In today’s Steady Investor, we cover current events that we believe are shifting the current state of the market, such as:

- Central banks raising interest rates around the world

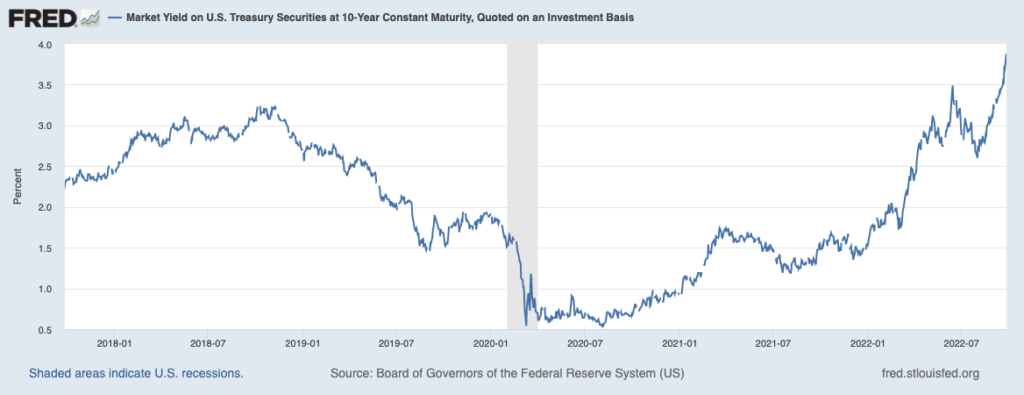

- Yields on long-duration U.S. Treasury bonds shoot higher

- U.K.’s new economic approach

How “Super Thursday” May Have Driven Equity Market Volatility – Many market commentators have focused on the Federal Reserve’s rate increases as a driver of market volatility, but there may be an even bigger force at work: the world’s central banks. Some readers may remember in the years following the Global Financial Crisis that central banks coordinated rate cuts and monetary loosening in an effort to revive the global economy. Though global central banks are not currently coordinating monetary policy in an effort to reduce inflation, many of the world’s most important banks are moving in the same direction at the same time. Such is the genesis of “Super Thursday,” which saw many of the world’s key banks raise benchmark interest rates on the same day. In addition to the Federal Reserve’s 75 basis-point increase, rates also rose in Sweden, Switzerland, Taiwan, the U.K., South Africa, and more. According to the Organization for Economic Cooperation and Development, inflation across the world’s 20 leading economies was 9.2%, so every country is essentially waging the same battle. But that has also led to worries that the sum of all of these central bank actions could impact global demand more than individual countries expect, which could result in a recession that is bigger and deeper than necessary to stem price pressures. When asked about this issue, Federal Reserve Chairman Jerome Powell responded that the Fed already considers other central bank decisions as it sets policy domestically, so global monetary conditions are taken into account.1

__________________________________________________________________________

Thinking About Exiting The Market? Here’s What You Need to Know!

It’s easy for investors to react emotionally to news and headlines surrounding market volatility. And in the current environment, many investors may be thinking “is it time to exit?”

To help you get the answer to this question and more, we’ve put together a free investing playbook with insights and guidance to help you seek success when investing through these unprecedented times. If you have $500,000 or more to invest, get our free investing playbook today.

Download – The Black Swan Investing Playbook2

Yields on Long Duration U.S. Treasury Bonds Shoot Higher – The yield on the 10-year U.S. Treasury bond shot higher last week, at one point crossing 4% for the first time in over 10 years. As readers can see in the chart below, the 10-year has been on the move since the early days of the pandemic, but yields have made a pronounced move higher in 2022. Investors have been selling bonds all year as the Federal Reserve continues to surprise to the upside with rate increases and projections for future rate increases, and upward pressure on the 10-year has also come as the Federal Reserve has ended its QE program and allowed maturing bonds to fall off their balance sheet without replacing them.3

The Market Isn’t So Sure About the U.K.’s Bold New Economic Approach – The U.K. government and the Bank of England are at odds over policy-making decisions, with the government aiming to ratchet up economic growth at a time that the central bank is trying to cool it down in an effort to tamp down inflation. The U.K.’s new prime minister, Liz Truss, announced last week a sweeping plan to cut corporate taxes and taxes on the highest income earners while implementing new spending, both of which are designed to spur economic growth and consumer demand. On the other hand, the Bank of England has been raising interest rates since December and trying to cool growth in an effort to halt the surge in prices, much like the Federal Reserve has been doing here in the U.S. Bond and currency markets in the U.K. signaled that market participants were not convinced this approach in the U.K. would lead to the desired outcome, and most wagers were that it would further exacerbate inflation. The British pound fell to its lowest level ever against the U.S. dollar on the news, and yields on U.K. gilts (bonds) shot higher.5

Events, such as the ones listed above, can easily cause uncertainty when trying to plan your financial future. While it’s difficult to remain calm, it’s also important to take actions right now that have the greatest potential to define your financial future.

That’s why we have put together a free investing playbook6 with insights and guidance to help you seek success when investing through these unprecedented times. If you have $500,000 or more to invest, get our free investing playbook today. You’ll learn about seven time-tested guidelines to help you seek investing success.

Disclosure

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Black Swan Investing Playbook offer at any time and for any reason at its discretion.

3 Wall Street Journal. September 28, 2022. https://www.wsj.com/articles/10-year-treasury-yield-hits-4-11664354445?mod=djemRTE_h

4 Fred Economic Data. September 27, 2022. https://fred.stlouisfed.org/series/DGS10#

5 Wall Street Journal. September 26, 2022. https://www.wsj.com/articles/british-pound-bonds-roiled-as-tax-cut-plans-spook-investors-11664192138

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Black Swan Investing Playbook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.