In this week’s Steady Investor, we provide insight into the biggest news stories and key factors that we believe are currently impacting the market such as:

• Home prices hit new record in September

• The secret weapon in the labor market

• Hot button items on the tariff list this Christmas

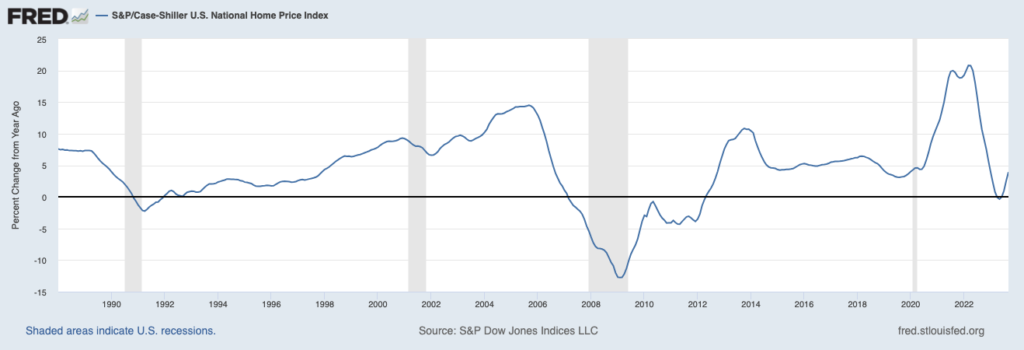

A Mixed Picture for the U.S Housing Market – Are prices for homes in the U.S. rising or falling? The answer depends on the type of home. Existing homes are feeling upward pressure on prices, as higher mortgage rates disincentivize would-be home sellers from moving—and giving up their low mortgage rate in the process. Existing home sales make up a majority of sales in the housing market, and in October they decreased 4.1% from September to a seasonally adjusted annual rate of 3.79 million, the lowest level since August 2010. With low national inventory and falling demand, prices are being pressured higher. The S&P CoreLogic Case-Shiller National Home Price Index rose 3.9% in September, compared to a 2.5% annual increase in August. As seen in the chart below, home prices can be volatile over time, but the post-pandemic surge means the starting point for rising prices today is very high.1

Is Trading Your Retirement Worth the Risk?

If you’re planning for retirement in the new year, we recommend thinking about how you would like to manage it. It’s different from managing your investments, and even if you’re a smart investor, trying to self-direct your retirement investments poses an extremely high risk.

So, instead of letting your emotions take control, take a look at our free guide, “Why Trading Your Own Retirement Can Be Hazardous to Your Financial Health”. You’ll get insight on:

• The conflicting goals of investment trading and long-term retirement strategy

• Common investor behaviors that can have long-term negative impact

• The near-impossibility of picking consistent winners over time

• Plus, more of the hazards of actively trading your retirement assets, and our views on how to avoid them

Download Your Copy of “Why Trading Your Own Retirement Can Be Hazardous to Your Financial Health.”2

National Home Prices (% Change Year-Over-Year)

But as mentioned at the outset of this story, not all home prices are rising. The median price of a new home fell nearly 18% in October from a year earlier, as builders have taken to building smaller homes while using incentives to keep prices down. New homes tend to be more expensive than existing homes, but at least the supply side of the equation is working in the buyer’s favor.

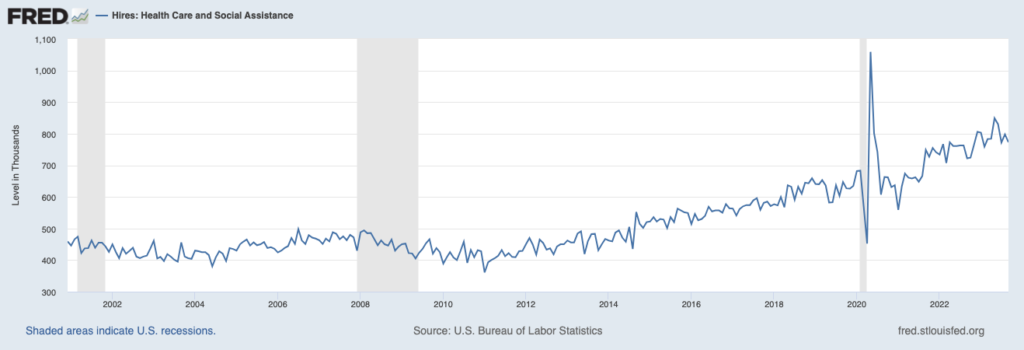

The Secret Weapon in the Hot Labor Market: Healthcare Workers – We often write in this space about the strength of the labor market, with strong job growth for over two years and rising wages to boot. But one area of the economy in particular has been a key generator of jobs, even as other sectors, like technology, have been shedding jobs in recent months. That area is healthcare. Providers from hospitals to clinics to pharmacies and doctors’ offices accounted for about one-third of all job gains in the last six months, even as the healthcare sector only makes up about 11% of the U.S.’s total workforce. As the baby boomer population ages, an increasing amount of healthcare workers will be needed to meet their needs and provide care, which suggests that the strong hiring trend in the healthcare sector could continue for years to come.4

Healthcare and Social Assistance – New Hires

Hot Button Items on the Tariff List This Christmas – Back in 2018, the U.S. imposed tariffs on steel and aluminum from Europe, and the EU retaliated by implementing tariffs on a range of U.S. goods, from Levi’s jeans to Harley Davidson motorcycles to orange juice. But one item in particular is facing a steep tariff starting on January 1, 2024, unless the U.S. and EU reach an agreement – whiskey. Each bottle shipped faces a 50% tax unless U.S. and EU officials hammer out a deal this month. The likely outcome for now appears to be that both parties will agree to delay the implementation of the tariff as negotiations continue, but in the words of Olof Gill, a European Commission spokesman, until the U.S. permanently removes the steel and aluminum tariffs, “the EU cannot permanently end its countermeasures.”6

Thinking About Trading Your Retirement? Managing for retirement is different than managing your own investments—and you don’t want to risk jeopardizing your financial security in your golden years.

Our free guide, “Why Trading Your Own Retirement Can Be Hazardous to Your Financial Health7” offers some compelling reasons—backed by facts and research—why trading your retirement assets can be hazardous to your financial health.

This guide also explores some of the key differences between trading and investing for retirement:

• The conflicting goals of investment trading and long-term retirement strategy

• Common investor behaviors that can have a long-term negative impact

• The near-impossibility of picking consistent winners over time

• Plus, more of the hazards of actively trading your retirement assets, and our views on how to avoid them.

If you have $500,000 or more to invest, get our free guide today!

Disclosure

2 ZIM may amend or rescind the “Why Trading Your Own Retirement Can Be Hazardous to Your Financial Health” guide for any reason and at ZIM’s discretion.

3 Fred Economic Data. November 28, 2023. https://fred.stlouisfed.org/series/CSUSHPINSA#

4 Wall Street Journal. November 24, 2023. https://www.wsj.com/economy/jobs/hot-healthcare-hiring-bolsters-cooling-u-s-labor-market-336a7b27?mod=djemRTE_h

5 Fred Economic Data. November 1, 2023. https://fred.stlouisfed.org/series/JTS6200HIL#

6 Wall Street Journal. November 27, 2023. https://www.wsj.com/economy/trade/u-s-whiskey-is-collateral-damage-in-trans-atlantic-trade-fight-688541bc

7 ZIM may amend or rescind the “Why Trading Your Own Retirement Can Be Hazardous to Your Financial Health” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.