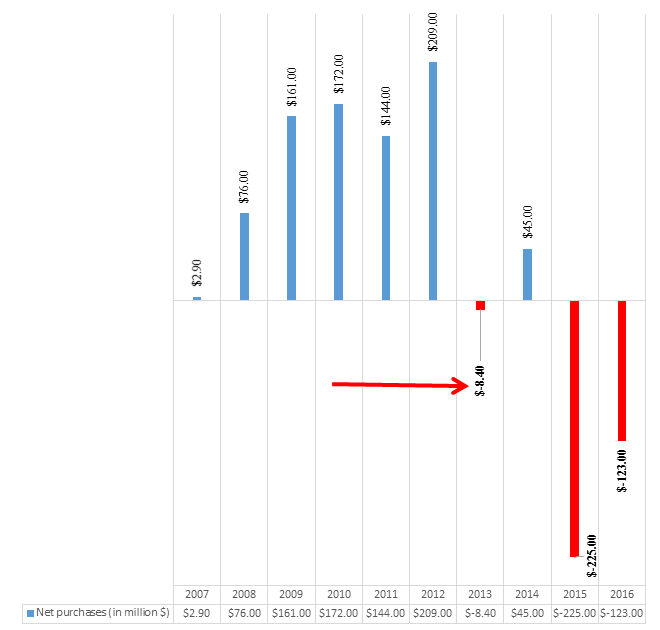

Central banks and government institutions around the world are aggressively selling off U.S. Treasury debt and other notes, in what appears to be an effort to save cash for their struggling local economies. Major emerging economies like China, Brazil and Russia have aggressively dumped U.S. Treasury bonds in the last few months, marking the fastest pace for a U.S. debt selloff by global central banks since at least 1978. For 2016, the global bank debt dump has already reached $123 billion.

U.S. Treasury Bond Net Purchases per Year by Foreign Central Banks

Source: Treasury Department

China, the biggest overseas creditor to the U.S. (with U.S. debt worth $1,244 trillion), initiated the sell-off to prevent the yuan from weakening beyond its target point versus the U.S. dollar. The People’s Bank of China also sought to boost the slowing economy in the process, but the jury is still out on how effective this has been. At the same time, oil price declines have also contributed to the sell-off. Countries like Norway, Mexico, Canada and Colombia all saw fiscal revenues drop with falling oil prices and weaker demand. These countries are arguably using the cash generated from the sale of Treasuries to fill giant holes in their budgets.

The question is, how far will this go?

Bottom Line for Investors

Though U.S. Treasuries are being sold off at a relatively quick pace, they are still among the safest securities in the world. What many fear, however, is that a massive debt dump could set-off a panic in the global financial markets and create additional stock market volatility, both of which could lower confidence in the ongoing economic expansion.

Those fears are likely overblown. For the U.S., China’s debt dumping actually does not amount to a whole lot—China only holds around 9% of the total U.S. foreign-owned debt, and it’s not as though they are selling all of their holdings (just a small percentage). What’s more, it is also true that, while China sells, other countries are stepping-in to buy. Case in point: India increased its Treasury debt holdings to $116.3 billion at the end of July 2015 (up from $79.7 billion the year prior).

While central bankers in Europe and Asia experiment with negative rates, it also means that the interest rates on alternatives to U.S. Treasuries like German and Japanese bonds are less desirable. That should help demand going forward, particularly as the Fed incrementally looks to raise rates over the course of the year.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.