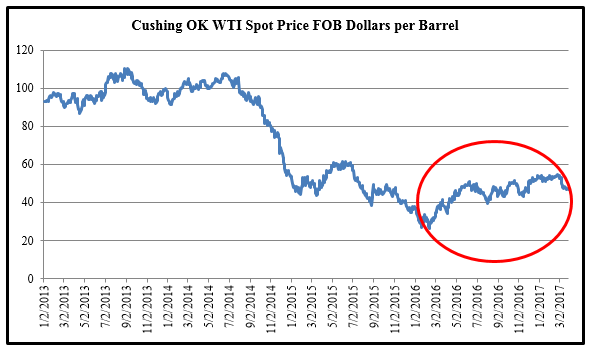

From more than $100 a barrel in 2014, crude prices collapsed to less than $30 by early 2016. That put U.S. producers at serious risks, resulting in job losses and closing of shale oil rigs, with smaller players being crushed the most. However, after bottoming out early last year, WTI managed to touch the $50 per barrel mark in late last year.

Source: Data from EIA

But, can the uptick graduate into a long-term trend?

The commitment from OPEC and 11 other leading oil producers, including Russia, to jointly cut output by 1.8 million barrels per day in the first half of the year may have given an upward push to prices. But, higher prices have also boosted the outlook for U.S. Shale production (not part of the production-cut pact), raising concerns on the latter’s diluting effect on chances of a price rebound.

Is There a Hidden Threat in U.S. Energy Investment Revival?

We’re already seeing the impact of the uptick in crude prices on investments in the U.S. energy sector. As of the week ending on March 31st, the number of rigs in the nation is 824 – almost twice of what it was around the same period a year ago. (According to data from Baker Hughes).

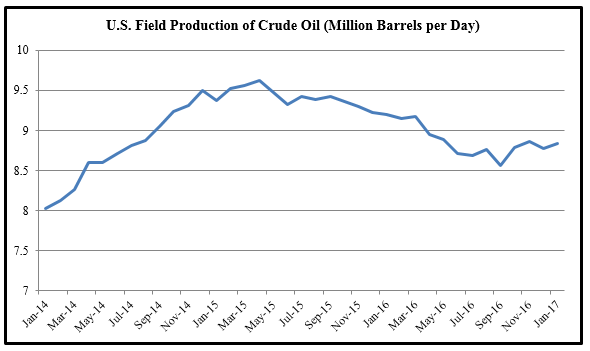

According to the U.S. Energy Information Administration (EIA), the nation’s crude oil production was 8.9 million barrels per day in 2016 and is expected to rise more than +4% to 9.3 million bpd in 2018.

Source: Data from EIA

EIA predicts that output from seven major oil and natural gas producing basins in the U.S. will increase by +109,000 barrels per day this month, bringing the total to 5 million barrels per day from those regions.

The shale revolution was once a big factor in driving the U.S. energy sector’s prosperity. But, shale output grew so much that it far outstripped demand at one point. And, the resulting oil price slump proved to be a big blow to the worldwide energy producers, including the U.S. shale industry. Now, with prices rising, the outlook for shale production growth in the U.S. has brightened, but not without raising apprehensions of another round of downward pressure on oil prices in the long-term, especially since OPEC is expected to end its production-cut phase by December.

Will Clean Energy Dampen Crude Prices?

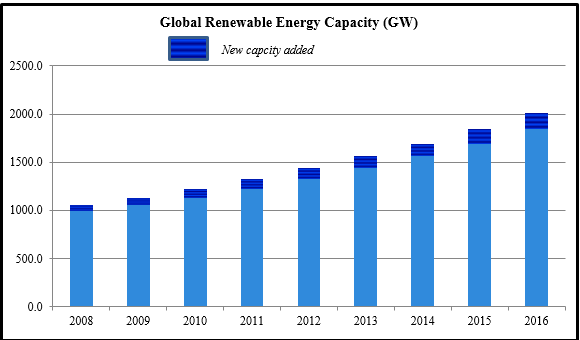

What’s further adding to speculation of another oil price slump is the clean energy boom and how it could affect the fossil fuel demand globally. In 2016, there was +161 GW (gigawatt) of additional capacity in worldwide renewable energy, with solar energy accounting for most of the increase with its +71 GW of new capacity. As of last year, the total worldwide renewable capacity is 2006.2 GW – a +8.7% growth from 2015.

Source: International Renewable Energy Agency

Bottom Line for Investors

The near-term outlook for U.S. oil sector is brimming with positives – while OPEC’s commitment to lower output levels has helped break the prolonged price slump, world demand for oil has grown in recent quarters (the International Energy Agency estimates that global demand grew by +1.6 million barrels per day in 2016). However, the long-term prospects may not be as sanguine.

The energy sector has surprised us time and again. The recent uptick in crude prices has breathed new life into the U.S. shale drilling prospects, but the signs of a serious price rebound and sustained growth in the energy sector are still clouded.

Given that volatility in the energy sector is inevitable, we think investors who want to buy in this space should look for big companies with diversified operations that can cushion downward price risks. The renewable sector could also offer buying opportunities given the segment’s bright prospects.

Still there is no certainty in the future of the energy sector and many investors struggle to identify emerging investment opportunities when faced with such uncertainty. Additionally, identifying investment strategies that effectively meet your long-term investment needs and risk/reward equation can be an ongoing battle. At Zacks Investment Management, leadership is more than just performance—it’s about our family-run business taking care of our clients and their families by managing risk. Learn more about our top five investment strategies—we call this our ‘Dean’s List.’ Click below to read more now…

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.