With the S&P 500 regaining some lost ground from the early February correction, media attention seems to be finally shifting – albeit slowly – back to positive news, specifically earnings season. As our regular readers know, Zacks Investment Management never left the earnings discussion. We have maintained unwavering focus on earnings even at the height of the selling pressure, as our optimistic outlook for the year hinges on stable earnings growth that we think will continue throughout 2018. Zacks Investment Management expects S&P 500 index earnings to be up a firm +20.4% in 2018.

As it stands today, Q4 2017 earnings season has been rock solid, in our view. Total Q4 earnings for the 370 S&P 500 members that have reported are up +14.5% from the same period last year on 8.5% higher revenues, with 77.2% beating earnings per share (EPS) estimates and 75.4% beating revenue estimates. One of the key takeaways for investors here: 77.2% marks the highest beat percentage in a decade.1

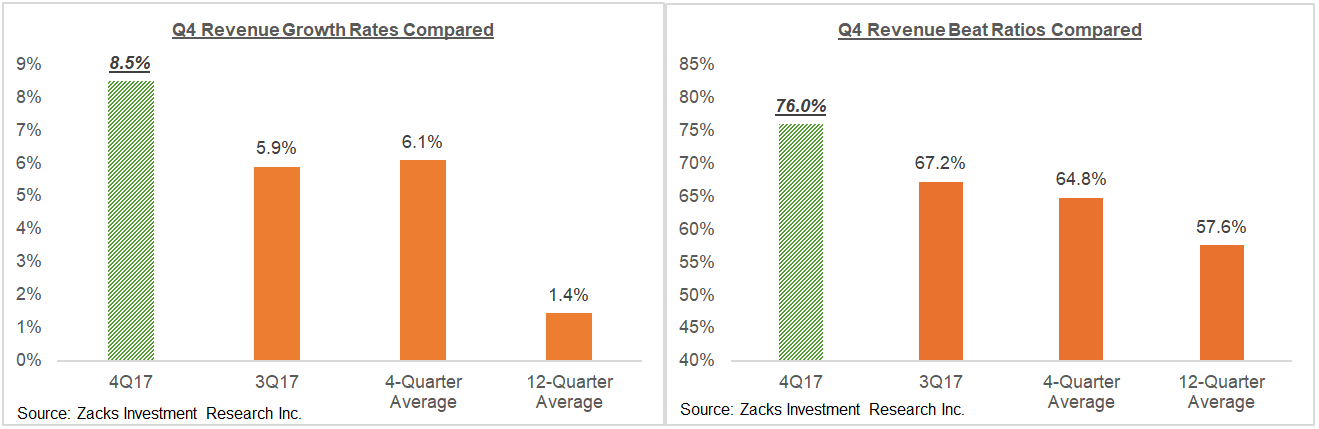

We believe that the standout feature of Q4 2017 earnings season is the clear momentum on the revenue front. As you can see in the chart below, Q4 revenue growth rates are far outpacing the previous quarter and the longer-term averages. The percentage of companies beating revenue expectations in Q4 is also materially higher than previous quarters. In short, U.S. companies are making significantly more money than expected – generally a positive for stock prices. The comparison charts below compare top-line performance for the 470 index members that have reported results already.2

In our view, one of the more critical sectors to watch in any fourth quarter is retail, as it generally serves as a litmus test for the health of the U.S. consumer – one of the most vital components of the U.S. economy. On that front, there’s more good news to report: as of Friday, February 16, we now have Q4 results from 24 of the 39 retailers in the S&P 500 index. Total earnings for those 24 retailers are up +8.9% from the same period last year on +9.4% higher revenues, with 66.7% beating EPS estimates and 79.2% beating revenue estimates. Solid numbers, in our view. 3

For Q4 as a whole, we expect total earnings for the S&P 500 to be up +13.9% from the same period last year on +8.2% higher revenues. Earnings growth is expected to be positive for 14 of the 16 Zacks sectors, with double-digit growth expected for the Energy, Technology, Aerospace, Construction, Industrial Products, Basic Materials, Business Services, and Autos sectors.

For full year 2017, total earnings for the S&P 500 index are expected to be up +7.7% on +4.8% higher revenues, which would follow +0.7% earnings growth on +3.5% higher revenues in 2016.4

Looking Ahead

As expected, many U.S. corporations are announcing big one-time charges related to the tax law change, which is making the gap between adjusted operating earnings and GAAP earnings the highest in recent years.

But conditions in the U.S. economy coupled with the tax law change seem to inspire many of these companies to also raise earnings estimates for the current period (Q1 2018) and future quarters this year. The ‘positive revisions’ are broad-based, with estimates for 14 of the 16 Zacks sectors trending higher over the last few weeks. Setting higher expectations also means setting higher sales and earnings benchmarks to reach, but to us, it points to increasing confidence in the U.S. economy.5

Bottom Line for Investors

In addition to strong revenue momentum, Q4 has also shown, in our view, a preponderance of positive earnings surprises and positive revisions to earnings estimates. In our view, all of these factors taken together produce tailwinds for stocks, not headwinds. If higher levels of volatility and more pullbacks take hold as we move forward, keeping focus on the earnings picture could potentially offer the respite needed to keep a steady hand.

Disclosure

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Any investment inherently involves a high degree of risk, beyond the specific risks discussed herein.

1 Zacks Research, Earnings Trend Report, https://www.zacks.com/commentary/149348/q4-earnings-season-scorecard

2 Zacks Research, Earnings Trend Report, https://www.zacks.com/commentary/149348/q4-earnings-season-scorecard

3 Zacks Research, https://www.zacks.com/commentary/149611/what-will-retail-earnings-show

4 Zacks Research, Earnings Trend Report, https://www.zacks.com/commentary/149348/q4-earnings-season-scorecard

5 Zacks Research, Earnings Trend Report, https://www.zacks.com/commentary/149348/q4-earnings-season-scorecard

6 ZIM may amend or rescind the free report offer for any reason and at ZIM’s discretion