U.S. debt has been a hotly debated topic for as long as it’s existed—which means it’s always been a hotly debated topic. The thought of knowing that our country has some $19 trillion in total debt outstanding makes many stomachs turn, especially when you consider that it’s more than our total annual GDP (estimated at $18.2 trillion through Q1 2016).

The questions on everyone’s minds are: Since when does the United States borrow more than it makes? Is this level of debt sustainable for our economy? Is it debilitating, helpful, or inconsequential?

Looking at US Debt from 19 Trillion Feet

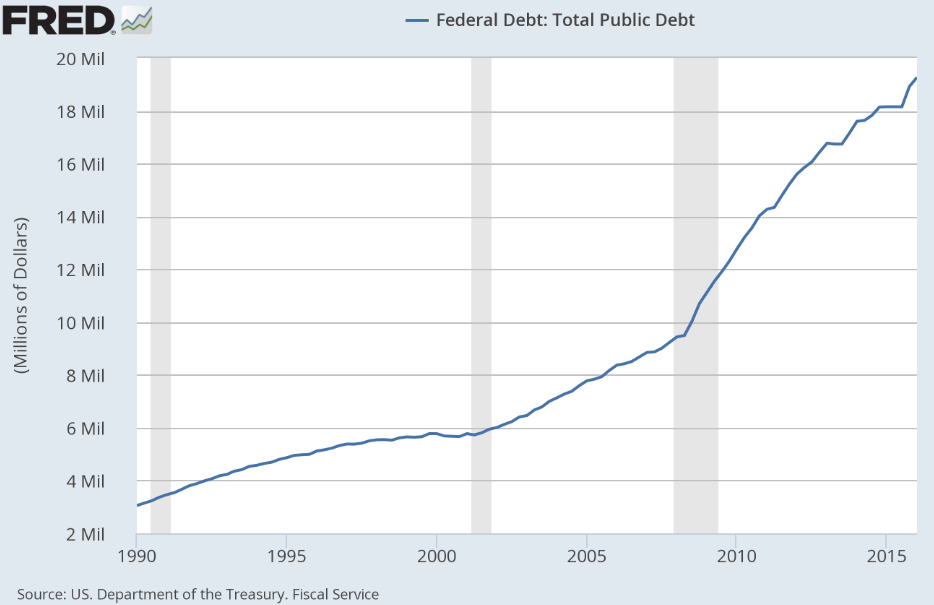

The following charts will help put U.S. total debt in context. Let’s start with the elephant in the room, which is total public debt. There is no question that the total amount of debt outstanding has been growing at an exponential pace since the 1990’s, expanding from some $3 trillion to $19 trillion in 25 years.

Total Public Debt

Source: U.S. Department of the Treasury, Fiscal Service

Source: U.S. Department of the Treasury, Fiscal Service

This chart, by itself, is alarming. In these 25 years, we’ve financed two wars and dedicated huge amounts of capital to the economic recovery in the aftermath of the ‘Great Recession,’ which included bank and auto bailouts. Even so, the economy saw big growth in the 1990s and, by measure of today’s GDP, the U.S. economy is the largest it has ever been. So, we can’t say that debt has been debilitating, but it is still worrisome.

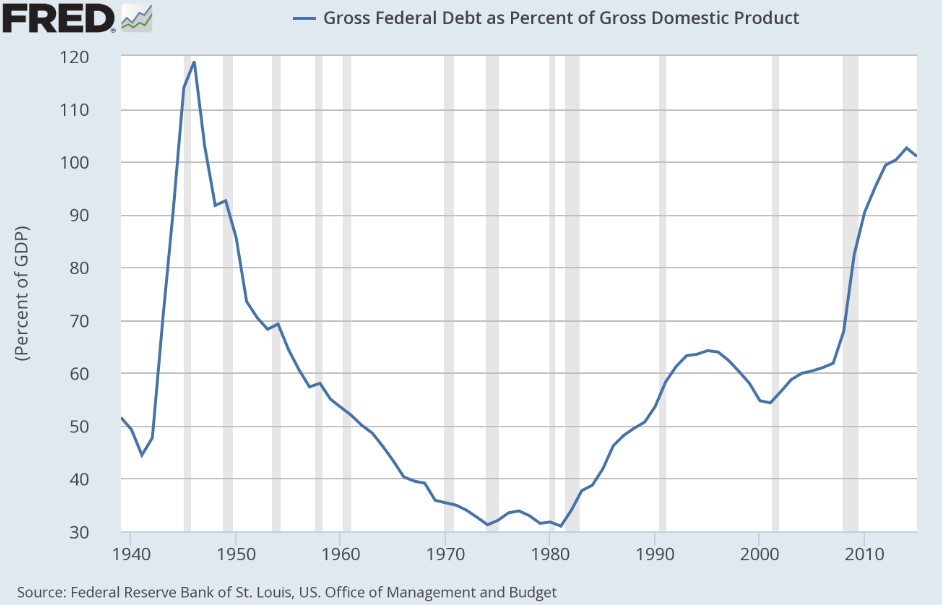

That is, until you think of debt in a different context—in this case as a percent of GDP. Doing so does not necessarily debunk the notion that our debt levels are high, but it is worth noting that we have been at these levels before (in the aftermath of debt financing during World War II). Back then, our debt-to-GDP ratio nearly touched 120%. Today it’s about 100%.

Gross Federal Debt as Percent of GDP

Source: Federal Reserve Bank of St. Louis, U.S. Office of Management and Budget

Source: Federal Reserve Bank of St. Louis, U.S. Office of Management and Budget

If we return to the question of debt either being debilitating, helpful or inconsequential, in the case of WWII we can at least conclude that it was not debilitating. From the end of WWII through the early 1970’s, the U.S. economy grew very swiftly and was referred to as a “golden age of economic growth.” The economy saw leaps and bounds of growth in productivity, income gains, manufacturing through innovations in automation, retail and wholesale growth through improved highway systems, and so on. With that, the impact of high debt was probably somewhere between helpful and inconsequential, but definitely not debilitating.

