In the U.S., small businesses are arguably the backbone of the economy, and what remains of the “American Dream.” When small businesses do well, the economy does well and vice versa. But, the role of small businesses in the U.S. economy is all too often underrated. Small businesses generally consist of solo start-ups or small groups who don’t even play in the same league as competing, large businesses, and they certainly don’t generate the same kind of tax dollars. As a result, the perception of small businesses’ role in the economy has been minimized.

But, this doesn’t change the fact that entrepreneurship has always been a driving force behind the economy. U.S. small businesses (less than 500 employees) employ 77.9% of Americans and produced 78.7% of all new jobs in the last decade (according to Jobenomics, United States Unemployment Analysis: Q1 2016).

The following statistics (from the Small Business Association (SBA)) help to display small businesses’ significant contribution to the economy:

- There are nearly 28 million small businesses in U.S

- Small businesses represent more than 99.7% of all employers

- Small businesses generate nearly 54% of the total sales in the country

- More than 50% of the working population of U.S. are employed by small businesses

- Two out of every three new private sector job came from small businesses since 2008.

- Small businesses have generated 55% of all jobs and 66% of all net new jobs since the 1970s

So what happens when the small business climate sours? Could it mean trouble?

The recently released report from the National Federation of Independent Business (NFIB) showed that the index of Small Business Optimism moved south once again in March 2016.

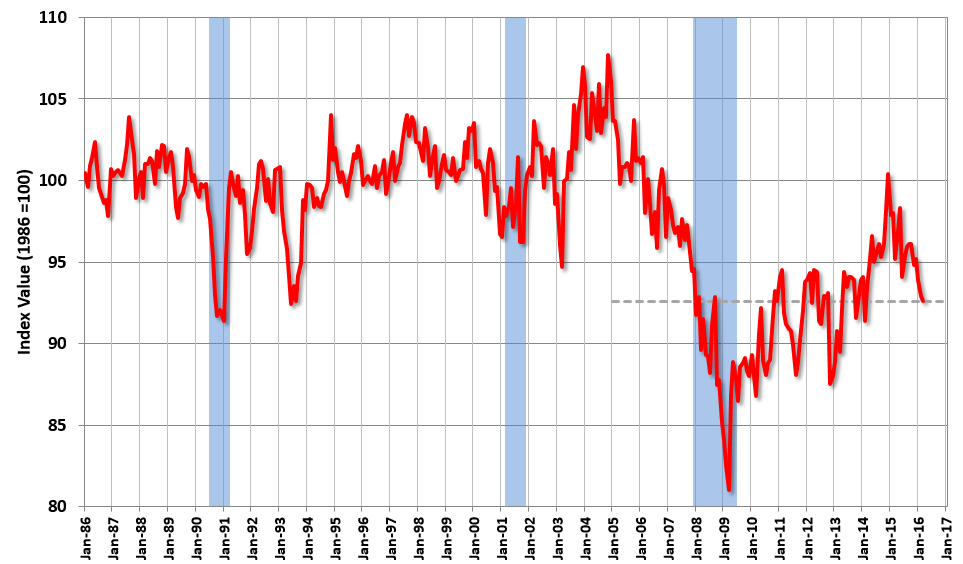

Amidst the growing worries about top line and bottom line growth, the index of Small Business Optimism dropped from 92.9 in February to 92.6 in March. Two data points don’t mean much in the large scheme of things, but this has been happening for some time—since December 2014 it has declined by nearly 8 points.

Optimism Index

Based on Ten Survey Indicators (Seasonally adjusted 1986=100)

Source: NFIB Small Business Economic Trends March 2016

Source: NFIB Small Business Economic Trends March 2016

Industry experts say the decline in confidence was consistent with slowing rates of economic growth, which is something to watch moving forward. It’s also true that this slump was not massive in relation to the fluxuations throughout the years, but studying the chart above makes it appear as though the index has found a peak. Many wonder if this could be a sign that we’re in greater risk of recession. The surveys in the next few months will be telling.

Regardless of the downshift in sentiment and weaker economic growth, small businesses didn’t scale back on hiring and continue to report a shortage of qualified workers to fill job vacancies. This is a great sign, or as a business owner might say a “great problem to have.” The number of new jobs created in March was marginally positive, but we also saw wages rise to the highest level since 2007—a sign that businesses are more willing to spend more for qualified workers. It’s a mixed bag in small business sector right now, which should make it interesting to watch going forward.

Bottom Line for Investors

It’s true that the small business sector is under pressure, and the numbers may suggest that tough times are ahead. But if the broad overall economy continues to grow as we expect, and if earnings recover in the back half of the year which we also expect, small businesses should feel the tailwinds and hopefully become more optimistic about the future.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.