As of March 15, the S&P 500 went 106 straight days without a 1% drop – the longest such streak since December 1995. By contrast, the index had undergone 15 different 1% declines by this time last year, along with three reductions of 2% or more. (According to a CNN Money report). The Dow Jones Industrial Average also registered a similar duration of ‘not-even-1%-drop,’ which is its longest since September 1993.

At a time when uncertainties surrounding global politics and the economic world order are rippling across the globe, the US stock market’s historic stretch of limited trading losses is a picture of exceptional resilience.

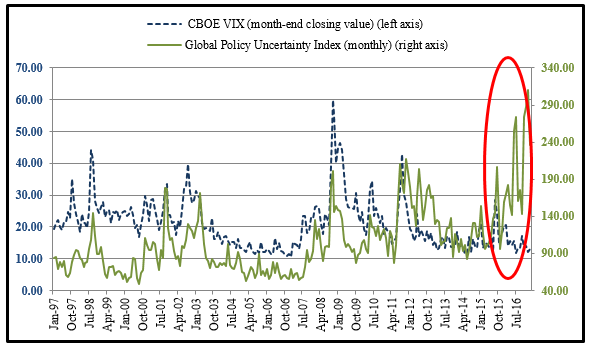

Indeed, the Global Policy Uncertainty Index has been trending upwards over a period of 12+ months, but U.S. stock volatility has been subsiding. That’s a marked divergence from the historical pattern of co-movements between the two metrics. In fact, the daily VIX has plunged by more than -30% since Election Day, falling well below its historic average (across the last 10 years) of close to 20.

Source: CBOE; Economic Policy Uncertainty

The spike in Global Policy Uncertainty is no doubt tied to the election of President Trump and ambivalence over how his “America First” policies may dismantle or significantly adjust trade relationships and hegemony across the global economy. The rise of populist movements in Europe also add to the uncertainty as critical elections this year could threaten the strength of the European Union.

U.S. markets seem to have ‘sifted through the noise,’ registering a solid +18% growth over the last 12 months for the S&P 500. The market may be anticipating that President Trump’s ambitious plans – including cutting US tax rates, boosting domestic employment and slashing banking regulations – could supercharge domestic growth, thereby bolstering the outlook for US equities.

But there is more to it than that. The market’s rally – complete with declining volatility and a record-long stretch of ‘not-even-1%’ intra-day losses – appears to us as an affirmation of sturdy fundamentals, which include below 5% unemployment levels and steadily rising corporate earnings over the last four quarters. That’s the factor that no one talks about but is of critical importance.

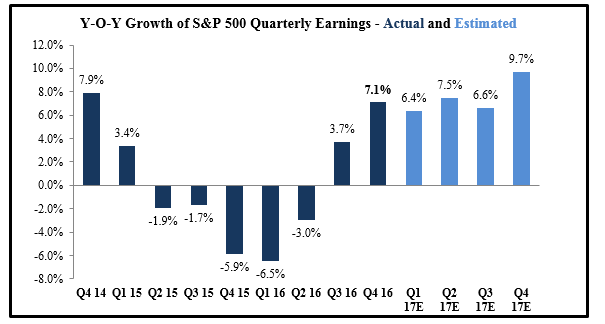

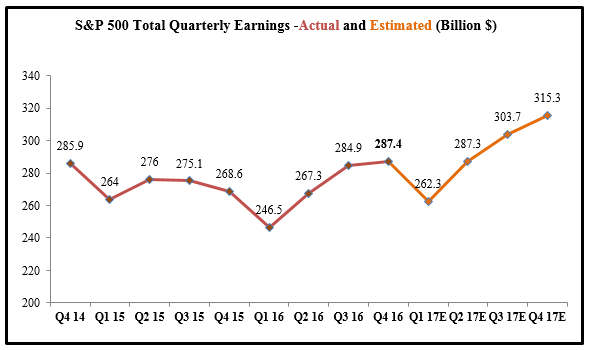

The proof is in the pudding: year-over-year growth for S&P 500’s Q4 earnings was +7.1% – the fastest pace in two years, with the absolute value of quarterly earnings hitting a record-high, at $287.4 billion (According to Earnings Trend reports from Zacks Investment Research). Additionally, current projections for this year’s quarters point towards even higher earnings levels, especially in the back-half of the year (see charts below).

Source: Zacks Investment Research Earnings Trends reports of May, 1 and May 15, 2017

Source: Zacks Investment Research Earnings Trends reports of May, 1 and May 15, 2017

Bottom Line for Investors

With upward momentum, reduced volatility and a record long stretch of going without 1% or greater loss in a single trading day, the US stock markets seem to be enjoying an exceptional mix of positives – even as policy uncertainties and controversies rule global headlines.

It is important for investors to keep a close eye on too much optimism, or what many may identify as “irrational exuberance.” But in this case, we believe the US markets are simply responding to the economy’s steadily strengthening fundamentals in addition to factoring-in expectations of further improvements ahead. The positive surge in prices has not been over-the-top, either – it’s been more than 60 consecutive days that the daily range between high and low points of the S&P 500 has been less than 1%, marking the longest such stretch since 1995, according to LPL Financial.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.