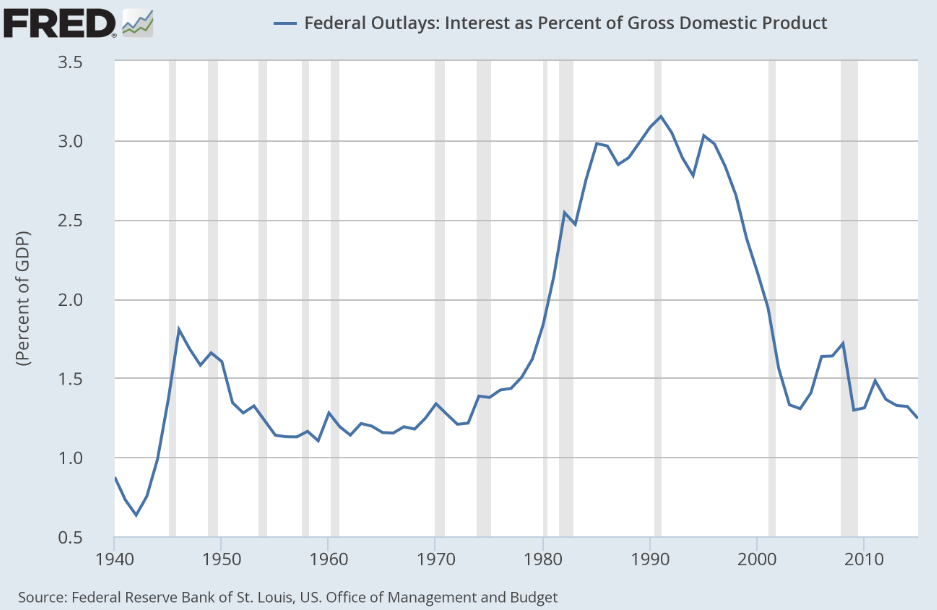

The other important question to ask when it comes to debt is: how expensive is it? And, by that I mean, how much is it costing us to service our debt? The answer to that question today is that it is near historical lows—cheap as ever.

Think of it this way—it is one thing if an unqualified borrower takes on big debt loads at high interest rates (that’s a recipe for crisis, see Greece). But, this is not the situation for the U.S. We are a qualified borrower paying super low interest rates for new debt. The interest we pay on debt as a percent of GDP is the lowest it has been since the 1970’s. Servicing our debt in the 1980’s and 1990’s was costlier than it is now, and the economy did well in both of those decades. There is no reason it can’t do well now under the current circumstances.

Interest as Percent of GDP

Source: Federal Reserve Bank of St. Louis, U.S. Office of Management and Budget

Source: Federal Reserve Bank of St. Louis, U.S. Office of Management and Budget

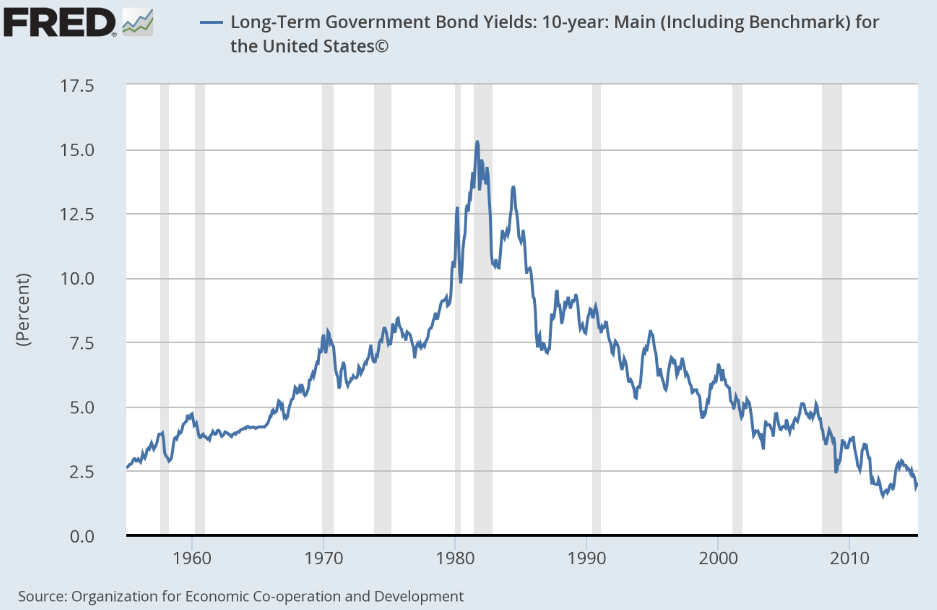

Additionally, refinancing debt that is maturing is as cheap now as ever with rates on the 10-year U.S. Treasury at very low levels. The chances of interest rates skyrocketing on us by surprise and making debt levels less manageable is pretty low in my view. I expect the 10-year U.S. Treasury to remain below 5% for at least a couple of years, if not more.

Long-Term Government Bond Yields

Source: Organization for Economic Co-operation and Development

Source: Organization for Economic Co-operation and Development

Bottom Line for Investors

Perhaps the biggest takeaway is that having elevated levels of debt is not necessarily debilitating for the economy. The U.S. economy is a lot more resilient and diverse than most people give it credit for and, though lower levels of debt are arguably preferable to higher ones, the economy can still do quite well even with a higher debt load—especially if that debt is dirt-cheap, which it is today.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.