In this week’s edition of Steady Investor, we dive into recent events and their impact on the market, including:

• Rising long-duration bond yields

• September CPI data

• Robust consumer spending

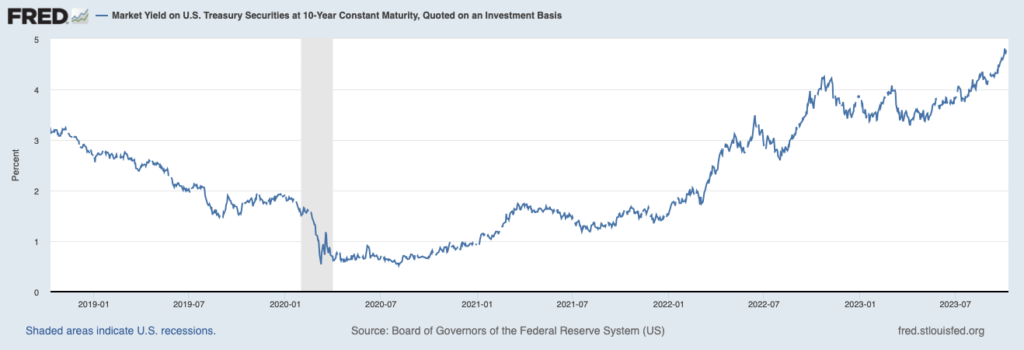

Rising Long-Duration Bond Yields Could Help the Fed’s Cause –10-year U.S. Treasury bonds have had a rough few weeks, with yields jumping by 61 basis points over the past two months (remember that as yields rise, prices fall). As seen on the chart below, 10-year Treasury bond yields have been going up since early 2020, as inflation pressures mounted and then later as the Fed embarked on monetary tightening that ended the era of ‘quantitative easing’ and pushed the federal funds rate to a 22-year high.1

10-Year U.S. Treasury Bond Yields

How to Shield Your Investments from Retirement’s Unknowns

There are so many unknowns that come with planning your retirement – what if the market crashes or a medical emergency arises? No one can predict if these what-ifs will materialize—but there are simple steps you can take NOW to help ensure your secure and comfortable retirement.

Get our practical advice that is based on decades of experience and can potentially guard your retirement assets against the “what ifs” in life, including:

• How to counteract the effects of rising inflation

• Ideas to allocate your assets to defend against a correction or crash

• Strategies to deal with financial emergencies without liquidating investments

• Tax planning ideas to help avoid unpleasant surprises

• Plus, more ways to help protect yourself and your family against retirement unknowns

If you have $500,000 or more to invest, download our Retirement Uncertainties…and How to Breeze Through.3

Higher long-duration bond yields tend to have the effect of cooling economic activity since higher borrowing costs change business’s perspectives on new investment and spending. Insofar as the Federal Reserve would like to see overall demand in the economy soften – which in turn helps to alleviate price pressures – higher rates could in effect do the Fed’s job for them. Higher rates also add to the likelihood that the Federal Reserve could be done raising rates, since monetary policy is arguably already sufficiently tight. The final key to a Fed “pause” at the remaining two meetings of 2023 is inflation, which must continue trending downward in order for the Fed to confidently back away from raising short-term interest rates.

September CPI Data Shows Inflation Trending Modestly Downward – It wasn’t great news, but it wasn’t bad news either. In September, core CPI (which strips out food and energy) was up 0.3% from August and 4.1% year-over-year, an improvement from August’s 4.3% print. Core prices continue to trend lower, but the pace of decreases has moderated in recent readings. When including food and energy, CPI rose 3.7% from a year earlier. Importantly, when core CPI is looked at over a 3-month period, it increased at an annual rate of 3.1%, which is a substantial improvement from the 5% annual rate recorded in the spring.4

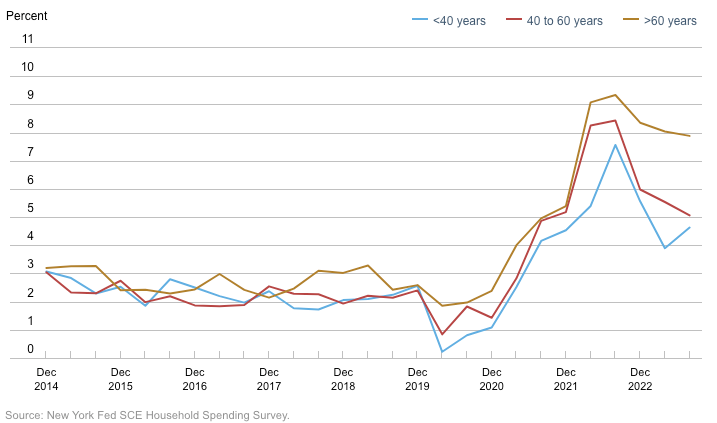

Older Americans are the Ones Driving Robust Consumer Spending – We often cite strong consumer spending as a key factor in fundamental economic strength, but rarely do we parse out how spending is rising or falling among different demographic groups. In doing so, one thing is clear: baby boomers are getting out there and spending. Americans age 65 and older accounted for 22% of total consumer spending last year, the highest percentage since records began over 50 years ago (see chart below). It’s also up significantly from the 15% of consumer spending which seniors accounted for in 2010.5

Consumer Spending by Age Group

There are a few factors to consider for why this is happening. The first is that there are just a lot of boomers. According to the Census Bureau, 17.7% of the population was 65 or older in 2023, the highest percentage going back to 1920. Boomers also have relatively stable and healthy finances, with little consumer debt, minimal student loan balances, and mortgages with ultra-low rates (or homes owned outright). Many are also just entering retirement, which is a time for less working and more spending. In August, 60+ year-old consumers reported spending +7.9% more than a year earlier, compared to a 4.6% increase for consumers under 40. Strong spending could get another boost in January 2024, when retirees will receive a 3.2% cost-of-living-adjustment to their Social Security checks.

Just as we cannot predict exactly how these stories will pan out, we also cannot predict life’s uncertainties when it comes to retirement planning. No matter how carefully you prepare for retirement, life’s unknowns can throw your plans off track.

But you can take steps to prepare yourself and help protect your secure and comfortable retirement.

If you have $500,000 or more to invest, get our free guide, Retirement Uncertainties…and How to Breeze Through Them.7 It provides advice, based on our decades of experience, that we believe can help ensure that your golden years will be comfortable and secure.

Disclosure

2 Fred Economic Data. October 11, 2023. https://fred.stlouisfed.org/series/DGS10#

3 ZIM may amend or rescind the “Retirement Uncertainties…and How to Breeze Through Them” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. October 12, 2023. https://www.wsj.com/economy/central-banking/cpi-report-september-mild-inflation-862679f7?mod=hp_lead_pos1

5 Wall Street Journal. October 5, 2023. https://www.wsj.com/economy/consumers/us-economy-seniors-spending-money-d9f529c5

6 The Federal Reserve Bank of New York. 2023. https://www.newyorkfed.org/microeconomics/sce/household-spending#/experiences-change-in-spending2

7 ZIM may amend or rescind the “Retirement Uncertainties…and How to Breeze Through Them” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.