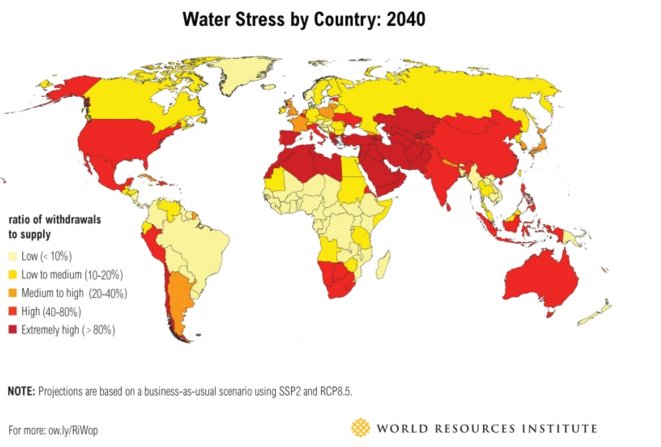

Water is the world’s lifeblood, and it’s impossible to deny that there’s a global shortage that may be getting worse. While water accounts for ~70% of our planet’s surface, freshwater comprises a mere 3%. Since the 1980s, rapid urbanization and growing populations have driven 1% growth per year in freshwater demand. With that, around 1.1 billion people across the globe still lack adequate water. Additionally, by 2025, water withdrawals are expected to rise by 50% in developing countries and 18% in developed countries, meaning two-thirds of the world population could face serious water stress, according to a United Nations report. The following figure shows how water stress would intensify in various regions including the U.S., India and China by 2040:

Source: World Resources Institute

While the statistics look alarming, let’s look at the glass half full outlook of this situation—it presents opportunities for investments in water management and distribution. To better understand how, let’s have a look at some areas in the water industry that need urgent improvements:

Agriculture Exhausts Water Reserves

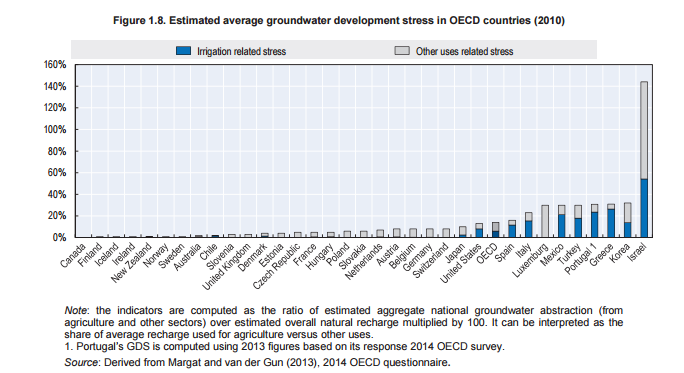

Agriculture is the largest consumer of water, with 70% of water withdrawals from rivers and underground flowing toward irrigation (according to Lenntech). Additionally, rising population and rapid urbanization are pressuring farmers to grow more food and, as a result, withdraw water at an ever increasing pace. This is particularly true of groundwater, since it is seemingly the most convenient source for individual farmers, especially in arid/semi-arid regions. But, such withdrawals are often not accompanied by adequate recharges causing concern about groundwater’s sustainability as a water reserve. With increased industrialization, the pressure on this “water savings account” will only increase if other sources remain underutilized. There is potential to invest in improving groundwater management and develop alternatives such as distribution networks designed to supply water from rivers and lakes to moisture-deficient regions.

Source: OECD

Plenty of Water, But Little is Safe

Availability of natural water doesn’t help if it is not treated properly. In India, for example, around 77 million lack access to hygienic water, exposing the country’s population to dire water-borne diseases (Water.org).

Shortcomings in water treatment are something even developed countries encounter as an issue. The Flint water crisis is an example of how aging water systems and poorly maintained infrastructure can have an extremely harmful impact on people’s health. The mishap is reminiscent of the 2001-2004 Washington D.C. public drinking water lead contamination fiasco.

On one hand, these crises reveal challenges faced by state-owned utility projects; on the other, they unveil investing opportunities.

Fiscal Budget Pressures Beckon Private Investments

With politically-driven objectives of delivering water at abnormally low prices, state-owned utilities eventually find themselves cutting corners on maintenance expenses, pressured by budget constraints. This then can result in threatening consequences—akin to the Flint, Michigan debacle. What follows is government facing an even greater uphill challenge to fix problems that have been building up for decades. Replacing 7 million lead service lines across the U.S. could cost $50 billion, according to Fitch Ratings. Additionally, repairing water distribution systems could require $1 trillion over the next two decades, as estimated by American Water Works Association. Thus, the figures raise questions as to how much an already constrained fiscal budget can be stretched to address the task ahead.

Here lies the immense possibility for states to seek private sector services to maintain and distribute water. Private players may need to charge more initially than state owned counterparts, but given the private sector’s potential to invest in cost-saving technologies and/or achieve economies of scale over time, this could make water relatively cheaper in the long run.

Involving private players brings additional sources of capital, such as publicly traded equity, that could ease government debt burdens and assuage taxpayers’ anticipations about having to foot the bill for the city’s water treatments.

The need for increasing the private sector’s presence in the water industry, particularly in the aftermath of crises like the Flint contamination case, is reaffirmed by authorities’ pushing forward bills such as the Sustainable Water Infrastructure Act to invite private capital into water and wastewater management. Additionally, bills have been introduced in Wisconsin, Illinois, New Jersey and Pennsylvania to facilitate transfer of municipal water systems into the hands of for-profit players.

Water Investments Should Aid in Economic Progress

Investments in water can potentially generate economic development through a variety of channels—manufacturing could get a boost through demand for water extraction and treatment equipment, and better public health could contribute to an increase in productivity. In fact, a 2016 UN report points out that a high positive correlation exists between water investments and national income. In the U.S., $188.4 billion investments in water quality preservation and storm water management can generate 1.9 million jobs, according to the report.

Bottom Line for Investors

Given the scarcity in water and inefficiency in water treatment, there’s no dearth of opportunities for new investments. After being scarred by recent mishaps of state-owned utilities, consumers are expected to be supportive of more private capital in the industry. But, what is perhaps the greatest incentive for water utility investors is that the demand for water is non-cyclical—its demand shouldn’t sway much with inflation and/or interest rate changes. This should induce investors to eye water utility equities for long-term potential.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.