In today’s Steady Investor, we examine the important factors affecting the market and what might lie ahead, including:

• PMI shows signs of economic resilience

• 10-year U.S. treasury bonds reach 5%

• China implements stimulus

• Natural gas surplus expected to reduce heating bills

Purchasing Manager’s Indices Show Further Signs of Economic Resilience – Manufacturing and services PMIs offer a useful glimpse into U.S. economic activity each month. For unfamiliar investors, S&P Global and Institute for Supply Management (ISM) are the two major companies that report PMI data. Their methodologies and reported figures are generally different each month, but both tend to provide the same insights about services and manufacturing activity, i.e., whether we’re seeing expansion or contraction. This week, S&P Global released October PMI data for U.S. manufacturing and services, and both gauges showed that economic activity improved in the month. S&P Global indicated that manufacturing hit 50 in October, while U.S. services PMI reached 50.9 – a three-month high. A high-level takeaway here is that the economy performed better in October than in late summer, confirming again that the U.S. economy is doing better-than-expected. Among the top reasons the U.S. economy is likely performing better than expected: strong hiring continues to fuel strong spending.1

Tips On How to Survive Market Volatility

Bull or Bear market? The stock market’s most undeniable feature is its continuous shift between bullish and bearish cycles. Each cycle brings a different outcome, but some investors still question how to manage their investments during uncertain times like these.

To help you understand market downturns and steps you can take to protect your assets during the next bear market, you’re invited to get our free guide – Everything You Need to Know About Bear Markets.2

If you have $500,000 or more to invest, get this helpful guide today. It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what we can learn from the history of bear markets and pandemics.

Download – Everything You Need to Know About Bear Markets2

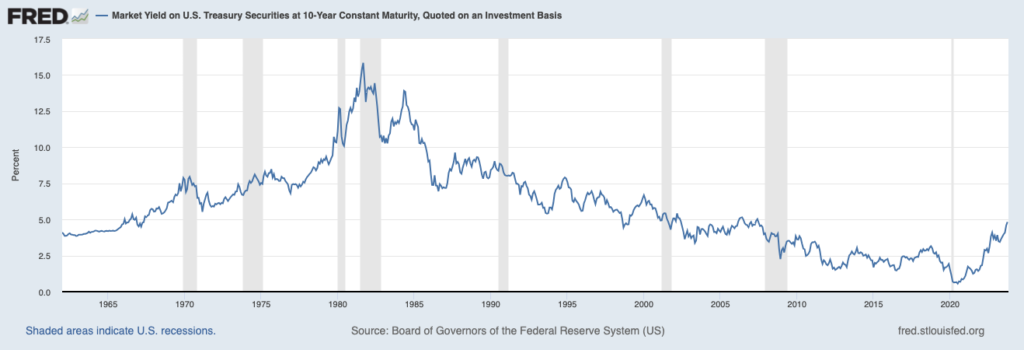

10-Year U.S. Treasury Bonds Reach 5% for First Time 2007 – The big headline this week once again involved the 10-year U.S. Treasury bond, whose yield touched 5% for the first time in 16 years. Interestingly enough, demand for the higher yield put upward pressure on bond prices, which pushed the yield back down below 5% before the end of the trading day. We have written before in this space about better-than-expected economic growth being a driver of higher interest rates, as investors re-price a higher-for-longer rate outcome. Because interest rates determine many borrowing costs, from mortgage rates, credit cards, auto loans, business loans, and other government debt, upward pressure risks slowing economic activity going forward. We don’t dispute this possibility – but as seen on the chart below, even with the strong upward move recently, long-duration interest rates are still below their average in the previous 50+ years. Over that time, the economy has gone through some ups and downs, but they’ve mostly been ups.3

China Implements Stimulus to Bolster Economy, But Is It Enough? China’s economic challenges are well-documented, and range from weak consumer spending, slow growth in exports, and a beleaguered property market. What is less well-documented are the government’s efforts to prop up economic growth, largely because there haven’t been many material stimulus packages put in place. That may be changing. For the first time in more than 10 years, China issued additional sovereign bonds and raised its budget-deficit target in somewhat of an ‘emergency legislative session.’ The government agreed to issue 1 trillion yuan, or $137 billion, in additional sovereign debt, which will provide additional capital to use for stimulus measures – though it is unclear at present what these stimulus measures will be. The government has yet to engage in any type of direct transfer fiscal stimulus and instead has engaged in interest rate cuts, lowering mortgage costs, and other less robust measures. Investors may read the new bond issuance as a signal that the government is growing wary of economic weakness, but also that the mindset about addressing the issues may have changed as well.5

Looking Forward to Lower Bills This Winter – Winter weather is coming, which means Americans will spend more time indoors. Fortunately, the bill for heating homes should be lower this year than last, with strong natural gas stockpiles and expectations for a warmer-than-normal winter both keeping downward pressure on natural gas prices. There are about 60 million U.S. households that use natural gas to heat homes, and the Energy Information Administration expects winter bills to be about $600 on average, which would be 21% lower than last year. Higher utility bills crimped household budgets last year and resulted in higher input costs for businesses – which contributed to inflation. Those pressures should abate this winter.6

Prepare for Market Downturns – We’ve all witnessed how quickly the stock market can change. That’s why it is important for investors to understand how bear and bull markets work.

To gain insight into market downturns and steps you can take to protect your assets during the next bear market, you’re invited to get our free guide – Everything You Need to Know About Bear Markets.7

If you have $500,000 or more to invest, get this helpful guide today. It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what we can learn from the history of bear markets and pandemics.

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

3 Wall Street Journal. October 23, 2023. https://www.wsj.com/finance/investing/bond-rout-drives-10-year-treasury-yield-to-5-ab74c98e?mod=djemRTE_h

4 Fred Economic Data. October 25, 2023. https://fred.stlouisfed.org/series/DGS10#

5 Wall Street Journal. October 24, 2023. https://www.wsj.com/world/china/china-increases-bond-issuance-to-help-its-economy-661be543?mod=djemRTE_h

6 Wall Street Journal. October 24, 2023. https://www.wsj.com/finance/commodities-futures/heres-a-bill-that-might-be-lower-than-last-years-7c8e9e41

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.