amid continued cost-savings.

For a sector that’s faced severe global market challenges, an increase in cash flow, albeit concomitant with some shortcomings, is a healthy sign. And that’s only going to get better with an oil price rebound—something which already may be underway. Does that spell opportunities for bargain buys? We can help you answer this question! At Zacks Investment Management, we focus on both industry-level research and company-specific fundamentals to help you optimize on market movements while keeping your long-term goals in mind. To learn more, call us today for free at 1-800-245-2934. In the meantime, download our latest Stock Market Outlook report to help give you insights into various industries. Download this report, by clicking on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.