In today’s Steady Investor, we take a look at key factors that we believe are currently impacting the market, such as:

- Americans record-breaking mortgage activity

- Housing market strengthened in 2020

- The regulatory push against big tech intensifies

- Signs of strength across metal markets

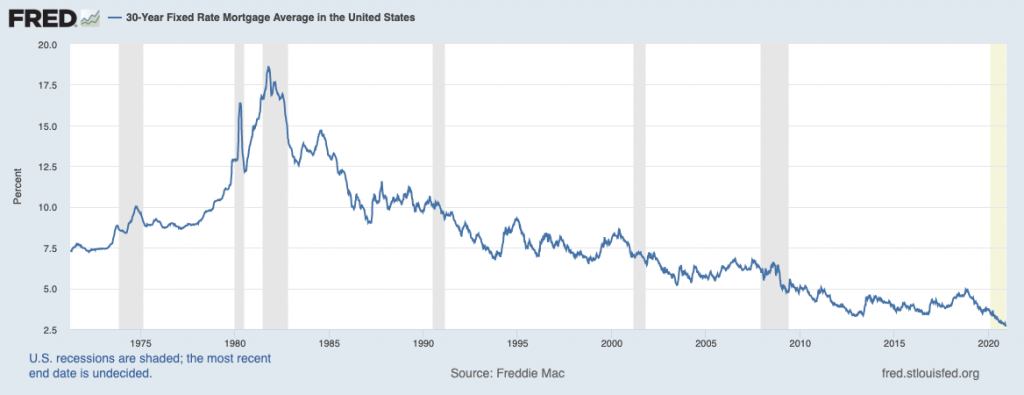

Record-Breaking Mortgage Activity – The pandemic and associated lockdowns caused major disruption in many parts of the economy – but not housing. In 2020, Americans are on pace to take out more mortgages than ever before, which would mean exceeding the prior record of $3.7 trillion reached in 2003. 15 years ago, the surge in mortgage lending was driven in large part by subprime lending and excess risk-taking. Today, the surge is being driven by record-low interest rates and a drive to refinance. In the first three quarters of 2020, refinancing applications made up 65% of all originations.1

______________________________________________________________________

Use Market Volatility to Your Advantage!

With the unknowns and outcomes that are stemming from this current pandemic, it’s a challenge for investors to adjust to market volatility. Predicting the future can result in discomfort and uncertainty. As we wait for the market to fully recover, we recommend that investors learn the positives of volatility.

If you have $500,000 or

more to invest, get our free guide, “Using Market Volatility to Your Advantage”

and learn our insights, based on decades of experience, about how a volatile

market may be able to actually help investors refine their strategies and

potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”2

______________________________________________________________________

30-Year Fixed Mortgage Rates Hover at All-Time Lows

Source: Federal Reserve Bank of St. Louis3

New buyers are also flooding the market, in what Toll Brothers CEO framed as “the strongest housing market I have seen in 30 years.” Many millennials are entering the market as first-time home buyers, nudged into buying as a result of moving away from cities and into more rural areas with more space. Housing strength on the level we’re seeing in 2020 cannot persist long-term, however, and we’d expect to see a softening in activity in 2021.

The Regulatory Push Against Big Tech Intensifies – A few weeks ago, the Justice Department brought a landmark case against Google, accusing the company of being anti-competitive in regards to its search business. The regulatory headwinds against Big Tech grew stiffer this week: The Federal Trade Commission (FTC) and 46 states sued Facebook, accusing the company of thwarting competition through acquisitions. The Facebook and Google cases mark two sweeping antitrust cases that may just be the tip of the iceberg for some of the biggest companies in the world.4 In the Facebook case, the suit is seeking to unwind Facebook’s acquisitions of WhatsApp and Instagram, while also accusing the company of weakening privacy protections for consumers. The cases against Google and Facebook may take years to play out, but one thing seems clear – the days of total impunity for tech giants are fading fast.

Commodities Rally May Signal Expectation of Future Growth – When making forecasts for future economic growth, it’s important for investors to consider leading indicators that may offer clues for expected activity. One of those indicators, interestingly, is commodity prices – particularly industrial metals. Industrial metals are used in a wide variety of ways, from building houses to expanding plants to manufacturing cars. Anytime we see a uniform rise in commodity prices when the economy is signaling expansion in other areas, it often serves as confirmation that investors and producers are betting the recovery will continue. In the past several weeks, we’ve seen signs of strength across the metal markets – copper has risen to its highest level in eight years, iron ore is one of the best performing assets in 2020, and aluminum and zinc are up at least 40% since early summer. China’s swift recovery has ushered in much of this support for metals, but the expectation for a broader global economic recovery may be pushing prices even higher.5

Finding Silver Linings amid the Pandemic – During this time of constant changes in the market, it may be hard to find the silver linings in the current crisis, but that doesn’t mean they aren’t there. To help give you additional insight into how you can make the most of turbulent times, I recommend reading our guide “Using Market Volatility to Your Advantage.”5

This guide

can help you learn about our insights, based on decades of experience, about

how a volatile market may be able to actually help investors refine their

strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

3 Fred Economic Data. December 12, 2020. https://fred.stlouisfed.org/series/MORTGAGE30US

4 Wall Street Journal. December 9, 2020. https://www.wsj.com/articles/facebook-hit-with-antitrust-lawsuit-by-federal-trade-commission-state-attorneys-general-11607543139

5 Wall Street Journal. December 6, 2020. https://www.wsj.com/articles/soaring-metals-prices-signal-bets-on-global-economic-recovery-11607250600

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.