In this week’s edition of Steady Investor, we dive into recent market events, including:

• The strikes in the summer and fall

• Rising rates

• Americans keeping their jobs

The Summer and Fall of Strikes – Workers have been walking off the job in significant numbers in 2023. The Hollywood writers’ strike garnered a lot of attention this summer, only to be followed shortly after by walkouts orchestrated by the United Auto Workers (UAW). Then, on Wednesday, more than 75,000 Kaiser Permanente employees – which included nurses, pharmacists, and others – went on strike, marking the largest healthcare strike ever recorded. Kaiser’s hospital workers, which for the strike are mostly based in California, are striking over contract negotiations related to pay, but also issues with staffing, arguing that Kaiser needs to hire more personnel to address work demands. The auto workers are focused largely on pay, and strikes to date have been measured but could amp up from here. While auto worker stoppages can have a measurable impact on domestic production, it’s important to note that it would not shut off U.S. output completely, as there are many foreign-owned and non-UAW plants across the country. Strikes would also not affect production across Mexico, Asia, Europe, and the rest of North America.1

4 Steps to Prepare for Retirement Amid Market Concerns

In times like these with media chatter surrounding rising rates and a looming recession, it can be hard to feel secure in your investments. But with proper guidance, retirement planning can be easier.

When the headlines focus on ‘worrisome stories,’ it can lead to hasty short-term decision-making. To avoid this pitfall, we recommend that investors:

• Determine your expenses

• Determine your income

• Match your income source with your goals and time frame.

Considering these factors can be a daunting task, but four simple steps can help you plan for retirement!

If you have $500,000 or more to invest, get the scoop on these simple steps with our guide. Click on the link below to get your copy today:

Download “4 Steps to Managing Your Retirement Assets!”2

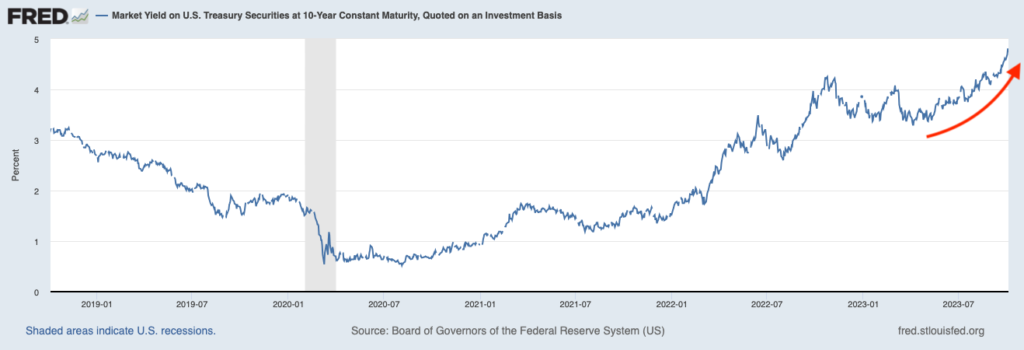

Rising Rates Creating Headwinds for Stocks, Economy – The yield on the 10-year U.S. Treasury bond has been rising, and stocks have been falling. That has been the takeaway for many investment prognosticators over August and September, and recent action in the Treasury bond market has arguably made the volatility more pronounced. As seen in the chart below, yields have been moving up rather quickly – rising to their highest levels since 2007 – while the S&P 500 sold off -4.8% for the month of September.3

There’s a good argument that a spike in long-duration Treasury yields could be caused by one of three things or a combination of them. First is better-than-expected economic growth, second is rising inflation expectations, and third is investor concern over rising federal deficits, which require more bond issuance and that the marketplace needs to absorb. With inflation trending lower, rising yields appear to be a combination of the other two factors, which we view as a positive for markets looking forward. We think investors can absorb new debt issuance and that the economy is growing better-than-expected, which factors as a good thing.

Americans are Keeping Their Jobs – In April 2022, Americans were quitting their jobs in large numbers. The labor market was so tight – with the number of job openings far exceeding the number of unemployed – American workers had plenty of choice and bargaining power. That dynamic is starting to change. While the labor market is still strong and historically tight, the number of job openings has fallen from peaks and layoffs have started to appear mostly in the knowledge economy, with white-collar workers in technology feeling the biggest sting. Americans appear more reluctant to quit their jobs today, perhaps because they think it’s the best they’ll get, but also because overall satisfaction has improved – likely a result of more flexibility and higher pay. According to the Conference Board, worker satisfaction is the highest it’s ever been, and the quits rate has fallen from a peak of 3% last April to 2.3% as of July 2023.5

Managing Your Retirement Assets During a Potential Recession – Are fearful headlines in the media (regarding rising rates and a potential recession) causing you to worry about your next investment decision?

If so, I recommend that you explore four simple steps that can drastically help your investments. These steps are outlined in our exclusive guide, “4 Steps to Managing Your Retirement Assets6.” This guide will help give you some ideas for how to transition into retirement with confidence.

If you have $500,000 or more to invest, get the scoop on these simple steps with our guide. Click on the link below to get your copy today:

Disclosure

2 ZIM may amend or rescind the “4 Steps to Managing Your Retirement Assets” guide for any reason and at ZIM’s discretion.

3 Wall Street Journal. October 4, 2023. https://www.wsj.com/economy/central-banking/bond-selloff-threatens-hopes-for-economys-soft-landing-80bb152a?mod=djemRTE_h

4 Fred Economic Data. October 4, 2023. https://fred.stlouisfed.org/series/DGS10#

5 Wall Street Journal. October 3, 2023. https://www.wsj.com/economy/jobs/americans-growing-reluctance-to-quit-their-jobs-in-five-charts-e72b58ce?mod=djemRTE_h

6 ZIM may amend or rescind the “4 Steps to Managing Your Retirement Assets” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.