In this week’s Steady Investor, we explore current market news that we believe investors should keep on their radar, such as:

• Consumers starting 2024 off strong

• The $8.8 trillion available to equity markets

• China’s economic growth

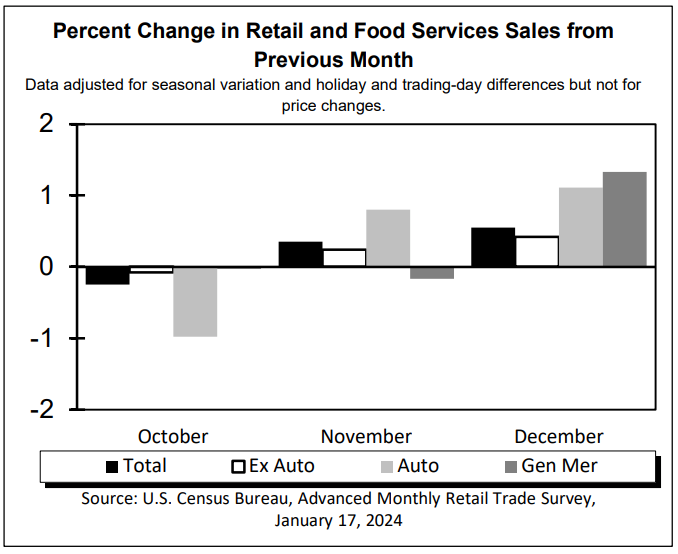

Another Strong Showing from U.S. Consumers – Some economists and analysts were worried that paltry consumer spending data in October was a sign that U.S. consumers were running out of steam heading into the holiday shopping season. They weren’t. The Commerce Department reported that U.S. retail sales rose by a seasonally-adjusted 0.6% month-over-month in December, which followed an also strong 0.3% uptick in November. It appears that consumers put a pause on spending in October in anticipation of coming out with greater force in the holiday months (see chart below).1

Download Our User-Friendly Guide to Tax Planning in 2024

While tax planning might not be the most thrilling topic, it’s a crucial component of your financial strategy.

Our free guide, Tax Planning in 2024: A User-Friendly Guide2, aims to simplify the complexities of tax laws, empowering individuals and business owners to make strategic decisions that minimize tax liability. It also covers a range of key tax issues, such as:

• Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

• Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

• Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions and other essential topics.

• Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Download Tax Planning in 2024: A User-Friendly Guide2

On a year-over-year basis, retail sales rose 5.6% in December, which was virtually in line with last year’s 5.8% December consumer spending data and was about 200 basis points higher than inflation. When consumer spending rises faster than inflation, it’s a clear signal that ‘real’ spending in the economy is rising, a strong growth indicator and a likely sign that the U.S. economy expanded again in the fourth quarter.

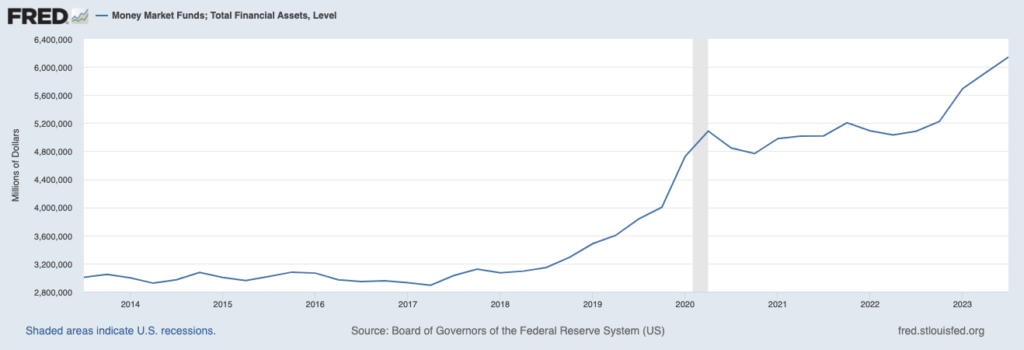

The $8.8 Trillion Available to Rotate into Equity Markets – Rising interest rates in 2023 resulted in short-term downside volatility in equity markets, and also raised borrowing costs for families, businesses, and investment property owners. The other side of higher rates—for savers—was a much better story. Banks offered higher deposit rates in lockstep, and yields on ultralow risk instruments like certificates and money markets shot from basically 0% up to the 5% range. This surge in risk-free yields attractive trillions of new dollars into money-market funds and other cash-like instruments, such that by the end of Q3 2023 there was nearly $9 trillion parked in cash (see chart below).4

Money Market Funds Attracted Trillions of New Dollars in a Rising Rate Environment

So, what happens in an environment when interest rates are expected to come down, considering the Federal Reserve’s projections for 75 basis points of rate cuts in 2024? And also considering an economy that’s expected to downshift, which could ease pressure on the long end of the yield curve? Investors are hoping that falling rates might encourage some of the ~$9 trillion in money market funds ‘off the sidelines,’ rotating into equity markets which have historically outperformed bonds and cash, especially in the year following rate cuts.

China’s Economic Growth—and Outlook—Continue to Falter – The Chinese economy had a rough 2023. According to the National Bureau of Statistics, China’s GDP expanded by 5.2% in the fourth quarter and also by 5.2% for the year, which marks the slowest growth for the world’s second-largest economy since 1990 (when excluding the pandemic shutdown). China’s ailing property sector has been a key source of the economic drag, but consumer spending has also anchored growth over the past year. The youth unemployment rate remains astonishingly high, over 20% at last print, and has been such a sticking point for the government that they stopped publishing the data altogether. Consumers are increasingly lacking confidence about their economic prospects—and are also feeling negative about sagging property prices—that they’ve been saving more than spending. It follows that China is experiencing deflationary pressures while the rest of the world grapples with inflation, with consumer prices falling for the third straight month in December. These factors described above are all short-term problems for the Chinese economy, but there’s also a glaring issue China is confronting long-term: demographics. Births fell by more than 500,000 last year to just over 9 million, continuing a trend where the number of newborns is in freefall. For the first time since the early 1960s, China’s population shrank in 2022, a problem for a country that’s seeking to expand its economic prowess in the future. An aging population, a declining workforce, and strict immigration policies all factor as severe headwinds to economic growth.6

Tax Planning in 2024 – Don’t let tax planning be a headache this year!

Our user-friendly guide, Tax Planning in 20247, provides an overview of the many issues involved in tax planning, including ways you can reduce your tax burden. This guide is by no means exhaustive, but offers a solid resource you can use to have more effective discussions with your family and tax advisors. It covers:

• Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

• Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

• Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions and other essential topics.

• Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “Tax Planning in 2024: A User-Friendly Guide” for any reason and at ZIM’s discretion.

3 Census. January 17, 2024. https://www.census.gov/retail/marts/www/marts_current.pdf

4 Wall Street Journal. January 18, 2024. https://www.wsj.com/finance/investing/the-8-8-trillion-cash-pile-that-has-stock-market-bulls-salivating-0a1b4a8c?mod=djemMoneyBeat_us

5 Fred Economic Data. December 7, 2024. https://fred.stlouisfed.org/series/MMMFFAQ027S#

6 Wall Street Journal. January 17, 2024. https://www.wsj.com/world/china/chinas-growth-slows-to-three-decade-low-excluding-pandemic-93d61487?mod=djemRTE_h

7 ZIM may amend or rescind the free guide “Tax Planning in 2024: A User-Friendly Guide” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.