With all the recent headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

- U.S. Housing Market Update

- Today’s Gas Prices

- China Eases Covid Restrictions

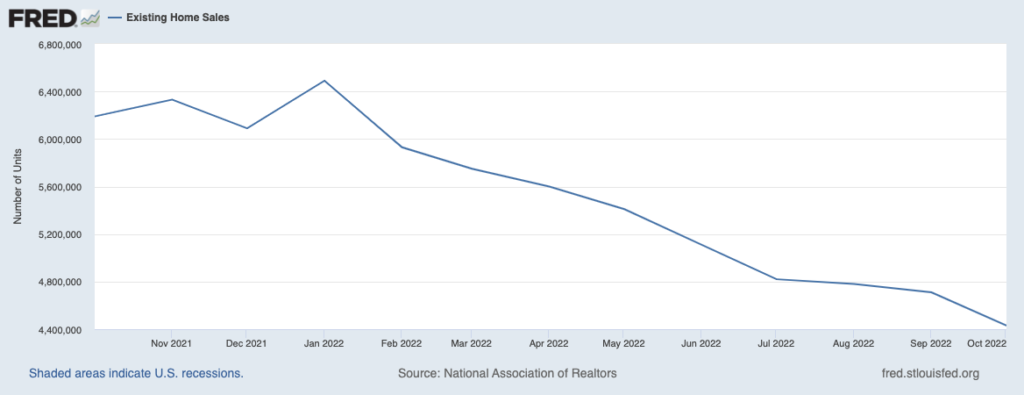

Where is the U.S. Housing Market Headed Next? Depends on Who You Ask – There is little doubt the U.S. housing market is in a slump. The chart below of existing home sales in the U.S. shows that when we zoom out, the housing market has arguably been feeling pressure throughout 20221:

Existing Home Sales in the U.S. (Number of Units)

Start Planning Your Retirement Today – It’s Easy!

It’s common for people to feel that they have a lot of time before they need to start seriously thinking about retirement planning. Here’s the truth – the sooner you plan, the better advantage you will have for your financial future. No matter what state the market is in, building an effective strategy will keep you on track for the long term.

If you want help creating a long-term financial plan and investment discipline, I recommend reading our Retirement Guide. This guide will give you a step-by-step outline of how you can plan for your financial future.

If you have $500,000 or more to invest and want to learn more about retirement planning, click on the link below to get your free guide today!

Download Your Copy of “Retirement Made Easy” Today!3

Several factors are at play, but the most glaring has been that mortgage rates have been rising at their fastest pace in decades. Mortgage rates started the year hovering around 3% but more than doubled in the months that followed, at one point crossing 7%. The rapid shift in the mortgage market has whipsawed both buyers and sellers, both of whom have more incentive to wait versus entering the market. As for where the housing market is headed next, forecasters are all over the map. KPMG, a consulting and audit firm, believes U.S. housing prices could fall by -20% in 2023. Goldman Sachs thinks housing prices could dip -7.5% next year, but the National Association of Realtors sees a 1.2% increase in existing-home prices. A variety of factors including the jobs market, interest rates, the possibility of an economic recession, and Fed policy decisions in the new year will impact the housing market. The wide dispersion of forecasts underscores how far apart industry watchers are from assessing these factors.

What’s Behind Topsy-Turvy Natural Gas Prices? Is heating a home this winter going to be more expensive, less expensive, or about the same as last year? For homes that heat with natural gas, the answer is unclear. That’s because 2022 has been the most volatile year for natural gas prices in decades, with wild fluctuations sending prices into strong uptrends followed almost immediately by heavy downdrafts. Prices have also been moving counter to seasonal trends – since Thanksgiving, U.S. natural gas futures are down -25%, which is the opposite of what investors would expect heading into the winter season when demand rises. Last Monday, the price of U.S. natural gas futures declined -11%, which would normally raise eyebrows except for the fact that it marked the 39th instance that gas prices have moved more than 7% up or down in a single day. There are a few reasons behind natural gas price volatility. Among them, domestic drillers have hit new output records this year, mild winter temperatures in parts of the country have softened demand, and a fire at a key liquified natural gas terminal prevented a significant amount of liquefication and export—which meant that gas was stored here in the U.S. and added to overall supply.4

China Finally Eases “Zero-Covid” Restrictions – China’s years-long “zero Covid” strategy has led to low death and infection rates, but has also stifled economic growth and led to rare protests across major cities. China’s exports have fallen for two consecutive months, with shipments plummeting -8.7% in November. Imports also fell by double digits in November, marketing the weakest month since the onset of the pandemic. The very rare show of defiance by protestors sent a strong message, however, with the state now scrapping rules for mass testing, ending mandatory hospitalization for people who test positive, and reconfiguring how lockdowns are imposed, among other changes. The focus is shifting to vaccinating a larger percentage of the population, particularly the elderly who currently have low vaccination rates. Only about 40% of those over 80 have received the two-shot vaccine plus a booster. China is making concessions on Covid that global investors have long awaited, but their strategy pivot also comes as the winter months approach. In our view, there is ample reason to be cautious about how long and to what extent this easing of restrictions lasts.5

Are You Ready to Retire? Here’s the truth – if you start preparing for your retirement now, you will have a better advantage when making future financial decisions.

To help you do this, I recommend reading our Retirement Guide.6 This guide will give you a step-by-step outline of how you can plan for a successful financial future, and it provides our answers to critical questions like:

- What is the best long-term approach?

- How do you manage your retirement income for taxes?

- How much should you be saving?

- And more…

If you have $500,000 or more to invest and want to learn more about retirement planning, click on the link below to get your free guide today!

Disclosure

2 Fred Economic Data. 2022.

3 ZIM may amend or rescind the “Retirement Made Easy” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. December 7, 2022. https://www.wsj.com/articles/natural-gas-prices-swing-again-in-unseasonal-slump-11670331531?mod=djemRTE_h

5 Wall Street Journal. December 7, 2022. https://www.wsj.com/articles/china-scraps-most-testing-quarantine-requirements-in-covid-19-policy-pivot-11670398522?mod=djemRTE_h

6 ZIM may amend or rescind the “Retirement Made Easy” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.