In this week’s Steady Investor, we take a deeper dive into key factors that we believe investors should keep an eye on, such as:

• U.S. retail status

• China’s economic growth

• Weak year for U.S. home sales

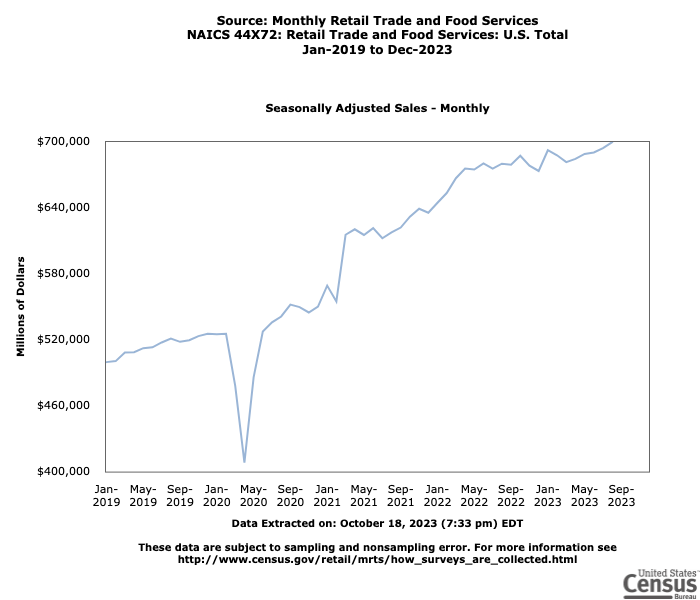

U.S. Retail Sales Blow Past Expectations – A major theme of the U.S. economic growth story in 2023 has been consumers who just keep on spending. September was no different. According to the Commerce Department, U.S. consumers kept splurging last month, with spending at stores, online, and restaurants (retail sales) jumping 0.7% from August to September. This figure was more than double economists’ estimates, signaling that the U.S. economy continues to expand at a stronger pace than most expect. Nearly all retail categories posted gains last month, and when you exclude gas stations, car dealers, building-materials stores, and food services – which is known as the ‘control group’ economists use to track the underlying pace of spending – retail sales still rose 0.6%. The takeaway here is one we’ve made in previous weeks, which is that the U.S. economy likely expanded at a far faster pace than just about everyone estimated in Q3. We’ve also made the argument that long-duration interest rates rose in August and September in response to this stronger-than-expected growth, which appears to have been verified by these strong consumer spending figures. As seen in the monthly retail trade and food services spending chart below from the U.S. Census Bureau, the spending recovery in the wake of the pandemic has yet to lose any steam1.

Tips for Handling Stock Market Volatility

Every investor understands the worries that come with a volatile market. It’s impossible to avoid market volatility, but there are ways you can minimize the worst impacts of it.

In our guide, ‘The Do’s and Don’ts of Stock Market Volatility’ we provide recommendations for investors, based on 30 years of expertise. We also explore:

• Three best practices to successfully manage periods of market volatility

• Three common mistakes investors make, and why they are so damaging to your long-term investing goals

• Historical data that supports our conclusions and underscores the recommendations we propose

If you have $500,000 or more to invest, get our free guide today!

Download Your Copy Today: The Do’s and Don’ts of Stock Market Volatility3

There is one specific area of spending, however, where Americans are starting to cut back: live entertainment. According to a survey from The Wall Street Journal and Credit Karma, nearly 60% of Americans said they have cut back on live entertainment like sporting events and concerts because of rising costs.

China’s Sputtering Economic Growth and Potential Crisis – China’s National Bureau of Statistics reported that the world’s second-largest economy grew 4.9% in the third quarter. While 4.9% GDP growth registers as consistent with China’s goal of 5% GDP growth for the year, mounting headwinds have many economists questioning China’s fundamental strengths. Let’s start with the positives. In the latest Q3 data, business surveys pointed to improving factory output, retail sales rose 5.5% in September year-over-year (compared to August’s 4.6% rate), and industrial production has been posting a strong recovery in the wake of weak export activity. Domestic travel has also picked up, as has lending to households and businesses. On the negative side, however, exports declined for the fifth straight month, and China’s real estate market is in distress. Home sales by value fell 3.2% in the first three quarters compared to a year ago, and major developers Evergrande and Country Garden have essentially collapsed. China’s government has been responding by cutting interest rates and scrapping restrictions on home purchases, but consumers are wary given real estate’s year-to-date performance.4

A Weak Year for U.S. Home Sales – If China’s real estate market can be described as battered in 2023, the U.S. might be aptly characterized as moderating. In September, existing home sales – which account for a majority of home sales each year – fell by 2% from August and 15.4% year-over-year. Meanwhile, the median existing home price increased by 2.8% year-over-year in September, to $394,400. Higher prices, combined with the highest mortgage rates in over 20 years and low inventories, are all working together to pressure sales in the market. By some estimates, total existing home sales in the U.S. could land at around 4 million in 2023, which would be the least number of existing homes sold since 2008. As Americans are reluctant to leave their homes given high mortgage rates, it has resulted in an increasing number of housing permits to build new single-family homes – which have risen for eight straight months.5

Overcoming Market Volatility – If you’re a long-term investor trying to avoid volatility, it’s impossible. But this doesn’t mean that volatility isn’t manageable! Our guide, ‘The Do’s and Don’ts of Stock Market Volatility’ explores:

• Three best practices to successfully manage periods of market volatility

• Three common mistakes investors make, and why they are so damaging to your long-term investing goals

• Historical data that supports our conclusions and underscores the recommendations we propose

If you have $500,000 or more to invest, get our free guide today!

Download Your Copy Today: The Do’s and Don’ts of Stock Market Volatility6

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind our free The Do’s and Don’ts of Stock Market Volatility offer at any time and for any reason at its discretion.

3 Census. 2023. https://www.census.gov/econ/currentdata/?programCode=MRTS&startYear=2019&endYear=2023&categories[]=44X72&dataType=SM&geoLevel=US&adjusted=1¬Adjusted=1&errorData=0#line015

4 Wall Street Journal. October 18, 2023. https://www.wsj.com/world/china/chinas-economy-grew-4-9-in-third-quarter-3e504ab0?mod=djemRTE_h

5 Wall Street Journal. October 19, 2023. https://www.wsj.com/economy/housing/home-sales-report-to-show-how-much-high-rates-squeezed-market-54f64ea1?mod=hp_lead_pos2

6 Zacks Investment Management reserves the right to amend the terms or rescind our free The Do’s and Don’ts of Stock Market Volatility offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.